- Executive Summary

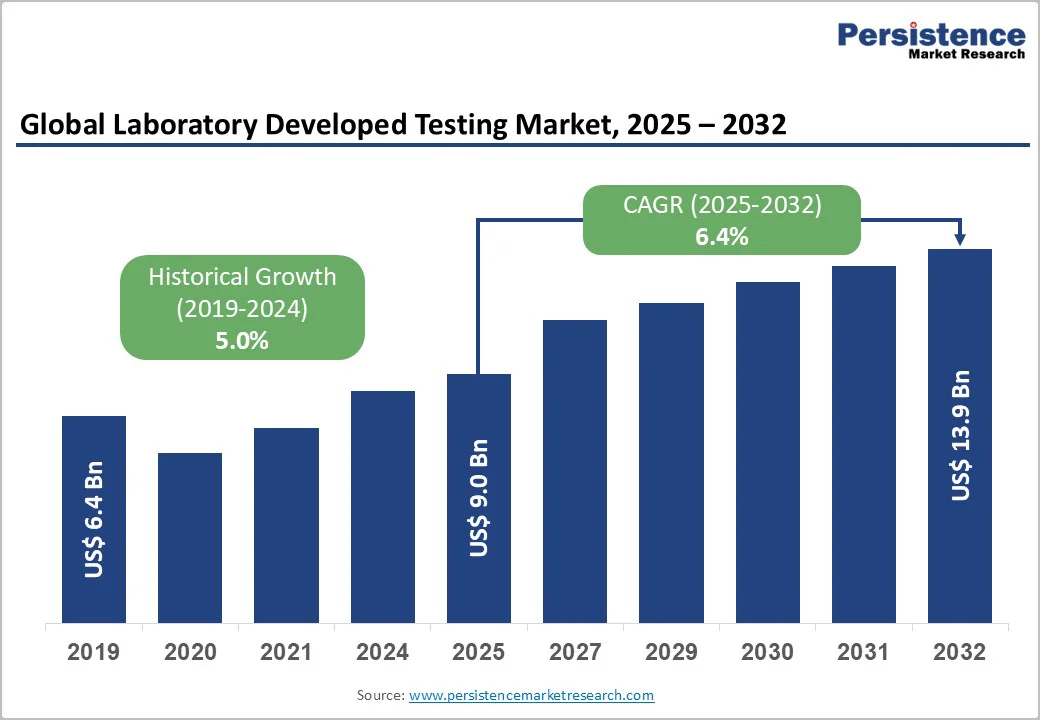

- Global Laboratory Developed Testing Market Snapshot, 2025 and 2032

- Market Opportunity Assessment, 2025 - 2032, US$ Mn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Challenges

- Key Trends

- Macro-Economic Factors

- Global Sectorial Outlook

- Global GDP Growth Outlook

- COVID-19 Impact Analysis

- Forecast Factors - Relevance and Impact

- Value Added Insights

- Product Adoption Analysis

- Regulatory Landscape

- Reimbursement Scenario

- Value Chain Analysis

- Key Deals and Mergers

- PESTLE Analysis

- Porter’s Five Force Analysis

- Global Laboratory Developed Testing Market Outlook:

