ID: PMRREP19030| 194 Pages | 27 Oct 2025 | Format: PDF, Excel, PPT* | Food and Beverages

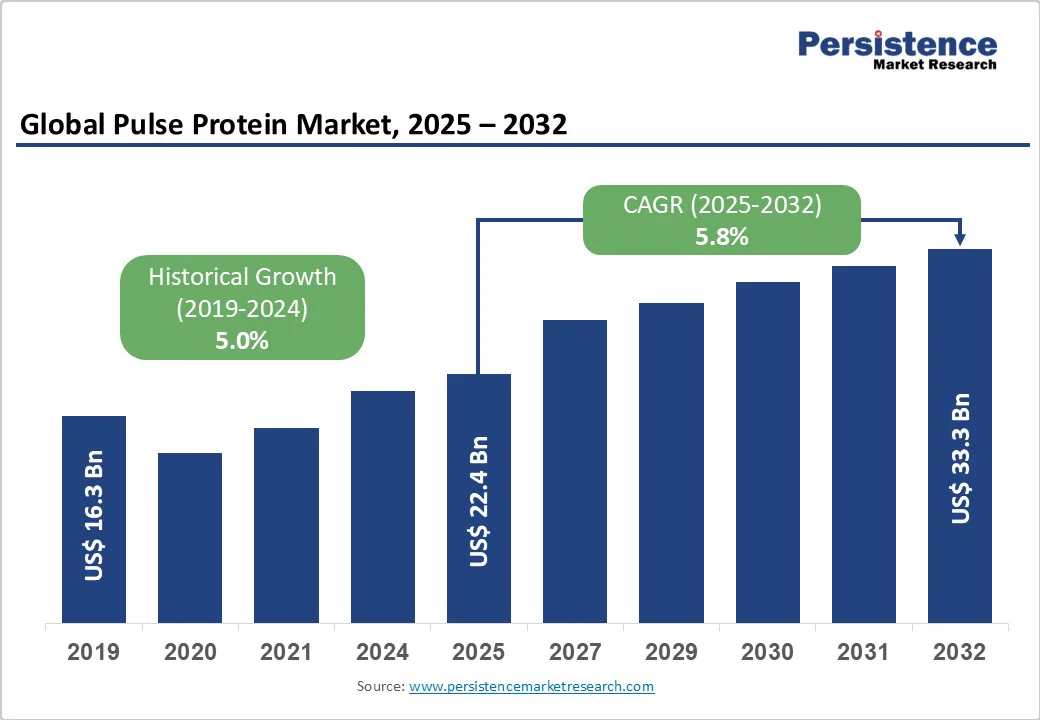

The global pulse protein market size is likely to be valued at US$22.4 Billion in 2025 and is expected to reach US$33.3 Billion by 2032, growing at a CAGR of 5.8% during the forecast period from 2025 to 2032, driven by rising demand for plant-based, allergen-free, and sustainable protein sources.

| Key Insights | Details |

|---|---|

|

Pulse Protein Market Size (2025E) |

US$22.4 Bn |

|

Market Value Forecast (2032F) |

US$33.3 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.0% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.8% |

The rising demand for plant-based proteins is a significant driver of the global market, influenced by shifting dietary preferences and health considerations. In India, pulses are a staple in vegetarian diets, with the country being the largest producer and consumer of pulses globally, accounting for 25% of global production and 27% of consumption. Despite this, average per capita pulse consumption in India remains below recommended dietary intake levels, indicating potential for increased consumption.

Globally, the average per capita consumption of pulses is approximately 7 kg per year, with projections to rise to 8.6 kg by 2032, reflecting a growing trend towards plant-based diets. This shift is driven by increasing awareness of the health benefits of plant-based proteins, such as their role in reducing the risk of chronic diseases and supporting sustainable agriculture. The market is experiencing significant growth, with governments and industries investing in research and development to meet the evolving consumer demand for plant-based protein sources.

The high production and processing costs of pulse proteins pose significant challenges to their widespread adoption. Advanced processing methods such as alkaline extraction and isoelectric precipitation are commonly employed to obtain high-quality pulse protein isolates. These techniques involve multiple steps, including milling, defatting, extraction, and drying, each requiring specialized equipment and energy inputs. For instance, the alkaline extraction process necessitates the use of alkaline solutions and precise pH adjustments, followed by centrifugation and drying, which collectively contribute to elevated operational expenses.

The need for large-scale infrastructure to handle the volume of pulses required for industrial-scale production further escalates costs. In India, while pulses are a staple in diets, the infrastructure for processing pulse proteins is still developing, leading to higher costs and limited availability of processed pulse protein products. These financial barriers hinder the scalability and competitiveness of pulse proteins in the global market.

The growing interest in sports nutrition presents a significant opportunity for pulse proteins, particularly in India, where pulses contribute approximately 13% to per capita total protein intake. This aligns with the increasing demand for plant-based protein sources among athletes and fitness enthusiasts seeking sustainable and allergen-free alternatives. The Indian government's emphasis on promoting pulses, as outlined in the "Strategies and Pathways for Accelerating Growth in Pulses towards the Goal of Atmanirbharta", further supports this trend.

