PMRREP3395

28 Aug 2025

Food and Beverages

172 Pages

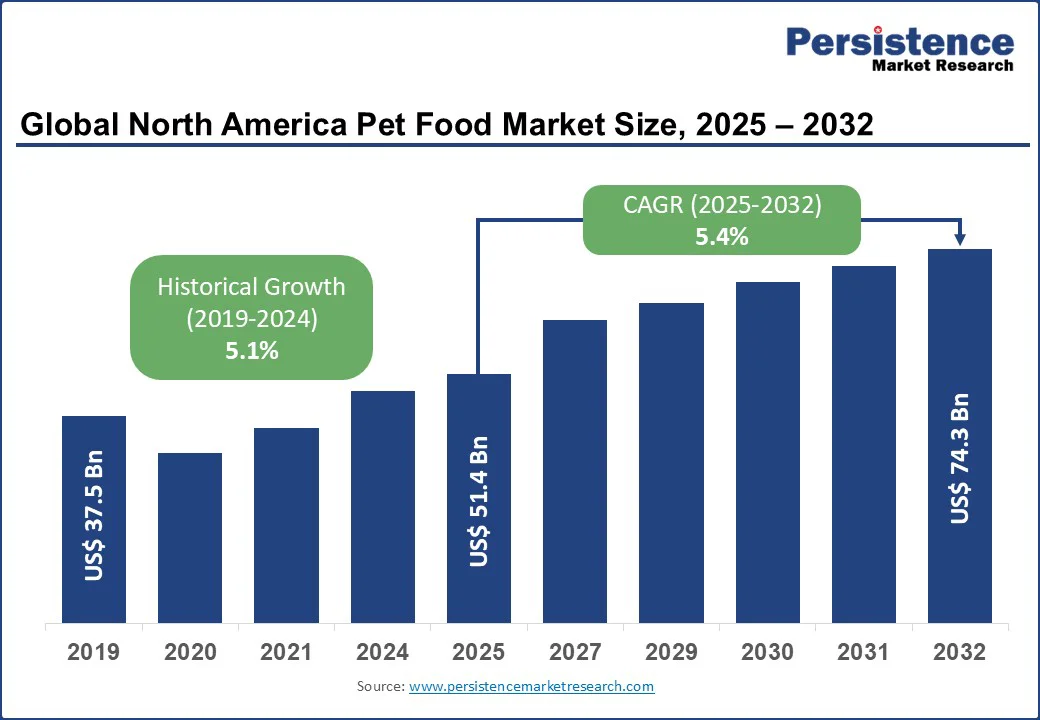

The North America pet food market size is likely to be valued at US$51.4 Bn in 2025 and is expected to grow to US$74.3 Bn by 2032, achieving a steady CAGR of 5.4% during the forecast period 2025 - 2032.

The pet food industry is experiencing robust growth in the U.S., driven by evolving consumer preferences, increased pet ownership, and innovations in product offerings. The pandemic has led to a surge in pet adoptions, with many viewing pets as family members, thereby increasing spending on their care. Functional diets incorporating prebiotics and probiotics are gaining popularity, with significant growth observed in both dogs and cats.

There is a growing interest in eco-friendly and sustainable ingredients, including lab-grown and insect-based proteins, to reduce environmental impact. Developing products with functional benefits, such as digestive health or joint support, can cater to the growing health-conscious consumer base.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

North America Pet Food Market Size (2025E) |

US$51.4 Bn |

|

Market Value Forecast (2032F) |

US$74.3 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.1% |

The North American pet food market is propelled by several key factors, with a significant focus on rising pet ownership and health-conscious pet owners, driving demand for pet food, dog food, and cat food. Pet ownership in North America reached 70% of households in 2025, increasing demand for dog and cat diet solutions, natural pet treats, and specialty pet food.

The rise in pet humanization, with 50% of pet owners treating their pets as family members, fuels demand for grain-free and hypoallergenic pet food options, as well as functional pet food for the health and wellness of pets, resulting in a 15% growth in veterinary-recommended pet food.

Premium and organic pet food brands, using natural ingredients, grew by 18%, driven by eco-conscious consumers. The North American pet care market, valued at US$100 Bn in 2025, supports pet snack products and pet food for aging pets and special diets, with 40% of new pet food launches incorporating healthy and functional pet foods.

High costs of premium pet food and stringent regulatory challenges pose significant restraints to the North America Pet Food Market, impacting specialty pet food and premium and organic pet food brands. The cost of high-quality ingredients for grain-free and hypoallergenic pet food options increased by 15% in 2025, affecting the diets of dogs and cats.

