ID: PMRREP35776| 195 Pages | 26 Oct 2025 | Format: PDF, Excel, PPT* | Packaging

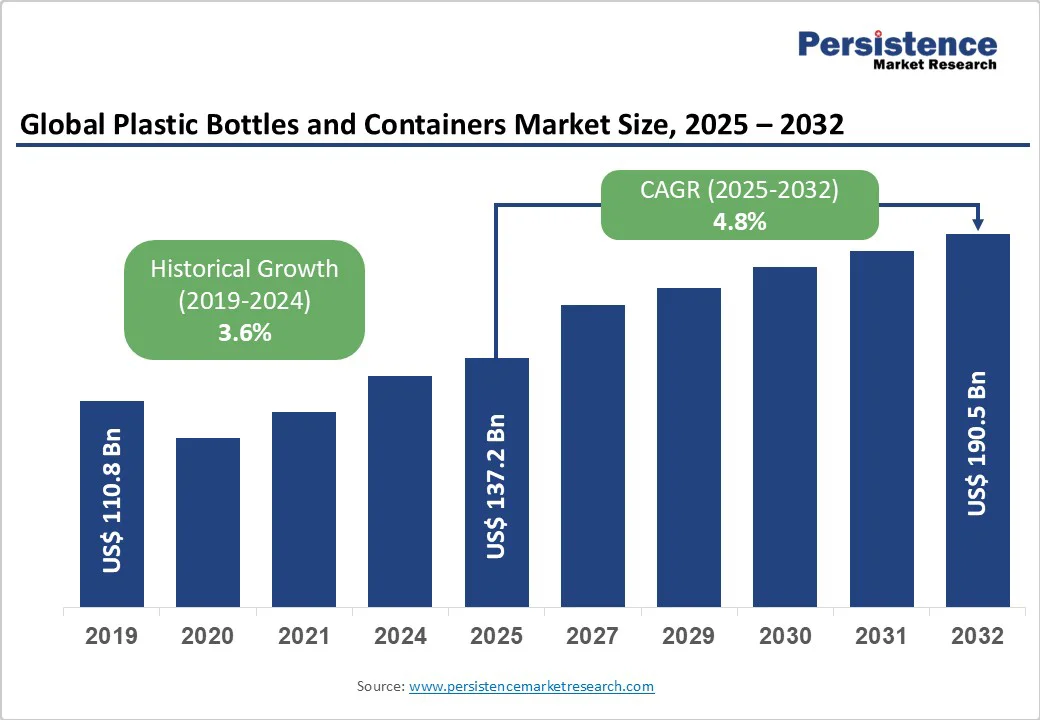

The global plastic bottles and containers market size is likely to be valued at US$137.2 Billion in 2025 and is estimated to reach US$190.5 Billion in 2032, growing at a CAGR of 4.8% during the forecast period 2025-2032, driven by rising demand for lightweight and shatter-resistant packaging across beverages, personal care, and pharmaceutical sectors.

| Key Insights | Details |

|---|---|

|

Plastic Bottles and Containers Market Size (2025E) |

US$137.2 Bn |

|

Market Value Forecast (2032F) |

US$190.5 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.6% |

The increasing preference for lightweight and shatter-resistant packaging is drastically influencing the global market. Materials such as polyethylene terephthalate (PET) are favored for their strength, clarity, and recyclability, making them ideal for beverages, pharmaceuticals, and personal care products. For instance, PET's high tensile strength and impact resistance ensure that products remain intact during transportation and handling.

The lightweight nature of PET reduces transportation costs and the carbon footprint, helping meet sustainability goals. This trend is particularly evident in the pharmaceutical sector, where PET bottles are widely used for oral syrups and vitamin formulations due to their protective properties and compliance with regulatory standards.

The ongoing expansion of e-commerce is pushing the demand for efficient and sustainable packaging solutions. With the surge in online shopping, there has been a significant increase in packaging waste, especially plastic used for protective packaging such as bubble wrap and air pillows. For example, in 2022, online shopping packaging waste increased by 14.6% from the previous year, totaling approximately 1.76 million tons.

To address environmental concerns, companies are adopting sustainable packaging practices such as using recyclable materials and optimizing packaging sizes to reduce waste. This shift not only helps minimize environmental impact but also aligns with consumer preferences for eco-friendly products, thereby influencing packaging strategies in the e-commerce sector.

Governments worldwide are implementing bans and taxes on single-use plastics such as bottles and containers to combat environmental pollution. For instance, South Australia recently prohibited the use of small fish-shaped soy sauce bottles, commonly provided with sushi meals. It is due to their tendency to escape disposal systems and contribute to microplastic contamination in oceans.

Los Angeles County also filed a lawsuit against PepsiCo and Coca-Cola, accusing them of contributing to plastic pollution and misleading the public about the recyclability of their products. These regulatory measures are pressuring companies to find sustainable alternatives, affecting the production and distribution of plastic bottles and containers.

The shift toward sustainable packaging is gaining momentum, with industries exploring alternatives such as aluminum and paper to replace plastic. For example, Botnia Skincare has switched to fully recyclable and recycled aluminum packaging, emphasizing its commitment to sustainability.

However, this transition presents challenges, as aluminum production can be energy-intensive, and paper alternatives may not always provide the same durability and cost-effectiveness as plastic. Also, the infrastructure for recycling these materials varies by region, potentially complicating the widespread adoption of such alternatives.

The European Union's Directive (EU) 2019/904, effective from July 2024, mandates that all plastic beverage containers up to three liters must have caps that remain attached after opening. This regulation aims to reduce litter and enhance recycling by ensuring caps are not discarded separately.

Manufacturers are adopting tethered cap solutions to comply with this directive, presenting an opportunity for development in cap design and production. For instance, companies such as Corvaglia are developing tethered cap systems that meet EU standards, delivering brands a way to comply with regulatory requirements while maintaining product functionality.

Brands are increasingly focusing on incorporating recycled polyethylene terephthalate (rPET) into their packaging to promote sustainability and meet consumer demand for eco-friendly products. Coca-Cola HBC, for example, has committed to using 50% rPET in plastic bottles across EU markets by 2025, with a target of achieving over 60% rPET usage by 2025.

This shift not only supports the circular economy but also complies with regulatory pressures and consumer expectations. However, challenges such as the higher cost of rPET compared to virgin PET and potential supply shortages remain, prompting brands to explore unique solutions and partnerships to secure a sustainable supply of rPET.

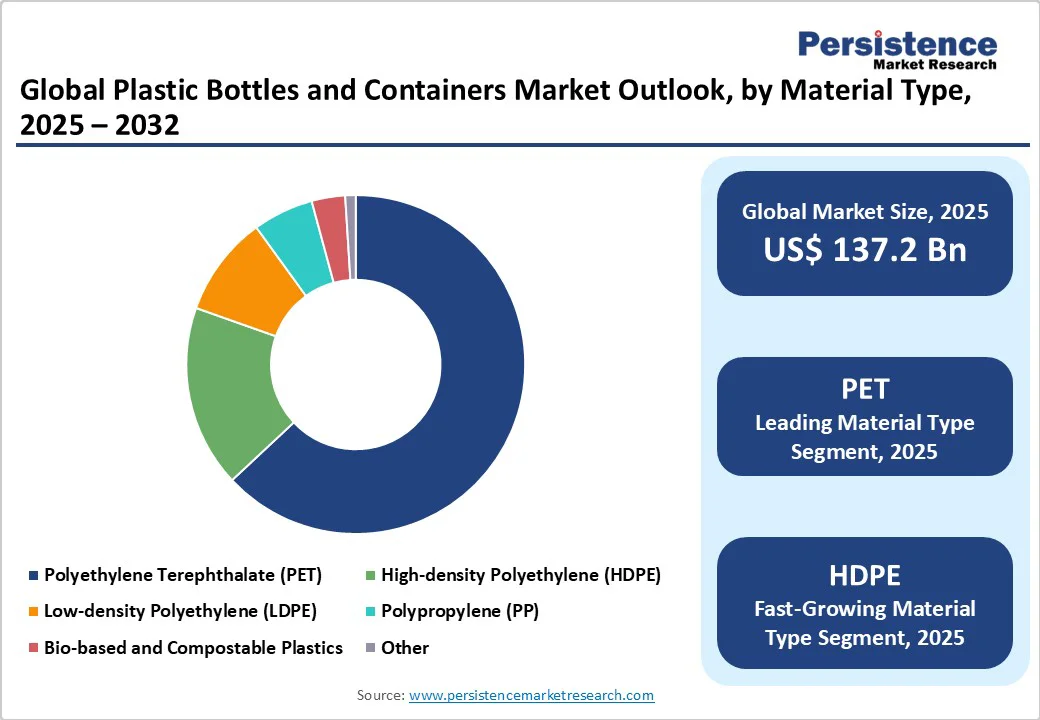

PET is expected to lead with a share of approximately 63.1% in 2025, due to its combination of strength, lightweight nature, and recyclability. PET's high strength-to-weight ratio ensures durability while remaining easy to handle and transport. PET is also 100% recyclable, reducing environmental impact and supporting sustainability efforts. Its ability to be reprocessed multiple times supports a circular economy, making it a sustainable packaging choice.

High-Density Polyethylene (HDPE) is being used in packaging due to its exceptional durability, chemical resistance, and recyclability. HDPE's high strength-to-density ratio makes it suitable for a wide range of applications, from food containers to industrial products. Its resistance to impact, moisture, and chemicals ensures product integrity and safety. HDPE is also one of the most widely recycled plastics, complying with surging environmental concerns and consumer demand for sustainable packaging solutions.

Injection Blow Molding (IBM) is projected to hold about 49.4% of the share in 2025, owing to its precision and versatility. This process involves injecting molten plastic into a mold to form a preform, which is then transferred to a blow mold where it is inflated to the desired shape. IBM provides superior control over wall thickness and dimensional accuracy, making it ideal for applications that require high-quality standards, such as pharmaceuticals and cosmetics.

Extrusion Blow Molding (EBM) is gaining traction in the production of plastic bottles and containers, backed by its cost-effectiveness and design flexibility. In EBM, plastic is melted and extruded into a hollow tube, or parison, which is then inflated within a mold to form the container. This method allows the development of large containers, such as jerry cans and industrial bottles, with varying wall thicknesses and features, including handles.

Beverages are expected to dominate with a share of nearly 56.8% in 2025, driven by high demand for convenient, portable, and shelf-stable packaging solutions. Plastic materials such as PET and HDPE provide excellent barrier properties, preserving the quality and freshness of products ranging from soft drinks and juices to bottled water and energy drinks.

Cosmetics and personal care products are key end users of plastic packaging because they require hygienic, lightweight, and customizable containers. Plastic packaging, such as bottles, jars, and tubes, provides an effective barrier against contaminants, ensuring product integrity and safety. The versatility of plastic allows for a wide range of designs and sizes, catering to diverse consumer preferences.

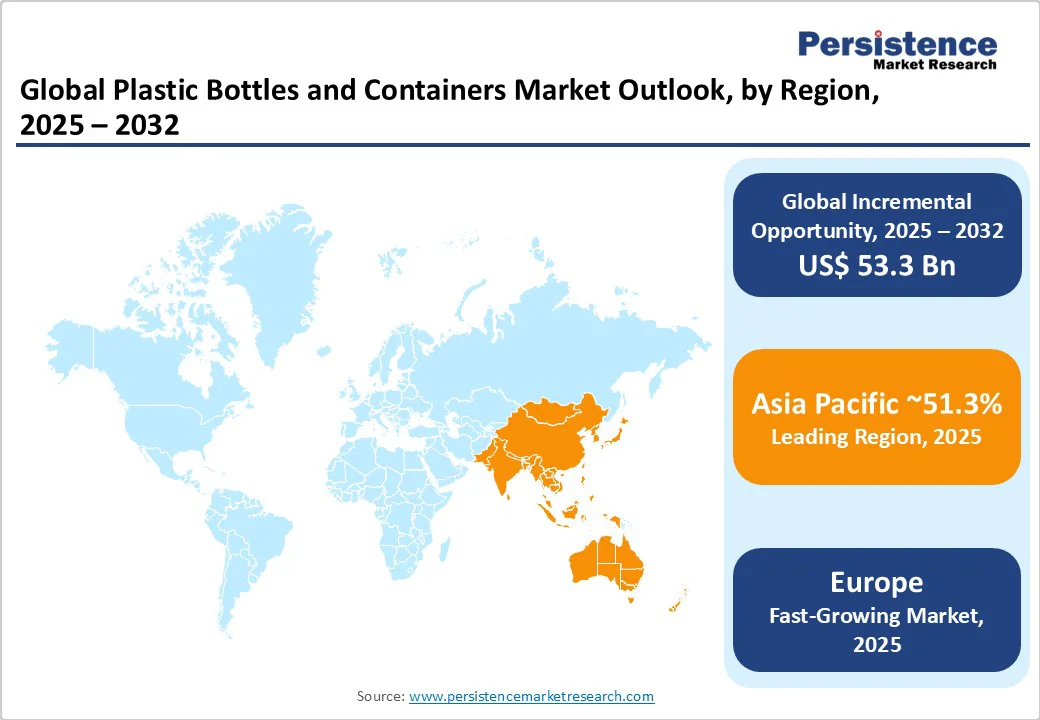

In 2025, the Asia Pacific region recorded a share of approximately 51.3%, due to a burgeoning middle class and increasing demand across sectors such as beverages, pharmaceuticals, and personal care. China remains dominant, while India is emerging as the fastest-growing market. However, this growth is accompanied by a surge in plastic waste, prompting governments across the Asia Pacific to implement stringent regulations.

For instance, China has enacted a nationwide ban on non-degradable plastic bags and is phasing out ultrathin plastics used in agricultural sheeting and packaging. Thailand has also banned the import of plastic waste to curb toxic pollution. These measures are transforming the packaging industry, encouraging the adoption of sustainable materials and technologies. In response to regulatory pressures and environmental concerns, companies are constantly focusing on recycling and the use of recycled plastics.

Europe’s market is undergoing a significant transformation, fueled by regulatory pressures, sustainability initiatives, and evolving consumer preferences. PET remains the dominant material, accounting for over 50% of the market share in 2024. The beverage industry is the largest end user, with bottled water, soft drinks, and juices leading the demand. However, the market is witnessing a shift toward sustainable practices, with increased adoption of recycled PET (rPET) and bioplastics, as well as innovations such as tethered caps to reduce littering.

Germany is a leader in recycling, with a collection rate of 51.1% for plastic waste in 2022. The country has implemented Extended Producer Responsibility (EPR) schemes and deposit return systems to improve recycling rates. France's recycling rate stands at 25.2%, highlighting the potential for improvement. The government has introduced measures to increase the use of recycled materials in packaging and reduce plastic waste. Italy has also made strides in promoting the use of biodegradable plastics and reducing single-use plastics. The country is continuing to work to improve its recycling infrastructure to meet EU targets.

North America is a key market, supported by superior manufacturing capabilities and rising consumer demand across sectors. The U.S. is the leading market for plastic bottles and containers in North America. The country benefits from a well-established manufacturing base and a high demand for packaged goods. However, environmental concerns are prompting shifts toward sustainable packaging solutions.

For instance, New Jersey has introduced legislation mandating all packaging materials to be recyclable or compostable by 2034. It aims to reduce plastic waste and improve recycling efforts. Canada is actively implementing EPR programs and deposit return schemes to strengthen recycling rates and reduce plastic waste. The country is also focusing on promoting the use of recycled materials in packaging to comply with environmental goals.

The global plastic bottles and containers market is marked by consolidation, with key players such as Amcor, Berry Global, and Gerresheimer leading the market. These companies are focusing on extending their product portfolios and entering emerging areas to maintain a competitive edge. Manufacturers are also adopting sustainable practices, with companies, including Coca-Cola, pledging to use 50% recycled content in their bottles by 2030. However, recent reports indicate a softening of these commitments, raising concerns about the market’s dedication to environmental goals.

The plastic bottles and containers market is projected to reach US$137.2 Billion in 2025.

Rising demand for lightweight packaging and growth in e-commerce logistics are the key market drivers.

The plastic bottles and containers market is poised to witness a CAGR of 4.8% from 2025 to 2032.

Developments in biodegradable plastics and regulatory-driven sustainable packaging initiatives are the key market opportunities.

Amcor plc, Graham Packaging Company, and ALPLA Group are a few key market players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Material Type

By Manufacturing Process

By End Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author