- Key Highlights

- Market Size (US$ Mn) and Y-o-Y Growth

- Absolute $ Opportunity

- Market Size (US$ Mn) Analysis and Forecast

- Historical Market Size (US$ Mn) Analysis, 2019-2024

- Market Size (US$ Mn) Analysis and Forecast, 2025-2032

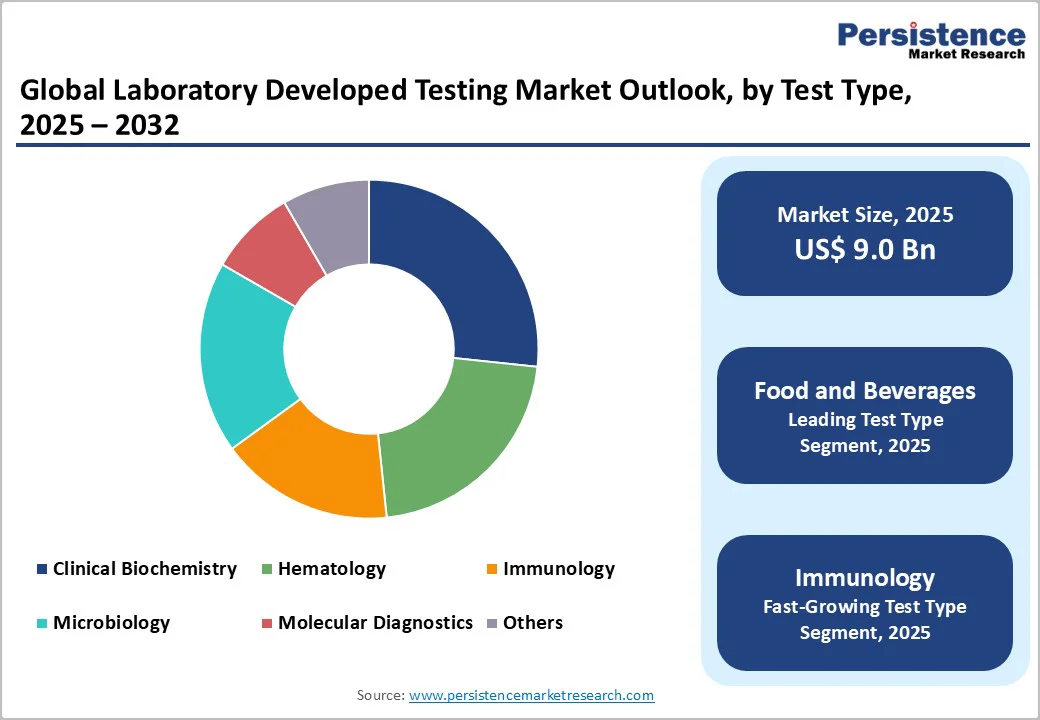

- Global Laboratory Developed Testing Market Outlook: Test Type

- Introduction / Key Findings

- Historical Market Size (US$ Mn) Analysis, By Test Type, 2019 - 2024

- Market Size (US$ Mn) Analysis and Forecast, By Test Type, 2025 - 2032

- Clinical Biochemistry

- Hematology

- Immunology

- Microbiology

- Molecular Diagnostics

- Others

- Market Attractiveness Analysis: Test Type

- Global Laboratory Developed Testing Market Outlook: Application

- Introduction / Key Findings

- Historical Market Size (US$ Mn) Analysis, By Application, 2019 - 2024

- Market Size (US$ Mn) Analysis and Forecast, By Application, 2025 - 2032

- Oncology

- Genetics

- Infectious Diseases

- Autoimmune Disorders

- Others

- Market Attractiveness Analysis: Application

- Global Laboratory Developed Testing Market Outlook: End User

- Introduction / Key Findings

- Historical Market Size (US$ Mn) Analysis, By End User, 2019 - 2024

- Market Size (US$ Mn) Analysis and Forecast, By End User, 2025 - 2032

- Hospital Laboratories

- Specialty Diagnostics Centers

- Clinical Research Organizations

- Research Institutes

- Others

- Market Attractiveness Analysis: End User

- Key Highlights

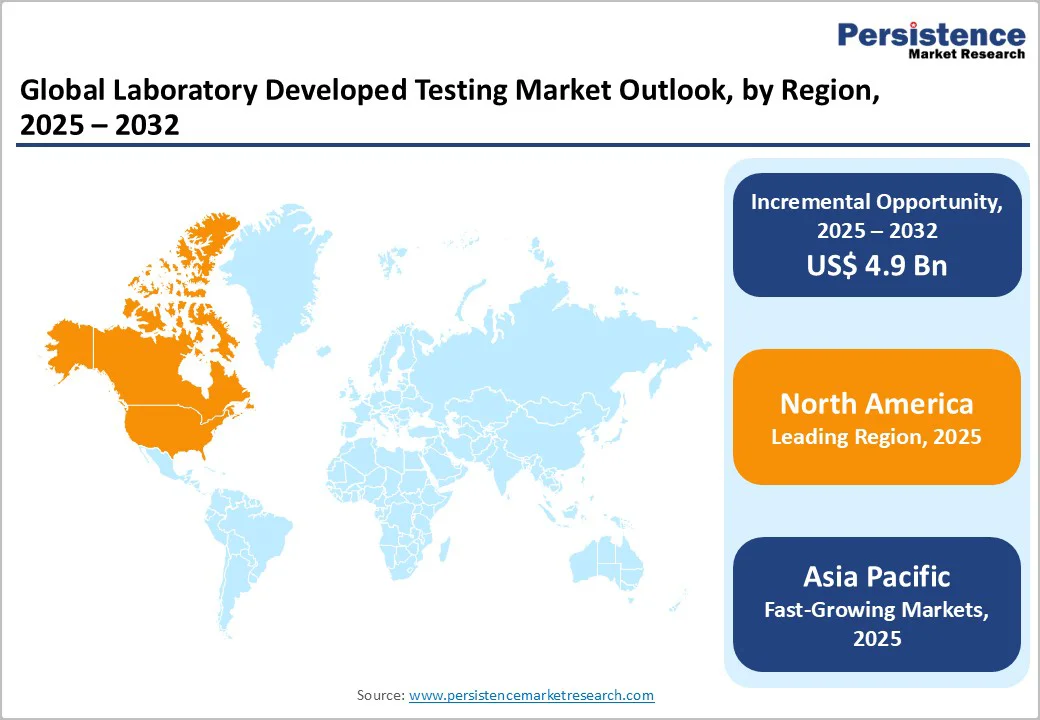

- Global Laboratory Developed Testing Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Mn) Analysis, By Region, 2019 - 2024

- Market Size (US$ Mn) Analysis and Forecast, By Region, 2025 - 2032

- North America

- Europe

- East Asia

- South Asia and Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Laboratory Developed Testing Market Outlook:

- Key Highlights

- Historical Market Size (US$ Mn) Analysis, By Market, 2019 - 2024

- By Country

- By Test Type

- By Application

- By End User

- Market Size (US$ Mn) Analysis and Forecast, By Country, 2025 - 2032

- U.S.

- Canada

- Market Size (US$ Mn) Analysis and Forecast, By Test Type, 2025 - 2032

- Clinical Biochemistry

- Hematology

- Immunology

- Microbiology

- Molecular Diagnostics