Regulatory compliance, such as FDA and AAFCO standards for veterinary-recommended pet food, raised production costs by 10%, limiting pet supplements and vitamins scalability. 30% of consumers in price-sensitive markets prefer cheaper conventional pet food, restricting the adoption of natural pet treats and pet food for aging pets and special diets.

Limited awareness of functional pet food for the health and wellness of pets in rural areas, with 20% of pet owners unaware of healthy and functional pet foods, constrains the growth of pet snack products in regions like parts of Canada and Mexico.

The rise of e-commerce and specialist veterinary nutrition presents significant opportunities for the North American pet food market. The global pet food e-commerce market is projected to grow at a CAGR of 8% through 2032, increasing demand for premium and organic pet food brands and pet food for puppies and kittens through e-commerce channels.

E-commerce, with 30% growth in pet snack products, enhances accessibility for natural pet treats and veterinary-recommended pet food. Companies such as Nestlé Purina are investing US$200 million in R&D for functional pet food, targeting the health and wellness of pets, as well as pet supplements and vitamins, with a focus on pet specialty stores and the hospitality and restaurant (HoReCa) sector.

Emerging consumer trends, with 1.5 Mn new pet owners by 2030, offer opportunities for pet food for aging pets and special diets and healthy and functional pet foods, positioning the North America pet food market growth and forecasts as a key growth driver.

Dry pet food holds approximately 50% of the industry share in 2025 due to its convenience and affordability in dog food and cat food, with 55% adoption in supermarkets/hypermarkets. Its popularity is largely due to its convenience, longer shelf life, and cost-effectiveness compared to wet alternatives. Dry kibble is easy to store, measure, and serve, making it highly favored by busy pet owners.

Wet pet food is driven by specialty pet food and pet food for puppies and kittens. Wet pet food is expected to see a 15% growth in sales, driven by pet owners’ willingness to invest in quality, palatable, and nutritionally balanced meals for their pets. Wet food is often perceived as healthier and more appetizing, which helps drive its adoption among discerning pet owners.

Dog commands a 55% market share in 2025. A wide range of dog-specific diet solutions, including breed-specific, age-specific, and health-focused formulations, primarily drives this growth. Premium nutrition, functional ingredients, and tailored diet plans are increasingly appealing to dog owners who prioritize their pets’ health and well-being, with 60% adoption in 2025.

Cat is fueled by cat food and natural pet treats, with 12% growth in 2025. Natural and functional treats, along with age- and health-specific cat diets, are driving this expansion. The segment benefits from a growing focus on feline wellness and the popularity of premium and specialty products. Emerging as one of the fastest-growing areas within the pet food industry, it reflects both the humanization of pets and the trend toward holistic, wellness-oriented feeding practices.

Traditional pet food is expected to hold a 65% market share in 2025, driven by its widespread adoption, with 70% of pet owners using it in 2025. This category encompasses standard dog and cat food products that cater to general nutritional needs and are widely available in retail channels.

Specialist Veterinary Nutrition is fueled by veterinary-recommended pet food and pet supplements and vitamins, with 15% growth in 2025. Pet owners increasingly prioritize clinical-grade nutrition for preventive care or therapeutic purposes, making veterinary-backed products highly sought after. The category is particularly popular among pet owners looking for specialized solutions for aging pets, chronic conditions, or breed-specific needs.

Supermarkets/Hypermarkets hold a 40% market share in 2025. Their growth is driven by the wide availability of healthy and functional pet food options, including products targeting weight management, digestion, and overall wellness. These large retail formats offer convenience, competitive pricing, and variety, which encourages repeat purchases.

E-commerce is fueled by premium and organic pet food brands, with a projected 20% growth in 2025. Online platforms offer the convenience of home delivery, subscription models, and access to niche products that may not be widely available in physical stores. E-commerce also benefits from targeted marketing and digital engagement, which helps brands reach discerning pet owners more effectively.

North America pet food market is highly competitive, with pet food companies competing on innovation, health focus, and sustainability. Nestlé Purina and Mars Incorporated dominate in dog and cat diet solutions, while Hill’s Pet Nutrition Inc. leads in veterinary-recommended pet food.

Healthy and functional pet foods, premium and organic pet food brands, and pet supplements and vitamins add a competitive layer. Strategic partnerships and R&D investments in pet food for puppies and kittens are key differentiators.

The North America pet food market is projected to reach US$ 51.4 Bn in 2025, driven by pet food and dog food.

Rising pet ownership, grain-free and hypoallergenic pet food options, and functional pet food for health and wellness of pets are key drivers.

The north America pet food market grows at a CAGR of 5.4% from 2025 to 2032, reaching US$ 74.3 Bn by 2032.

Opportunities include premium and organic pet food brands, e-commerce, and specialist veterinary nutrition.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: As Applicable |

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Pet Type

By Food Category

By Distribution Channel

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author