ID: PMRREP31943| 191 Pages | 23 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

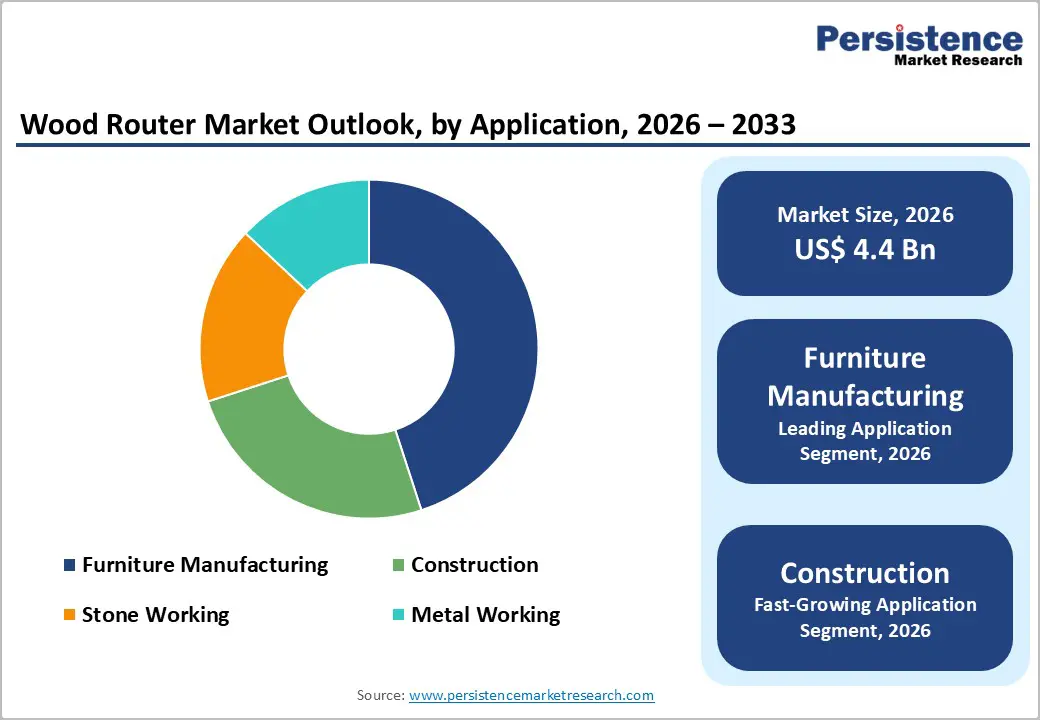

The global wood router market size is likely to be valued at US$ 4.4 billion in 2026, and is projected to reach US$ 6.0 billion by 2033, growing at a CAGR of 3.6% during the forecast period 2026−2033. Product demand is being supported by structural shifts in woodworking operations, particularly the increasing integration of automated production workflows and digitally controlled equipment. Manufacturers are progressively investing in productivity-enhancing tools to improve precision, reduce material waste, and shorten production cycles, which is strengthening baseline demand across industrial and semi-industrial end users. Market momentum is also being reinforced by rising demand for customized furniture, modular interiors, and engineered wood products across residential and commercial construction. The adoption of computer numerical control (CNC) routing technologies is expanding across manufacturing facilities as companies are prioritizing consistency, scalability, and skilled labor optimization. In parallel, the gradual recovery of residential construction activity is supporting replacement demand for professional-grade woodworking equipment. Emerging economies are contributing incremental growth as workshops and small manufacturers are modernizing legacy machinery to remain competitive.

| Key Insights | Details |

|---|---|

| Wood Router Market Size (2026E) | US$ 4.4 Bn |

| Market Value Forecast (2033F) | US$ 6.0 Bn |

| Projected Growth (CAGR 2026 to 2033) | 3.6% |

| Historical Market Growth (CAGR 2020 to 2025) | 3.7% |

The woodworking industry is undergoing a notable technological shift as manufacturers adopt automated routing solutions to improve precision, throughput, and consistency. Automated wood routing systems enable producers to handle more complex design requirements while maintaining tighter tolerances and cleaner finishes. The incorporation of CNC technology in routing equipment allows operators to translate digital designs directly into repeatable production workflows, which helps minimize manual intervention and reduce the risk of human error. As a result, manufacturers can better align their capabilities with customer expectations for high-quality, customized wood products delivered within shorter timelines.

