ID: PMRREP32347| 199 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

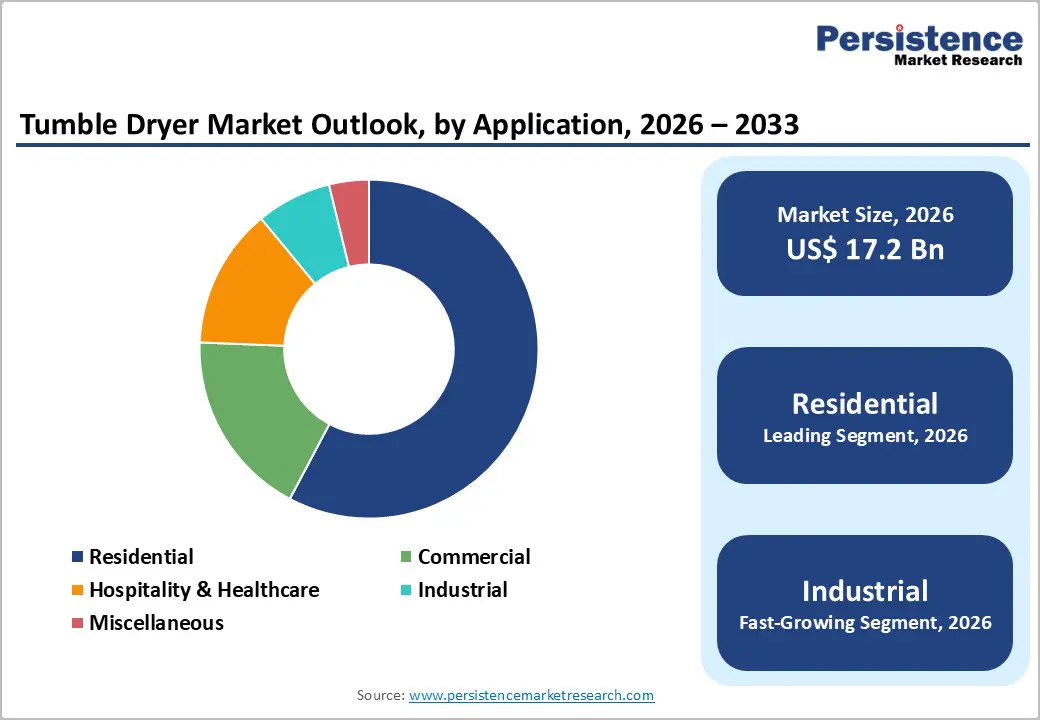

The global Tumble Dryers Market size is likely to be projected at US$ 17.2 Billion in 2026 and is projected to reach US$ 23.5 Billion by 2033, growing at a CAGR of 4.6% between 2026 and 2033. Market expansion is driven by systematic urbanization and shrinking living spaces reducing outdoor drying feasibility particularly in high-rise apartments and multi-family housing creating sustained appliance demand, escalating consumer energy consciousness with heat pump dryers offering around 20-30% energy savings compared to traditional vented models driving premium product adoption, and technological advancement integrating sensor-based drying, smart connectivity, and fabric care programs enhancing convenience and operational efficiency across residential and commercial applications.

| Key Insights | Details |

|---|---|

| Tumble Dryers Market Size (2026E) | US$17.2 Bn |

| Market Value Forecast (2033F) | US$23.5 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.6% |

| Historical Market Growth (CAGR 2020 to 2025) | 3.8% |

Market Drivers

Urbanization and lifestyle transformation systematically drive tumble dryer demand, with global urbanization reaching 60% in 2025 and projected to rise to 68% by 2050 per United Nations estimates, creating sustained demand for space-efficient laundry solutions across cities. Urban apartments and multi-family housing increasingly limit outdoor drying feasibility, accelerating appliance adoption. Shrinking living spaces, alongside a 15–20% decline in average household size across developed economies, highlight a clear consumer shift toward compact, integrated washer-dryer combinations. This transition supports an emerging market segment led by younger demographics and dual-income households that prioritize time efficiency, convenience, and reliability, positioning tumble dryers as essential lifestyle appliances rather than discretionary purchases in urban living environments.

Energy efficiency awareness and regulatory transformation systematically drive premium tumble dryer adoption, with the heat pump tumble dryer segment expanding at a 6.1% CAGR, reflecting strong consumer acceptance of energy-efficient alternatives that support premium category growth. European Union energy labeling regulations mandating higher minimum efficiency standards, combined with government rebate programs offering incentives of USD 300–800 per unit, reinforce regulatory momentum. These measures materially lower ownership costs and accelerate replacement cycles. The resulting policy-led demand creates recurring market opportunities, particularly across Europe and North America, where environmental consciousness, rising electricity costs, and sustainability commitments remain high, positioning heat pump dryers as long-term value propositions rather than short-term discretionary upgrades globally.

Market Restraints

Market expansion is constrained by heat pump dryers commanding USD 1,200–2,200 price points compared with USD 600–900 for conventional vented models, creating a significant purchase barrier for budget-conscious consumers and emerging market buyers. Extended return-on-investment payback periods of five to seven years, despite meaningful long-term energy savings, further limit adoption. These cost dynamics restrict mass-market penetration, particularly in price-sensitive residential segments, slowing replacement cycles and moderating overall market growth momentum until affordability improves through scale, incentives, or technology cost reduction across developing economies and first-time appliance purchasers globally worldwide markets.

Market expansion is constrained by heat pump dryers requiring 15–25% longer drying cycles than conventional models, creating adoption friction among time-constrained consumers prioritizing speed and convenience. Extended cycle times reduce perceived productivity benefits, particularly in households with frequent laundry loads. Additionally, ventless condenser and heat pump systems impose specific space, airflow, and electrical installation requirements. These constraints limit compatibility within compact urban apartments and multi-family housing, where utility layouts are fixed and space flexibility is minimal, collectively restraining broader adoption and slowing penetration across dense metropolitan markets globally over time.

Market Opportunities

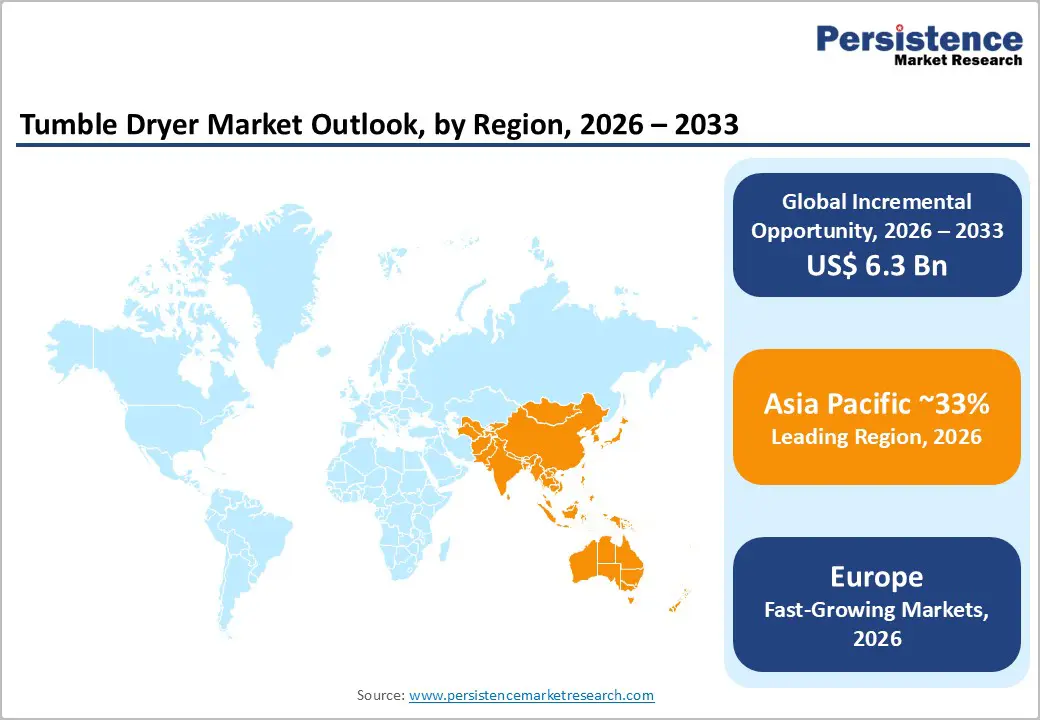

Emerging markets represent a substantial growth opportunity, with Asia-Pacific accounting for 33% market share and exhibiting strong expansion driven by rapid urbanization, rising disposable incomes, and increasingly aspirational consumption patterns. Demand acceleration is particularly evident across India, China, and Southeast Asia, where improving living standards and modern retail penetration support high-volume market development. Expanding middle-class populations and exposure to global appliance trends are reshaping laundry habits. India’s tumble dryer market, growing at a 5.4% CAGR, exemplifies early-stage adoption translating into sustained long-term demand, positioning emerging economies as critical growth engines for manufacturers seeking scale, localization advantages, and portfolio diversification beyond mature markets over the medium to long term horizon globally.

Commercial laundry and hospitality segments represent a compelling growth opportunity, as laundromats, multi-family housing, and hospitality facilities increasingly require heavy-duty, high-throughput tumble dryers. Rising urban density and outsourcing of laundry services are accelerating demand for reliable commercial equipment, supporting an emerging specialized segment estimated at US$ 1.5–2 billion annually. Hotels, resorts, and serviced apartments prioritize operational efficiency, consistency, and energy control, further strengthening adoption. Additionally, healthcare facilities and hospitals are expanding in-house and outsourced laundry operations to meet hygiene standards, driving institutional demand for specialized, high-capacity commercial dryers and reinforcing long-term growth potential beyond the residential market across global urban and tourism-driven economies with sustained replacement cycles and compliance requirements.

Heat-pump operated tumble dryers command 39% of global market share, representing dominant product type with superior energy efficiency delivering 20-30% energy consumption reduction compared to vented models combined with gentle fabric care through lower operating temperatures. Heat pump market growing at 6.1% CAGR reflects strong consumer embrace supporting consistent premium market expansion particularly in Europe and North America driving market dominance and revenue anchor.

