ID: PMRREP32153| 224 Pages | 11 Feb 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

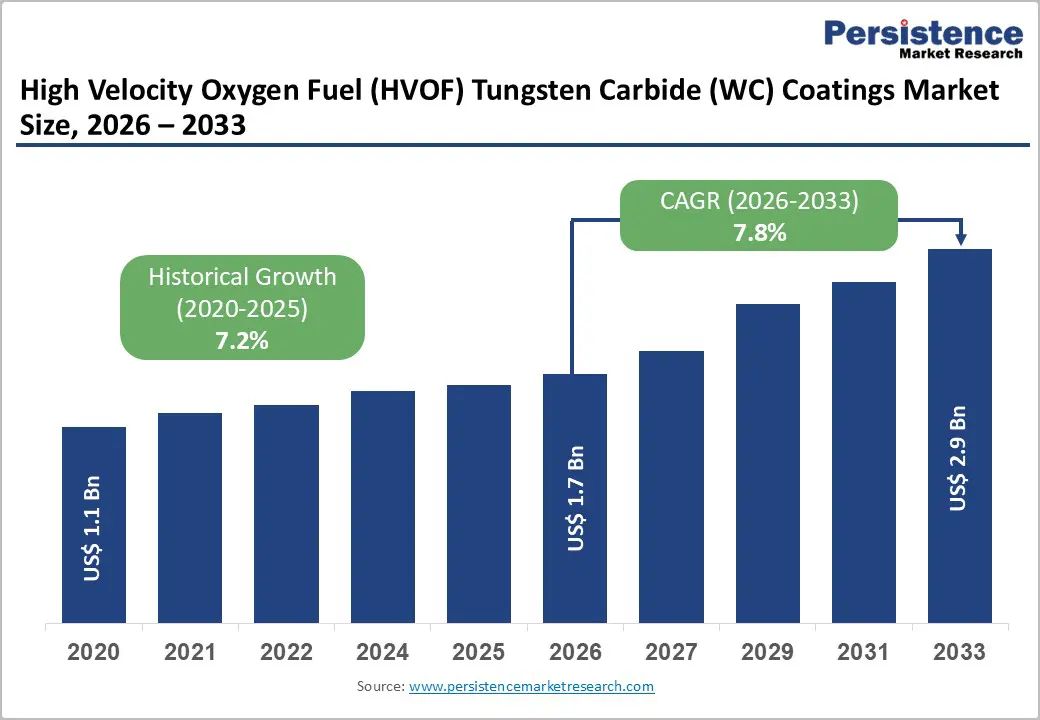

The global high velocity oxygen fuel (HVOF) tungsten carbide (WC) coatings market size is expected to be valued at US$ 1.7 billion in 2026 and projected to reach US$ 2.9 billion by 2033, growing at a CAGR of 7.8% between 2026 and 2033. Growth is driven by rising demand for wear-resistant coatings in industries exposed to high stress, supported by advancements in thermal spray technologies that enhance component durability. Increasing adoption in aerospace and automotive sectors, where HVOF coatings provide dense, hard, and long-lasting surfaces, further fuels expansion. NASA studies confirm WC-Co coatings’ reliability in landing gear, performing over 6,000 cycles, highlighting their critical application performance.

| Report Attribute | Details |

|---|---|

|

High Velocity Oxygen Fuel (HVOF) Tungsten Carbide (WC) Coatings Size (2026E) |

US$ 1.7 billion |

|

Market Value Forecast (2033F) |

US$ 2.9 billion |

|

Projected Growth CAGR(2026-2033) |

7.8% |

|

Historical Market Growth (2020-2025) |

7.2% |

Drivers -Strong Growth from Aerospace and Automotive Demand for Wear-Resistant Coatings

The HVOF WC coatings market is significantly driven by increasing demand from aerospace and automotive industries, where high-cycle and high-stress components require exceptional wear resistance. WC-Co coatings achieve hardness levels up to 1,200 HV, far surpassing traditional chrome plating, and reduce wear rates in engine components by 50–70%. NASA testing demonstrated HVOF WC-17Co coatings enduring 6,378 landings on aircraft struts, proving reliability in critical high-cycle operations.

This remarkable durability translates into lower maintenance costs and extended life, which is increasingly important as industries face stricter efficiency and sustainability regulations. Consequently, manufacturers are adopting HVOF coatings widely across engines, landing gears, and other high-performance parts, fueling market expansion globally.

Enhanced Corrosion Resistance Driving Market Adoption in Harsh Environments

Advancements in corrosion resistance are accelerating the HVOF WC coatings market, particularly in sectors like oil and gas, where components operate in aggressive environments. WC-CoCr coatings demonstrate superior protection against pitting corrosion, with experimental studies showing up to 90% lower degradation during saline exposure compared with standard carbide coatings.

The shift away from environmentally harmful hexavalent chrome, restricted under EPA regulations, further encourages the adoption of HVOF coatings as a sustainable alternative. Enhanced particle velocities in HVOF spraying produce dense coatings with porosity below 1%, offering higher reliability and longevity in critical applications such as petrochemical valves, pumps, and offshore equipment, boosting confidence among end-users and supporting market growth.

Restraints - High Initial Investment and the Complexity of HVOF Equipment Limiting Adoption

The adoption of HVOF WC coatings is constrained by the high capital investment required for equipment, often exceeding USD 500,000 per system. Such costs create a significant barrier for small and medium-sized enterprises looking to enter the market. Additionally, specialized powders, such as WC-Co, are 20–30% more expensive than conventional alternatives, further limiting scalability and cost-effectiveness for smaller operations.

Operational expertise is also critical for achieving optimal coating quality, requiring extensive training and skilled personnel. This combination of high equipment costs, expensive feedstock, and technical complexity slows adoption in emerging markets and cost-sensitive industries, restraining overall market growth despite the clear performance advantages of HVOF coatings.

Stringent Environmental Regulations Increasing Operational Burdens

Environmental compliance is a key restraint for the HVOF WC coatings market, as EPA and EU REACH regulations impose strict limits on emissions generated during oxygen-fuel spraying processes. Meeting these standards often raises operational costs by 15–20%, requiring investment in monitoring, filtration, and mitigation systems.

Powder overspray and waste management demand specialized disposal procedures, adding further cost and logistical challenges. These environmental and regulatory constraints discourage entry by smaller or cost-sensitive manufacturers, limiting market penetration. Despite the superior performance and durability of HVOF coatings, regulatory compliance remains a critical factor that can slow adoption, particularly in regions with stringent environmental standards.

Opportunity - Expanding Adoption of HVOF WC Coatings in Renewable Energy Applications

Significant opportunities exist for HVOF WC coatings in the renewable energy sector, particularly in power generation components such as turbine blades and hydraulic systems. These coatings provide exceptional erosion resistance at velocities up to 350?m/s, protecting critical parts from wear in wind, hydro, and other renewable energy equipment. Comparative studies show WC?10Co?4Cr coatings outperform HVAF alternatives, reducing erosion by approximately 40%, enhancing operational efficiency and component lifespan.

With the global renewable energy sector expanding rapidly, the International Energy Agency (IEA) projects a 50% growth in renewable capacity by 2030. This surge is expected to drive demand for durable, high-performance coatings, positioning HVOF WC coatings as a preferred solution for turbines, pumps, and other high-stress renewable energy components, creating significant market growth opportunities.

Rising Applications in Medical Devices and Electronics Sectors

Emerging applications of HVOF WC coatings in the medical and electronics industries present a new growth avenue for the market. In medical devices, WC-Ni coatings demonstrate excellent biocompatibility, with trials showing up to 99% bacterial resistance on implant surfaces. These coatings enhance durability, reduce infection risks, and support long-term device performance. FDA approvals for coated implants further validate their safety and efficacy.

In electronics, thin HVOF-applied layers offer wear protection for connectors, contacts, and precision components without compromising conductivity. These factors contribute to increasing adoption in both high-value medical and electronics equipment. Industry forecasts suggest that this segment could grow, making it a key driver of market expansion for HVOF WC coatings.

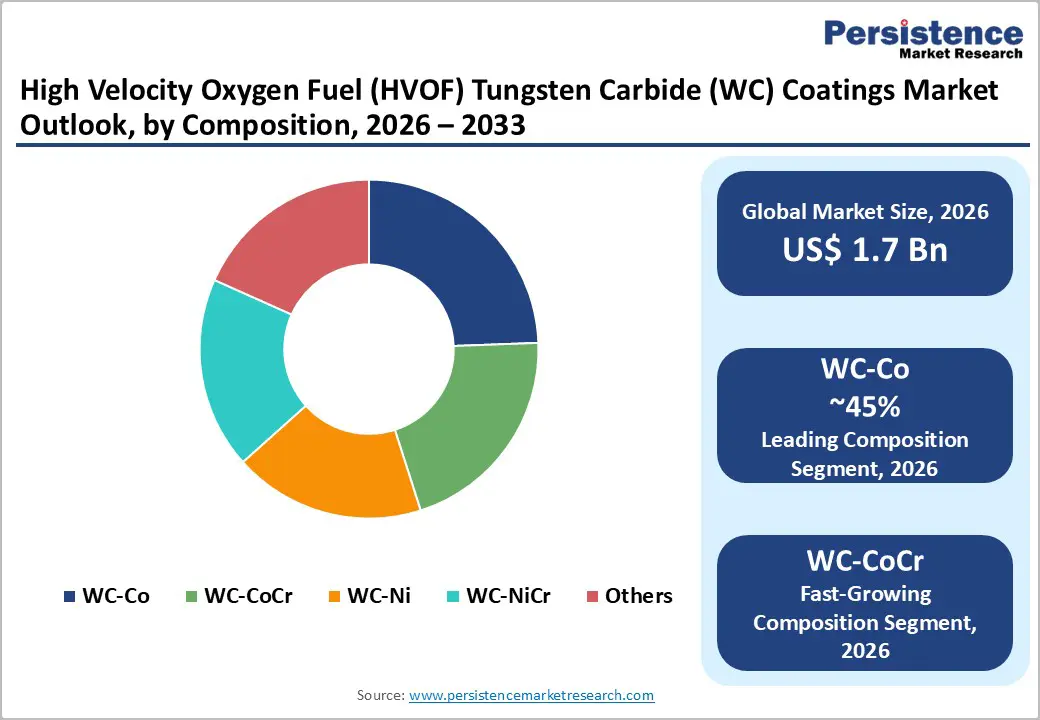

Composition Insights

WC-Co coatings dominate the HVOF tungsten carbide market, holding approximately 45% share in 2025. Favored for its balanced combination of toughness and hardness, WC-Co is widely used in automotive pistons and high-stress engine components. Its microstructure resists decarburization during the HVOF process, achieving hardness levels between 1,100–1,300?HV. Proven performance in high-volume production ensures it remains the leading choice over alternative corrosion-focused coatings, providing both durability and cost-effectiveness.

Emerging demand is observed for WC-CoCr coatings, which offer superior corrosion resistance in aggressive environments such as oil & gas and chemical processing. Their enhanced chemical stability and long-term durability make them ideal for applications requiring both wear and corrosion protection. Industries adopting these coatings are increasingly favoring them for valves, pumps, and high-performance machinery components.

Industry Insights

The aerospace and aviation sector commands a leading market share of 30% in 2025, primarily driven by applications in landing gear and critical engine components. HVOF WC coatings have increasingly replaced traditional chrome plating under initiatives like HCAT, supported by NASA validations demonstrating superior service life under high-cycle operations. Rising air traffic and stringent performance requirements continue to justify the premium adoption of these coatings in engines, turbines, and structural components.

The automotive sector is emerging as the fastest-growing end-use segment, fueled by the need for enhanced wear resistance and efficiency in pistons, cylinder liners, and transmission components. Adoption of HVOF coatings in high-performance and electric vehicles is accelerating, as manufacturers seek to improve component longevity and reduce maintenance costs while meeting evolving emission and efficiency standards.

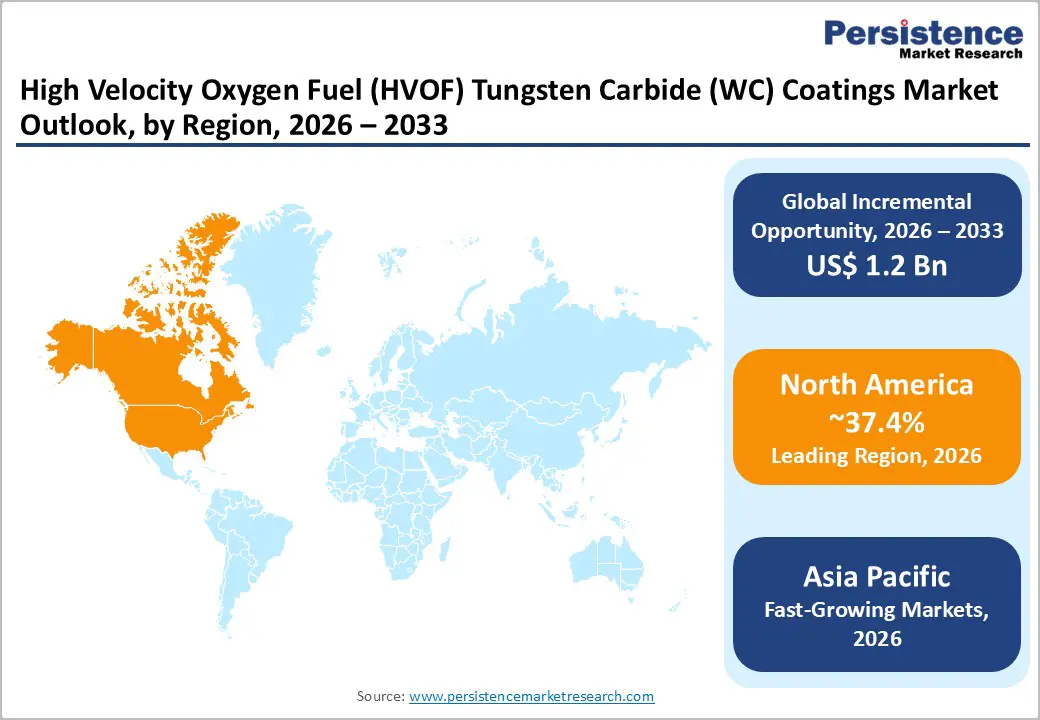

North America High Velocity Oxygen Fuel (HVOF) Tungsten Carbide (WC) Coatings Market Trends

North America dominates the HVOF tungsten carbide coatings market, accounting for approximately 37.4% share in 2025. The U.S. leads adoption through FAA-certified coatings used in Boeing and Lockheed landing gear, with HCAT initiatives promoting WC-Co over traditional chrome plating. Innovation hubs, such as ASM International, advance powder technology, while DoD R&D funding exceeding USD 100?million annually supports durable surface development. Regulatory action against hexavalent chrome further accelerates adoption, with EPA mandates favoring low-porosity HVOF coatings in aerospace, defense, and energy applications.

Emerging demand in Canada and Mexico is growing for industrial machinery and automotive components, particularly in sectors requiring enhanced wear and corrosion protection. Expansion is fueled by MRO operations and the adoption of HVOF coatings in high-performance equipment, suggesting steady market consolidation and technological penetration across the region.

Europe High Velocity Oxygen Fuel (HVOF) Tungsten Carbide (WC) Coatings Market Trends

Germany leads Europe in HVOF WC coatings adoption, particularly in the automotive and aerospace sectors, with major players like Airbus and BMW standardizing WC coatings under REACH eco-regulations. Innovations from Oerlikon Metco improve turbine efficiency, while Safran in the UK and France adopts HVOF for engine components. EU directives on emissions and environmental compliance drive the use of WC-CoCr coatings in power generation, aligning standards across Spain and neighboring countries.

The European market is projected to grow at a CAGR of approximately 8.1% during the forecast period, driven by increased adoption in aerospace, automotive, and energy sectors. Expanding interest in eco-friendly, durable coatings and regulatory compliance will continue to fuel demand, encouraging manufacturers to invest in R&D and high-performance coating solutions.

Asia Pacific High Velocity Oxygen Fuel (HVOF) Tungsten Carbide (WC) Coatings Market Trends

Asia Pacific holds around 35.8% market share in 2025, with China emerging as the key growth driver through industrial manufacturing hubs and a 20% annual industrial output increase per NBS. Rising automotive demand and infrastructure investments are accelerating the adoption of HVOF coatings. India and Japan leverage cost advantages to implement WC coatings in oil & gas, while ASEAN nations experience a 10% annual infrastructure boom, deploying HVOF for heavy machinery and industrial equipment.

The market in the region is rapidly expanding as manufacturers seek durable and wear-resistant coatings to meet high-performance requirements in automotive, energy, and construction sectors. Increased industrialization, rising quality standards, and the adoption of advanced coating technologies are expected to sustain robust market growth across the Asia Pacific.

The HVOF WC coatings market is highly consolidated, with leading players collectively holding a significant majority of the global share. Market competition is primarily driven by investments in research and development, particularly in advanced powders and nano-structured materials that enhance coating density, hardness, and performance. Companies focus on optimizing thermal spray processes to achieve superior adhesion, lower porosity, and consistent quality across high-stress applications.

Strategic initiatives emphasize acquisitions, technology partnerships, and expansion of service capabilities to strengthen market position. Differentiation is achieved through custom coating compositions and tailored solutions for specific industries, while emerging business models increasingly integrate end-to-end service offerings, including on-site spraying and maintenance support, to attract high-value industrial clients.

Key Market Developments

The global HVOF WC coatings market is expected to reach US$ 1.7 billion in 2026.

Rising demand in aerospace and aviation, with coatings demonstrating wear resistance over 6,000 cycles in high-stress applications.

North America leads with 37.4% share in 2025, driven by U.S. aerospace innovation and regulatory support.

Expansion in renewable energy applications, particularly erosion-resistant turbines requiring high durability.

Oerlikon Metco, Praxair Surface Technologies (Linde AMT), Bodycote plc, Curtiss-Wright Surface Technologies, Kennametal Inc. dominate with R&D focus.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 – 2025 |

|

Forecast Period |

2026 – 2033 |

|

Market Analysis Units |

Value: US$ Mn/Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

Composition

Industry

Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author