This transformation aligns closely with broader Industry 4.0 and smart manufacturing strategies, where connectivity, data visibility, and process integration serve as strategic levers rather than purely technical choices. Manufacturers increasingly view advanced routing equipment as a long-term productivity asset that supports flexible production planning, more predictable lead times, and improved utilization of skilled labor. In developed markets, where labor represents a substantial share of operating expenses, management teams use automation initiatives as part of a broader competitiveness agenda that also encompasses workforce upskilling, digital workflow integration, and closer collaboration with design and engineering teams.

High upfront investment in advanced wood routing systems, particularly CNC-enabled models, often limits adoption among smaller market participants. These platforms typically require not only the machine itself but also additional expenditures for commissioning, training, and ongoing maintenance, which can strain constrained budgets. For small woodworking workshops and independent craftsmen, such capital commitments are difficult to justify when cash flows remain volatile and external financing options are limited. This challenge is even more pronounced in developing economies, where restricted credit availability, higher borrowing costs, and stringent collateral requirements further reduce access to modern equipment.

The financial burden also extends across the entire lifecycle of the system rather than ending at the point of purchase. Businesses must budget for software licenses, specialized cutting tools, and infrastructure upgrades such as climate-controlled environments and reliable power supply to support consistent machine performance. In addition, they need to invest in structured training programs so operators can use advanced features effectively and safely, which adds to indirect costs. Decision-makers should evaluate these systems through a total cost of ownership lens, considering utilization rates, workflow redesign, and potential productivity gains, and then align acquisition timing with broader capacity expansion, pricing strategy, and customer positioning priorities.

The convergence of wood routing equipment with Industrial Internet of Things (IIoT) platforms and predictive maintenance capabilities is reshaping how manufacturers manage assets and design shop-floor operations. Smart wood routers that incorporate sensors, real-time performance monitoring, and secure cloud connectivity give the operations team greater visibility into machine health, process stability, and utilization patterns. By integrating these systems with production planning tools, manufacturers can schedule jobs more intelligently, reduce unplanned stoppages, and maintain more consistent quality across different product runs. This shift moves routing equipment from being an isolated asset to functioning as a connected node within a broader digital manufacturing architecture, which aligns closely with long-term Industry 4.0 roadmaps.

The emergence of subscription-based software platforms, remote diagnostics services, and automated calibration applications is reshaping the commercial model for both equipment providers and end-users. Manufacturers can view these digital capabilities as ongoing operational levers rather than one-time purchases, using them to support continuous improvement programs, operator upskilling, and the standardization of best practices across multiple sites. For equipment suppliers, recurring software and service revenues help smooth cyclical demand, deepen customer relationships, and increase switching costs by embedding their solutions more deeply into customers’ day-to-day operations.

Fixed-base routers are set to dominate, commanding approximately 45% of the total market revenue. This leadership position stems from their widespread use in applications such as edge profiling, dado cutting, and template routing, where consistency and control are essential. Fixed-base routers provide excellent stability and precise depth adjustment, enabling operators to deliver clean, repeatable cuts in high-volume production settings. As a result, they have become core equipment in professional manufacturing facilities and specialized woodworking shops that focus on precision and process reliability.

Plunge routers are likely to be the fastest-growing segment during the 2026-2033 forecast period. This accelerated growth is driven by their versatility in executing interior cuts, mortising operations, and intricate inlay work without requiring edge access. The segment benefits from increasing demand for customized furniture featuring complex joinery and decorative inlays, where plunge routing capabilities are essential. Technological advancements, including micro-adjustment systems, enhanced plunge mechanisms, and improved dust collection integration, have expanded their application scope, particularly in architectural millwork and custom cabinetry production, where precision interior routing commands premium pricing.

Furniture manufacturing is poised to capture approximately 52% of the wood router market revenue share in 2026. This segment’s leadership reflects the furniture industry’s broad and diversified production base, where wood routers play a central role in producing components such as table legs, chair frames, cabinet doors, and decorative trim elements. The application landscape spans from industrial facilities focused on high-volume edge banding and profiling to custom workshops that execute intricate carved details and bespoke finishes. Regular tool replacement, ongoing changes in furniture aesthetics, and growing demand for differentiated, value-added designs in expanding markets collectively reinforce this segment’s sustained dominance.

Construction is expected to be the fastest-growing segment over the 2026-2033 forecast period. This segment encompasses door and window frame production, architectural moldings, staircase components, decorative panels, and custom millwork for commercial and residential projects. It covers both standardized building elements and highly tailored joinery work, which makes routing capabilities central to achieving consistent fit, finish, and aesthetic quality across diverse construction requirements. One of the most important growth catalysts for this segment is the unprecedented scale of urbanization in developing economies, where luxury residential developments emphasizing custom woodwork and commercial construction are taking center stage.

The industrial segment is slated to lead with an approximate 55% of the wood router market share in 2026. This dominance reflects the substantial equipment needs of large-scale furniture factories, cabinetry manufacturers, and specialized woodworking facilities, which operate high-throughput production environments. Industrial users prioritize production capacity, machine durability, seamless automation integration, and minimal downtime to protect delivery commitments and margin performance. Their purchasing decisions focus on the total cost of ownership, including energy use and maintenance requirements, as well as comprehensive after-sales support and smooth compatibility with existing production lines and software systems.

Commercial is projected to be the fastest-growing segment during the 2026-2033 forecast period. This segment contains custom millwork shops, architectural woodworking firms, specialized contractors, and medium-sized furniture manufacturers that focus on tailored, project-based work. These businesses typically deliver higher-value projects where design differentiation, craftsmanship, and close coordination with architects and designers are critical to the final outcome. This segment also benefits from the broader experience economy trend, in which businesses invest in memorable physical spaces to differentiate customer experiences and strengthen brand perception.

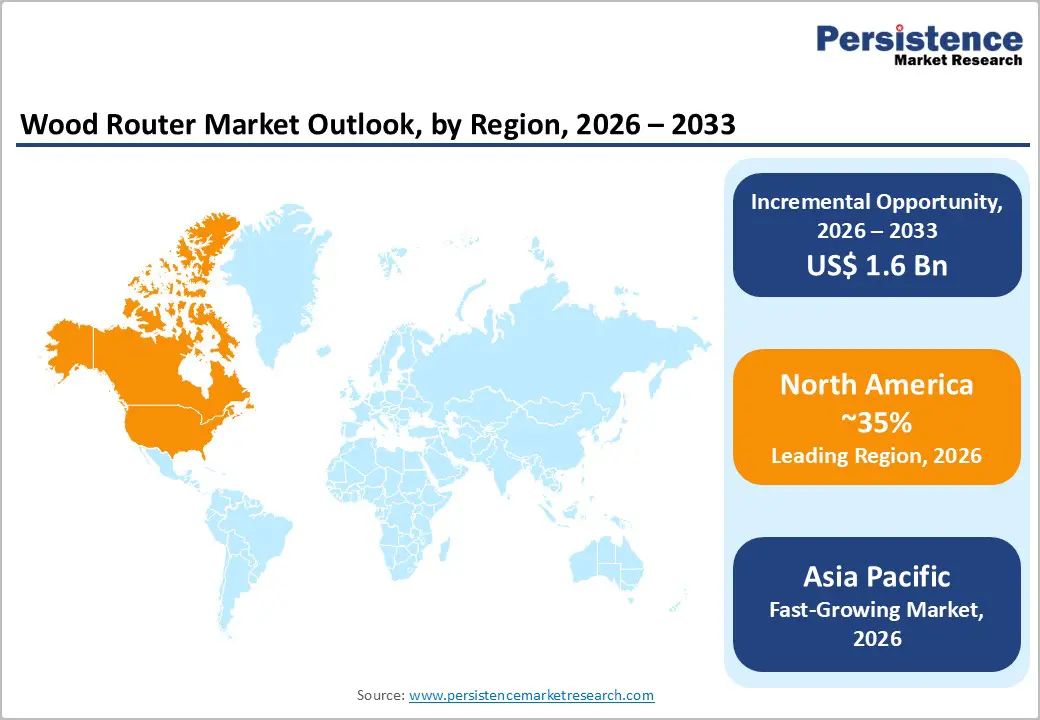

North America is set to hold the largest portion of the wood router market share at approximately 35% in 2026. The region is supported by a mature furniture manufacturing base, robust construction activity, and a strong home improvement culture. The United States accounts for the majority of regional demand, as professional shops and industrial users increasingly adopt CNC routers for precision machining, process repeatability, and integration with digital design workflows. This environment favors suppliers that offer high-performance equipment, reliable service coverage, and seamless compatibility with design and production software, making North America an attractive market for premium and technology-intensive product lines.

Several structural trends continue to reinforce North America’s strategic importance in the wood router market. Reshoring in furniture and millwork manufacturing is shifting production capacity back from overseas locations, as manufacturers seek tighter control over quality, lead times, and brand perception associated with domestic production. Regulatory emphasis on workplace safety and dust control is encouraging upgrades to machines with integrated extraction and comply-by-design features, which favors vendors that can offer solutions combining strong technical performance with assured regulatory compliance.

Europe is likely to hold around 28% market share in 2026. Germany, the United Kingdom, France, and Spain together form the core demand cluster in the European wood router market, reflecting their deep-rooted furniture and woodworking traditions. Germany holds a leading position due to its globally recognized woodworking machinery industry and highly developed furniture manufacturing base, which relies heavily on advanced routing technology for precision, automation, and integration with digital production systems. The U.K. market emphasizes high-quality custom millwork and heritage restoration projects, while France and Spain demonstrate strength in luxury furniture production and architectural woodwork.

Regulatory harmonization under European Union (EU) frameworks significantly influences market dynamics, particularly regarding safety standards EN ISO 19085, energy efficiency requirements, and sustainability mandates. The EU's Circular Economy Action Plan (CEAP) and stricter formaldehyde emission regulations have driven demand for precision routing equipment that minimizes waste and supports sustainable manufacturing practices. Competitive landscape characteristics include strong relationships between equipment manufacturers and end-users, emphasis on long-term service agreements, and collaborative innovation between router producers and software companies developing CAD/CAM solutions.

Asia Pacific is anticipated to emerge as the fastest-growing wood router market between 2026 and 2033. Regional market growth is underpinned by the rapid expansion of furniture manufacturing, export-oriented production, and a steady shift of capacity away from traditional manufacturing bases. China anchors regional demand through its large furniture production and export activity, where routing technology supports high-throughput processing, complex design execution, and strict quality expectations from global buyers. Japan contributes with a strong focus on precision engineering and premium woodworking, while India’s market is expanding as furniture production formalizes, urban housing increases, and policy initiatives encourage local manufacturing.

Southeast Asian economies such as Vietnam, Indonesia, Thailand, and Malaysia are strengthening their role as alternative manufacturing hubs, attracting furniture orders through competitive labor costs, favorable trade relationships, and increasingly capable industrial infrastructure. This shift is driving significant investment in modern routing equipment so manufacturers can meet international buyers’ expectations for consistency, surface quality, and reliable delivery timelines. Structural advantages, including access to timber resources and supportive industrial policies, reduce barriers for manufacturers that want to upgrade from manual or semi-automatic equipment to CNC platforms and integrated production cells.

The global wood router market structure is remaining moderately fragmented, with leading manufacturers such as Robert Bosch GmbH, Makita Corporation, and Stanley Black & Decker collectively accounting for an estimated 35-40% of market revenues. No single supplier is exercising dominant control, as demand is being distributed across a wide spectrum of professional, semi-professional, and hobbyist users. Competitive differentiation is increasingly depending on product breadth, reliability, and brand trust rather than scale alone. This structure is allowing both multinational brands and specialized regional players to coexist while serving distinct customer segments and usage intensity levels.

Market fragmentation is also reflecting the diversity of application requirements, price sensitivities, and regional operating conditions. Customers are prioritizing different attributes depending on use case, such as precision and durability for industrial workshops, or affordability and ease of use for small contractors and home users. Regional manufacturers are continuing to defend strong domestic positions by offering competitive pricing combined with localized service capabilities. Faster after-sales response, proximity-based technical support, and familiarity with local wood types and regulatory standards are strengthening customer retention. Suppliers that are aligning product portfolios with region-specific needs and investing in service networks are positioning themselves to compete effectively despite the presence of established global brands.

The global wood router market is projected to reach US$ 4.4 billion in 2026.

The market is driven by the rising demand for customized furniture and interior woodwork, coupled with the accelerating adoption of CNC automation and precision woodworking technologies in the furniture and construction industries.

The market is poised to witness a CAGR of 3.6% from 2026 to 2033.

Major opportunities lie in CNC and IoT-enabled smart routers, higher-end routers for premium/custom wood products.

Robert Bosch GmbH, Makita Corporation, and Stanley Black & Decker are some of the key players in the market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By End-User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author