Condenser tumble dryers expand at 4% CAGR driven by straightforward installation without external venting particularly attractive for apartments and space-constrained environments combined with moderate pricing positioning between vented and heat pump models. Condensing technology removing moisture through water drainage appeals to residential and multi-family housing applications supporting emerging market expansion particularly in urban environments with limited ventilation options enabling sustained growth momentum.

6.1 to 9Kg capacity dryers command 42% of market share, representing most popular household capacity balancing load handling capability with energy efficiency and space requirements across diverse residential applications. Established consumer preference supporting consistent volume demand and market stability anchor particularly for family household adoption where mid-range capacity provides optimal utility-to-footprint balance.

Above 9Kg capacity dryers expand at 5.2% CAGR driven by larger households, multi-family housing, and commercial laundry applications requiring high-capacity solutions for bulk laundry processing. Commercial laundromats and institutional facilities demanding heavy-duty, large-capacity equipment support emerging commercial specialized segment enabling premium market positioning and higher-value transactions.

Residential applications command 58% of market share, driven by household reliance on automatic drying solutions across diverse housing types from single-family homes to apartments. Urbanization and lifestyle shifts supporting consistent strong demand particularly in developed markets with established appliance ownership patterns providing market stability anchor and consistent revenue base.

Industrial applications expand at 6% CAGR driven by commercial laundries, laundromats, multi-family housing, and hospitality facilities requiring heavy-duty, high-throughput commercial dryers supporting emerging commercial segment. Healthcare facilities, hospitals, and care homes expanding laundry operations combined with commercial laundry equipment market growing at 4.30% CAGR drive emerging sustained institutional demand justifying specialized commercial product development.

North America maintains a 29% market share, supported by established appliance ownership, suburban housing development, and high replacement demand that drive consistent capital investment in tumble dryers. The United States market expands at a 3.2% CAGR, underpinned by strong environmental awareness and accelerating smart home adoption, supporting premium heat pump and connected dryer positioning across residential and commercial applications. Market maturity encourages frequent upgrades toward energy-efficient and feature-rich models. Established distribution through big-box retailers and online platforms ensures broad reach and rapid product availability. Consumers emphasize fabric care performance, energy savings, and connectivity features. Comprehensive financing plans, promotional incentives, and extended warranty programs further reduce purchase barriers, reinforcing premium adoption trends and sustaining long-term demand stability across the region overall.

Europe expands at a 4.3% CAGR while holding 26% market share, driven by stringent EU energy efficiency regulations, widespread heat pump adoption, and high environmental awareness. Heat pump tumble dryers account for approximately 34.2% market share in 2024 and continue growing rapidly, reflecting regulatory leadership and consumer sustainability preference. Premium product dominance is most visible in Germany, the United Kingdom, and France, which demonstrate strong technology adoption leadership. The region benefits from established technical expertise in energy-efficient appliance design and regulatory compliance. Strong emphasis on sustainability and circular economy principles shapes purchasing decisions. Advanced retail, service, and omnichannel distribution networks support premium appliance positioning, efficient aftersales support, and faster replacement cycles, reinforcing Europe’s role as a global benchmark market leader.

Asia Pacific dominates with a 33% market share and strong growth momentum, driven by rapid urbanization, rising disposable incomes, and lifestyle transformation across China, India, and Southeast Asia. India’s tumble dryer market, expanding at a 5.4% CAGR, highlights significant emerging opportunity through first-time purchases and accelerating middle-class penetration. Urban residential development and hospitality expansion increasingly support demand for modern laundry solutions. Emerging regional manufacturing capabilities and cost-competitive production bases enable broader availability and pricing flexibility. Rapid high-rise apartment construction reduces feasibility of outdoor drying, reinforcing appliance adoption. Growing consumer aspiration for convenient, time-saving household appliances further accelerates penetration, positioning Asia Pacific as the fastest-growing and most strategically important region for volume-led expansion over the medium to long term globally overall.

Strategic Developments

Market leaders employ innovation-focused product development advancing heat pump technology and smart connectivity, sustainability positioning through energy-efficient designs and recyclable materials, geographic expansion targeting emerging Asian markets, premium pricing for advanced features, and comprehensive aftermarket support excellence. Regional specialists emphasize cost-competitive positioning and local market adaptation. Direct-to-consumer models gaining traction.

The Tumble Dryers Market is anticipated at US$ 17.2 Billion in 2026 and projected to reach US$ 23.5 Billion by 2033.

Growth is driven by rapid urbanization fueling compact laundry demand, energy-efficiency regulations accelerating heat-pump adoption, and smart connected dryers growing at 12–15% CAGR.

The market expands at 4.6% CAGR during the forecast period between 2026 and 2033.

Key opportunities lie in Asia-Pacific expansion led by India, rising commercial laundry infrastructure, and sustainability-driven circular and refurbished appliance adoption.

The market is led by Electrolux, LG Electronics, and Bosch, with strong competitive presence from Whirlpool, Samsung, and Siemens, driven by ongoing smart, AI-enabled, and energy-efficient product launches.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Capacity

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author