The rise in health-conscious consumers and the expansion of the nutraceuticals market, projected to grow from US$455.01 Billion in 2024 to US$503.22 Billion in 2025, indicate a favorable environment for the integration of pulse proteins into dietary supplements and functional foods. These developments underscore the potential for pulse proteins to become a staple in sports nutrition, offering a sustainable and nutritious option for consumers.

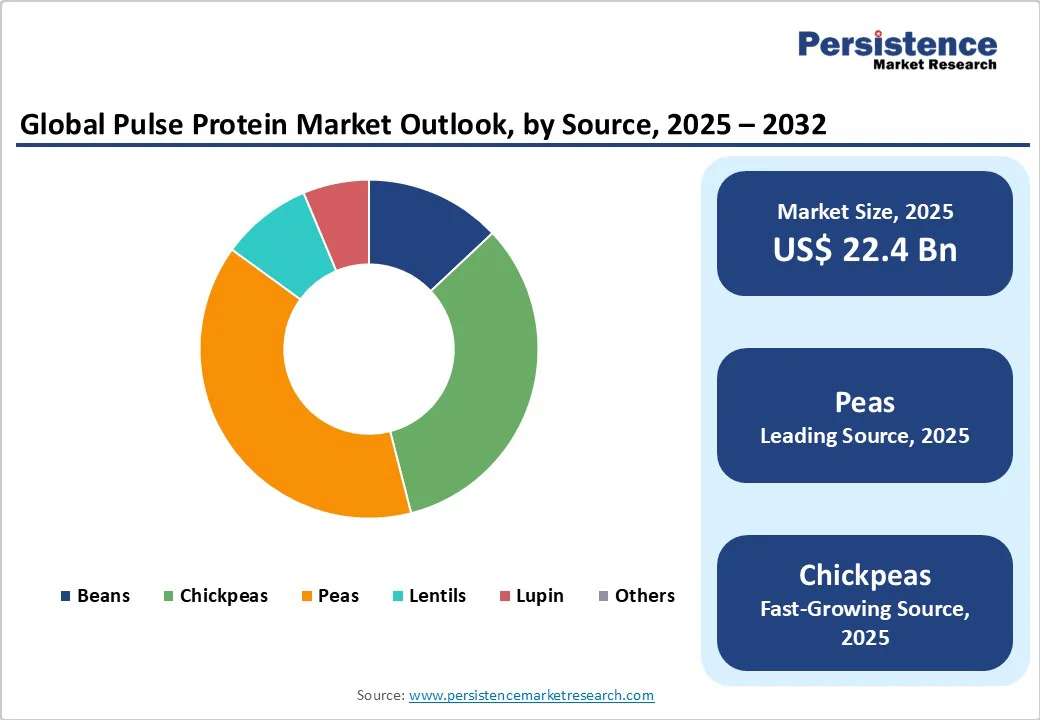

The peas segment dominates the market with a 39% share in 2025, due to its neutral taste, high protein content, and versatile functionality in food applications. Peas are widely cultivated, with India and Canada being major producers, contributing significantly to the global supply. In 2023, Canada produced over 6 million tonnes of yellow peas, supporting both domestic consumption and exports for protein extraction. Pea protein is highly soluble, allergen-free, and suitable for incorporation into beverages, bakery, meat analogs, and nutritional supplements, increasing its adoption across industries. Consumer preference for plant-based and clean-label products has driven the demand for pea protein, making it the leading source in the market.

Conventional pulse proteins dominate the market due to their established production infrastructure, lower cost, and widespread availability. Globally, conventional pulses account for the majority of cultivation; for instance, India produced 26.6 million tonnes of pulses in 2023, mostly through conventional farming methods. These proteins are more affordable for food manufacturers and consumers compared to organic alternatives, enabling large-scale incorporation into bakery, beverages, snacks, and meat analogs.

Conventional pulse proteins also benefit from stable supply chains and higher yields, ensuring consistent quality and accessibility. While organic pulse protein is gaining traction, the cost and limited supply restrict its penetration, allowing conventional pulse protein to maintain its dominance in global markets, particularly in regions with high protein demand and price-sensitive consumers.

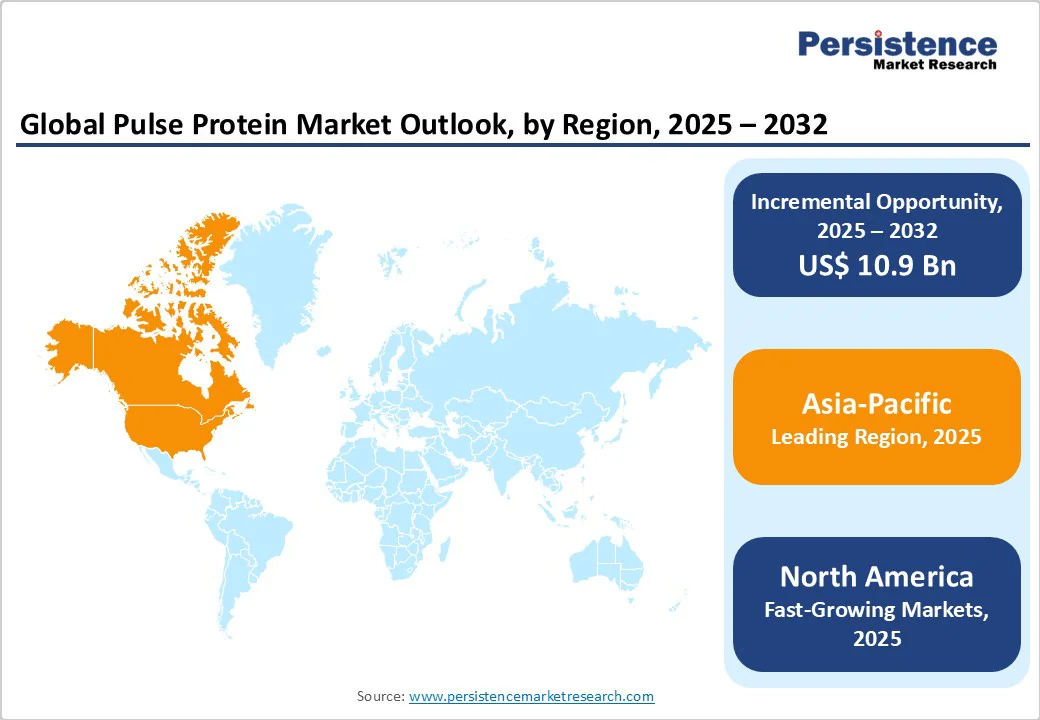

The Asia Pacific region dominates the global market with a 37.3% share in 2025, due to abundant pulse production, strong dietary habits, and growing health awareness. India, China, and Myanmar are major pulse-producing countries, with India producing 24.2 million tonnes of pulses in 2022–23 (desagri.gov.in), supporting both domestic consumption and export demand. Pulses are a staple in traditional diets, ensuring high acceptance of pulse-based products. Rising urbanization and disposable incomes have increased demand for processed and convenient high-protein foods.

Government initiatives promoting pulses, such as the National Food Security Mission and support for plant-based protein development (niti.gov.in), further strengthen production and consumption. These factors collectively position Asia-Pacific as the largest market for pulse protein, combining supply advantage, cultural acceptance, and growing health-conscious consumption trends.

Europe is an important region in the market due to high consumer awareness of health, sustainability, and plant-based diets. The European Union reported that over 12% of adults in EU countries follow vegetarian or flexitarian diets, driving demand for alternative protein sources. Countries, including Germany, France, and the U.K., are investing heavily in plant-based food innovation, including pulse-based meat alternatives, bakery products, and beverages. Government initiatives, such as the EU Protein Plan, support sustainable protein production and research into pulse cultivation and processing (ec.europa.eu). Consumers prioritize clean-label, non-GMO, and allergen-free products, making Europe a key market for premium pulse protein offerings and R&D-driven product development.

North America is witnessing rapid growth in the market due to increasing consumer demand for plant-based and sustainable protein sources. The U.S. produces over 3 million tonnes of dry peas and lentils annually, providing a strong raw material base for pulse protein extraction. Rising health awareness, a growing vegan and flexitarian population, and the popularity of clean-label and allergen-free products are driving adoption in food, beverages, and supplements.

The expansion of sports nutrition, bakery, and meat alternative markets further accelerates growth. Government initiatives promoting plant-based proteins and sustainable agriculture also support production and innovation. These factors position North America as a high-growth region for pulse protein.

The global pulse protein market is expanding as manufacturers innovate with advanced extraction, purification, and functionalization techniques. Leading companies emphasize high protein content, neutral taste, and versatile applications, while emerging players focus on organic, non-GMO, and allergen-free products.

Strategic collaborations, sustainable sourcing, and supply chain transparency strengthen competitiveness, driving adoption across food, beverages, sports nutrition, and bakery applications, and fueling market growth worldwide.

The pulse protein market is projected to be valued at US$22.4 Billion in 2025.

The pulse protein market is driven by rising demand for plant-based diets, health awareness, sustainability, functional food applications, sports nutrition, and innovation in protein extraction and processing.

The pulse protein market is poised to witness a CAGR of 5.8% between 2025 and 2032.

Key opportunities in the pulse protein market include plant-based product demand, functional foods, sports nutrition, emerging markets, sustainable production, and development of organic, allergen-free, and innovative protein applications.

Major players in the pulse protein market are Ingredion Incorporated, Cargill Incorporated, AGT Food and Ingredients, Glanbia Plc, Roquette Frères, and The Scoular Company.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn Volume: Tons |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Source

By Nature

By Form

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author