- Others

- Market Size (US$ Mn) Analysis and Forecast, By Application, 2025 - 2032

- Oncology

- Genetics

- Infectious Diseases

- Autoimmune Disorders

- Others

- Market Size (US$ Mn) Analysis and Forecast, By End User, 2025 - 2032

- Hospital Laboratories

- Specialty Diagnostics Centers

- Clinical Research Organizations

- Research Institutes

- Others

- Market Attractiveness Analysis

- Europe Laboratory Developed Testing Market Outlook:

- Key Highlights

- Historical Market Size (US$ Mn) Analysis, By Market, 2019 - 2024

- By Country

- By Test Type

- By Application

- By End User

- Market Size (US$ Mn) Analysis and Forecast, By Country, 2025 - 2032

- Germany

- France

- U.K.

- Italy

- Spain

- Russia

- Türkiye

- Rest of Europe

- Market Size (US$ Mn) Analysis and Forecast, By Test Type, 2025 - 2032

- Clinical Biochemistry

- Hematology

- Immunology

- Microbiology

- Molecular Diagnostics

- Others

- Market Size (US$ Mn) Analysis and Forecast, By Application, 2025 - 2032

- Oncology

- Genetics

- Infectious Diseases

- Autoimmune Disorders

- Others

- Market Size (US$ Mn) Analysis and Forecast, By End User, 2025 - 2032

- Hospital Laboratories

- Specialty Diagnostics Centers

- Clinical Research Organizations

- Research Institutes

- Others

- Market Attractiveness Analysis

- East Asia Laboratory Developed Testing Market Outlook:

- Key Highlights

- Historical Market Size (US$ Mn) Analysis, By Market, 2019 - 2024

- By Country

- By Test Type

- By Application

- By End User

- Market Size (US$ Mn) Analysis and Forecast, By Country, 2025 - 2032

- China

- Japan

- South Korea

- Market Size (US$ Mn) Analysis and Forecast, By Test Type, 2025 - 2032

- Clinical Biochemistry

- Hematology

- Immunology

- Microbiology

- Molecular Diagnostics

- Others

- Market Size (US$ Mn) Analysis and Forecast, By Application, 2025 - 2032

- Oncology

- Genetics

- Infectious Diseases

- Autoimmune Disorders

- Others

- Market Size (US$ Mn) Analysis and Forecast, By End User, 2025 - 2032

- Hospital Laboratories

- Specialty Diagnostics Centers

- Clinical Research Organizations

- Research Institutes

- Others

- Market Attractiveness Analysis

- South Asia & Oceania Laboratory Developed Testing Market Outlook:

- Key Highlights

- Historical Market Size (US$ Mn) Analysis, By Market, 2019 - 2024

- By Country

- By Test Type

- By Application

- By End User

- Market Size (US$ Mn) Analysis and Forecast, By Country, 2025 - 2032

- India

- Southeast Asia

- ANZ

- Rest of South Asia & Oceania

- Market Size (US$ Mn) Analysis and Forecast, By Test Type, 2025 - 2032

- Clinical Biochemistry

- Hematology

- Immunology

- Microbiology

- Molecular Diagnostics

- Others

- Market Size (US$ Mn) Analysis and Forecast, By Application, 2025 - 2032

- Oncology

- Genetics

- Infectious Diseases

- Autoimmune Disorders

- Others

- Market Size (US$ Mn) Analysis and Forecast, By End User, 2025 - 2032

- Hospital Laboratories

- Specialty Diagnostics Centers

- Clinical Research Organizations

- Research Institutes

- Others

- Market Attractiveness Analysis

- Latin America Laboratory Developed Testing Market Outlook:

- Key Highlights

- Historical Market Size (US$ Mn) Analysis, By Market, 2019 - 2024

- By Country

- By Test Type

- By Application

- By End User

- Market Size (US$ Mn) Analysis and Forecast, By Country, 2025 - 2032

- Brazil

- Mexico

- Rest of Latin America

- Market Size (US$ Mn) Analysis and Forecast, By Test Type, 2025 - 2032

- Clinical Biochemistry

- Hematology

- Immunology

- Microbiology

- Molecular Diagnostics

- Others

- Market Size (US$ Mn) Analysis and Forecast, By Application, 2025 - 2032

- Oncology

- Genetics

- Infectious Diseases

- Autoimmune Disorders

- Others

- Market Size (US$ Mn) Analysis and Forecast, By End User, 2025 - 2032

- Hospital Laboratories

- Specialty Diagnostics Centers

- Clinical Research Organizations

- Research Institutes

- Others

- Market Attractiveness Analysis

- Middle East & Africa Laboratory Developed Testing Market Outlook:

- Key Highlights

- Historical Market Size (US$ Mn) Analysis, By Market, 2019 - 2024

- By Country

- By Test Type

- By Application

- By End User

- Market Size (US$ Mn) Analysis and Forecast, By Country, 2025 - 2032

- GCC Countries

- Egypt

- South Africa

- Northern Africa

- Rest of Middle East & Africa

- Market Size (US$ Mn) Analysis and Forecast, By Test Type, 2025 - 2032

- Clinical Biochemistry

- Hematology

- Immunology

- Microbiology

- Molecular Diagnostics

- Others

- Market Size (US$ Mn) Analysis and Forecast, By Application, 2025 - 2032

- Oncology

- Genetics

- Infectious Diseases

- Autoimmune Disorders

- Others

- Market Size (US$ Mn) Analysis and Forecast, By End User, 2025 - 2032

- Hospital Laboratories

- Specialty Diagnostics Centers

- Clinical Research Organizations

- Research Institutes

- Others

- Market Attractiveness Analysis

- Competition Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping By Market

- Competition Dashboard

- Company Profiles (Details - Overview, Financials, Strategy, Recent Developments)

- Thermo Fisher Scientific Inc.

- Overview

- Segments and Applications

- Key Financials

- Market Developments

- Market Strategy

- Kaneka Eurogentec S.A.

- QIAGEN

- Vastian

- Roche Diagnostics

- Adaptive Biotechnologies.

- Guardant Health, Inc.

- Smiths Medical

- Quest Diagnostics

- Beckman Coulter

- OPKO Health, Inc.

- Siemens Medical Solutions USA, Inc.

- Quanterix

- Proteomics International

- Others

- Thermo Fisher Scientific Inc.

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment