ID: PMRREP15055| 193 Pages | 12 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

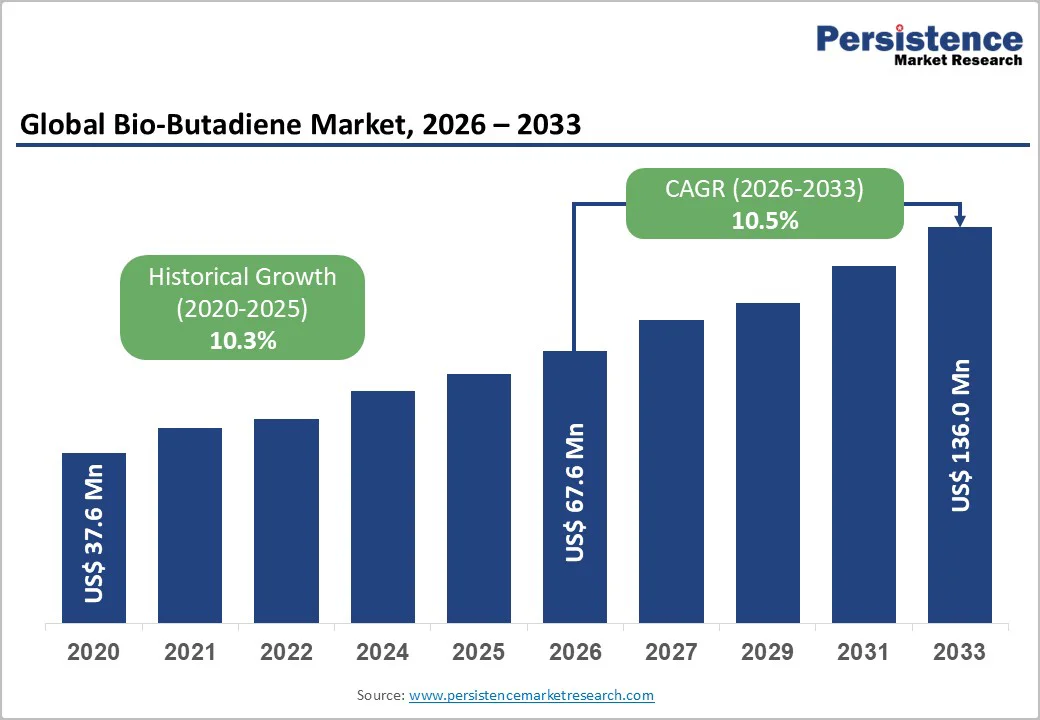

The global bio-butadiene market size is likely to be valued at US$67.6 million in 2026, and is estimated to reach US$136.0 million by 2033, growing at a CAGR of 10.5% during the forecast period 2026 - 2033.

Demand growth is driven by expanding adoption of bio-based polymers, rising circular-economy mandates, and advancements in fermentation-based production methods. Increasing sustainability compliance across automotive, consumer goods, and chemical manufacturing is accelerating industry integration.

Supportive bio-feedstock incentives across the U.S., European Union (EU), and Asia are strengthening investment commitments and scaling commercialization pathways.

| Key Insights | Details |

|---|---|

| Bio-Butadiene Market Size (2026E) | US$ 67.6 Mn |

| Market Value Forecast (2033F) | US$ 136.0 Mn |

| Projected Growth (CAGR 2026 to 2033) | 10.5% |

| Historical Market Growth (CAGR 2020 to 2024) | 10.3% |

Stringent environmental regulations and sustainability mandates are core drivers as industries shift toward low-carbon, renewable raw materials to meet compliance requirements. Policies targeting emission control, waste minimization, and reduced dependence on fossil feedstocks push manufacturers to redesign their sourcing strategies.

Enterprises elevate the role of renewable intermediates that demonstrate measurable environmental benefits, aligning operations with evolving regulatory frameworks. This compliance pressure strengthens the business case for sustainable monomers that support long-term decarbonization objectives and improve regulatory risk management.

Sustainability mandates reshape procurement criteria across automotive, consumer goods, and industrial manufacturing by prioritizing circularity, improved resource efficiency, and transparent supply chains. Companies integrate renewable inputs to maintain regulatory alignment, enhance brand responsibility, and secure access to environmentally conscious customer segments.

This shift reinforces the demand for bio-derived intermediates that deliver functional performance while supporting corporate sustainability commitments. The regulatory environment accelerates investment, adoption, and product development, creating a structured pathway for scalable integration across high-volume downstream applications.

High production costs and scale limitations remain central restraints, as current bio-derived processes rely on specialized fermentation systems, costly catalysts, and multi-step purification operations that increase unit economics.

Industry analyses indicate that bio-based intermediates can cost up to 30% more per ton than conventional petrochemical inputs, reflecting higher feedstock variability and lower process efficiency, a differential that directly affects commercial competitiveness. Capital intensity continues to rise due to the need for advanced reactors, stringent microbial control, and continuous process optimization.

Scale challenges persist, as most facilities operate at pilot or early-commercial volumes, limiting their ability to achieve the operational leverage needed to lower costs.

Limited availability of sustainable feedstock streams and fluctuating biomass prices complicate stable long-term supply planning. Strategic partnerships, feedstock integration models, and technology upgrades are under development, yet current capacity remains insufficient for broad-based industrial uptake. The resulting financial and operational constraints shape investment decisions and influence adoption timelines across end-use value chains.

The surge in construction activity in developing economies, especially in the Asia-Pacific region, presents prime market opportunities. Further fueling the bio-butadiene market growth are the region’s accelerating industrialization, rapid mobility growth, and strong commitment to low-carbon manufacturing. The demand for advanced polymers, elastomers, and sustainable intermediates is rising as manufacturers in the region transition toward renewable feedstock integration.

Governments across Southeast Asia, India, and China are strengthening bio-economy agendas, improving feedstock availability, and enabling large-scale deployment of bio-derived chemicals. The region’s expanding production base creates an environment that supports technology transfer, long-term supply agreements, and capacity expansion.

Asia Pacific delivers a competitive advantage through scale, evolving regulatory incentives, and a fast-growing end-use ecosystem. Automotive, chemical processing, and consumer goods clusters are investing in renewable materials to meet regional sustainability targets.

Strong manufacturing ecosystems across the region enhance the pull for sustainable intermediates that feed into tires, polymers, and performance materials. This structural shift elevates the area as a strategic growth corridor for long-term industry expansion.

Industrial grade is likely to be the leading segment with 61% of the bio-butadiene market revenue share. It is expected to maintain dominance in 2026 due to its extensive use in rubbers and plastics, particularly for automotive tires.

Its high purity allows seamless integration into large-scale synthesis, matching petrochemical alternatives without requiring production retooling. Forecast growth is supported by expanding industrial applications and ongoing adoption in high-volume manufacturing sectors.

Laboratory grade is anticipated to be the fastest-growing segment from 2026 to 2033, driven by research and development (R&D) in fine chemicals and biotechnology. Rising investments in pilot projects and specialized applications across healthcare, textiles, and experimental polymer synthesis are accelerating adoption.

Projected growth is underpinned by the need for scalable, high-purity solutions that enable innovation and support emerging technology-focused industries.

Styrene butadiene rubber (SBR) is poised to be the leading segment, with a market share of about 40% in 2026, driven by its abrasion resistance and its critical role in tire manufacturing. Bio-based SBR supports sustainability initiatives by reducing emissions, and forecast demand is expected to remain strong, driven by automotive production expansion and adoption in high-volume industrial applications that require durable, high-performance elastomers.

Polybutadiene is anticipated to be the fastest-growing application area, projected to expand significantly during the 2026-2033 forecast period. The segment's prolific growth is driven by its growing use in electric vehicle (EV) tires, seals, and specialized polymer applications.

Improvements in production technology enhance efficiency and scalability, while demand is expected to rise across automotive and specialty sectors, supported by broader adoption in chemical processing and innovative material applications.

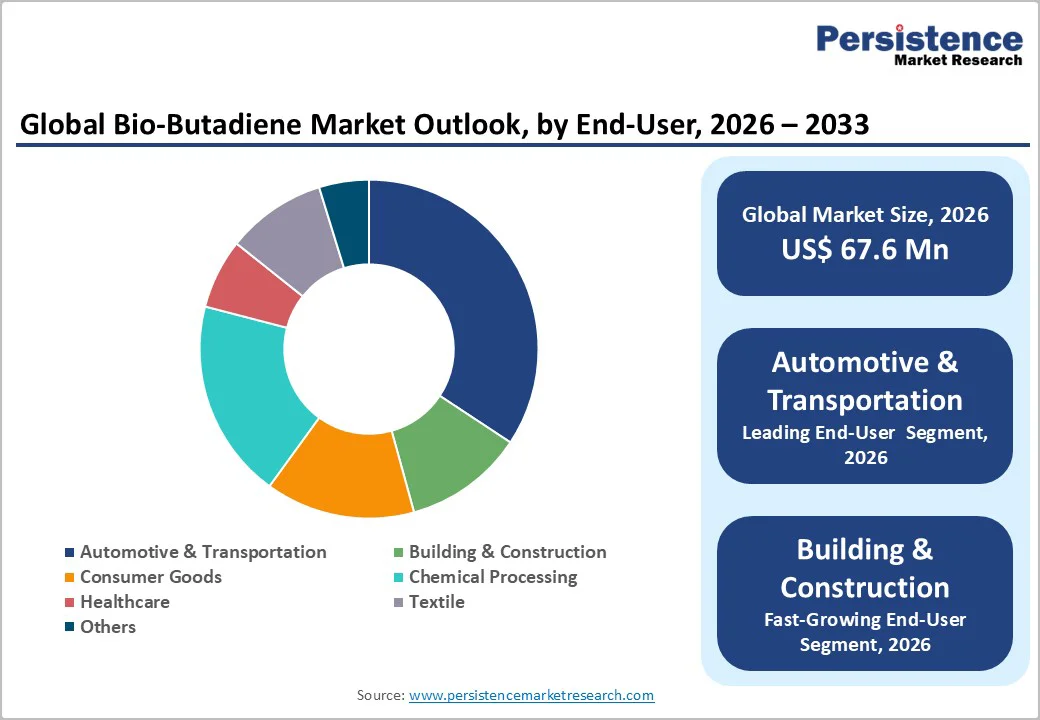

Automotive & transportation is set to dominate with an estimated market share of 36% in 2026, owing to its substantial consumption of SBR and nitrile butadiene rubber (NBR) in tire manufacturing. Tire mandates and regulatory requirements continue to drive volume growth. Forecast demand remains strong as the automotive sector expands, emphasizing high-performance and durable elastomers for large-scale industrial applications.

The building & construction sector is anticipated to register the highest CAGR for 2026 - 2033. This growth is primarily attributable to the deployment of adhesives, latex, and other polymer-based solutions that align with increasingly stringent green building codes.

Rising demand for sustainable construction materials supports the adoption of bio-butadiene, while forecast expansion reflects broader infrastructure development and regulatory emphasis on environmentally friendly building solutions.

The North American market for bio-butadiene is projected to witness significant growth between 2026 and 2033, on account of the increasing adoption of sustainable materials across automotive, consumer goods, and chemical manufacturing sectors.

The regional market benefits from advanced technological capabilities in fermentation-based and catalytic production processes, enabling efficient and high-purity bio-butadiene output. Investments in research and development foster innovation in specialty polymers and elastomers, enhancing application diversity.

Key growth drivers include regulatory emphasis on carbon reduction, incentives for bio-feedstock utilization, and rising corporate commitments to circular economy practices. Expanding electric vehicle production and the push for bio-based tires and industrial materials further stimulate demand.

Strong infrastructure, well-established chemical manufacturing hubs, and proximity to high-value end-use industries position North America as a rapidly expanding market, supporting both domestic consumption and potential export opportunities for sustainable bio-based intermediates.

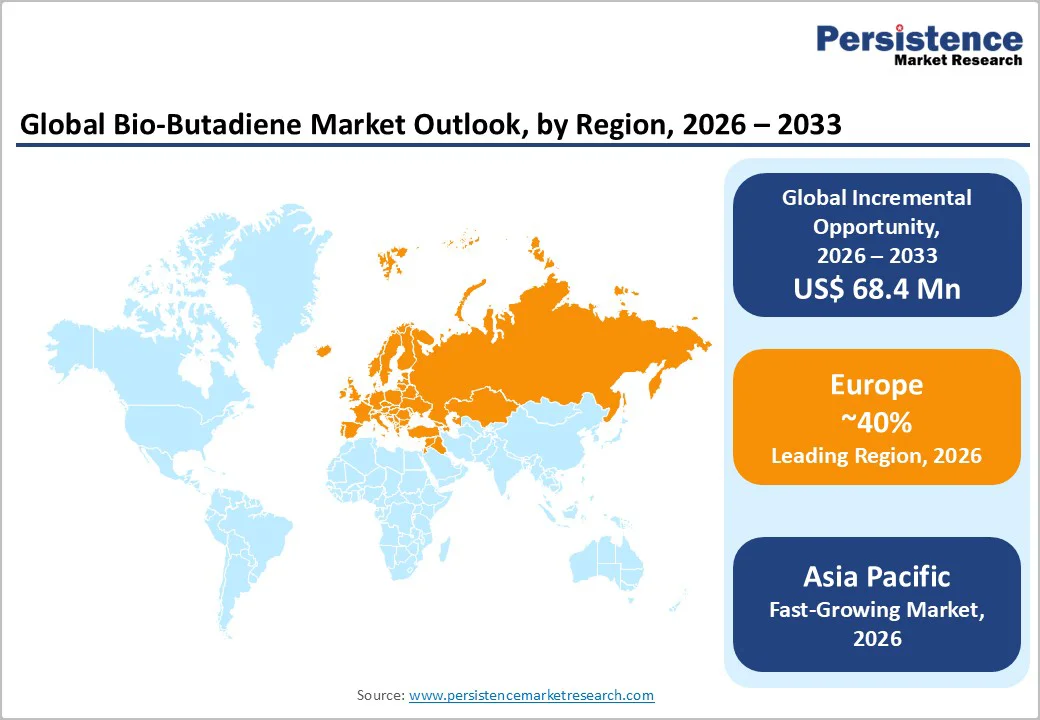

Europe is projected to dominate with an estimated bio-butadiene market share of around 40% in 2026, reflecting its strategic position as a hub for advanced polymer manufacturing and automotive production. The region’s dominance is driven by stringent environmental regulations and ambitious carbon neutrality targets, which have accelerated the adoption of bio-based alternatives over conventional petrochemicals.

Leading automotive manufacturers and tire producers in Germany, France, and Italy are integrating bio-butadiene into high-performance elastomers, enabling compliance with EU emission standards while maintaining product quality and durability. The availability of established chemical infrastructure and specialized feedstock supply chains ensures efficient large-scale production, further strengthening Europe’s competitive advantage.

A key factor sustaining Europe’s leadership is its investment in innovation and circular economy initiatives. Industrial clusters actively collaborate with research institutions to optimize fermentation-based and catalytic production technologies, enhancing yield and reducing cost.

Incentives for bio-feedstock utilization, combined with growing demand for sustainable tires, plastics, and industrial elastomers, create a structurally favorable environment. This convergence of regulatory support, advanced technology adoption, and integrated supply chains solidifies Europe’s preeminent position in the global bio-butadiene market.

Asia Pacific is anticipated to be the fastest-growing regional market for bio-butadiene in 2026, driven by rapid industrialization, expanding automotive production, and rising demand for sustainable polymers.

The regional market benefits from abundant bio-feedstock availability, including sugarcane, corn, and cellulosic biomass, which supports large-scale bio-butadiene production. Countries such as China, India, and Southeast Asian economies are increasingly integrating renewable intermediates into tire manufacturing, plastics, and specialty chemicals, aligning with global sustainability goals.

Key factors fueling growth include supportive government policies, incentives for bio-based technologies, and expanding research and development in fermentation and catalytic conversion processes. Investment in infrastructure and local manufacturing clusters enhances supply chain efficiency, enabling faster commercialization of bio-based products.

The combination of rising industrial output, regulatory focus on low-carbon solutions, and scalable feedstock availability positions the Asia Pacific as a high-growth corridor for bio-butadiene adoption and market expansion.

The global bio-butadiene market structure exhibits moderate concentration, where established chemical producers and innovative biotechnology companies control roughly 50% of total capacity.

These leaders compete vigorously in process technologies such as microbial fermentation and catalytic conversion, alongside optimized procurement of bio-based feedstocks and vertical partnerships with synthetic rubber manufacturers. Market participants gain advantages by securing cost-effective renewable inputs from agricultural waste or algae, thereby lowering production costs and aligning with circular economy principles.

Strategic consolidation accelerates through mergers, acquisitions, and R&D collaborations, fostering economies of scale and expedited market entry for novel bio-derived products. Forward-thinking firms prioritize breakthrough innovations, adherence to environmental regulations, and resilient supply networks to sustain leadership positions.

Stakeholders should evaluate joint ventures in second-generation feedstock to unlock premium pricing in tire and elastomer segments, ensuring long-term resilience amid fluctuating crude oil dynamics and escalating sustainability mandates.

The global bio-butadiene market is projected to reach US$ 67.6 million in 2026.

Rising demand for sustainable polymers, automotive and tire applications, environmental regulations, and advancements in bio-based production technologies are driving the market.

The market is poised to witness a CAGR of 10.5% from 2026 to 2033.

Increasing adoption of sustainable polymers, advancements in bio-based production technologies, and supportive government policies are key market opportunities.

Some of the key market players include Braskem, LanzaTech, BASF SE, UPM Biofore, Michelin, Versalis, Genomatica, and Kuraray.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Grade

By Application

By End-User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author