ID: PMRREP35775| 219 Pages | 26 Oct 2025 | Format: PDF, Excel, PPT* | Energy & Utilities

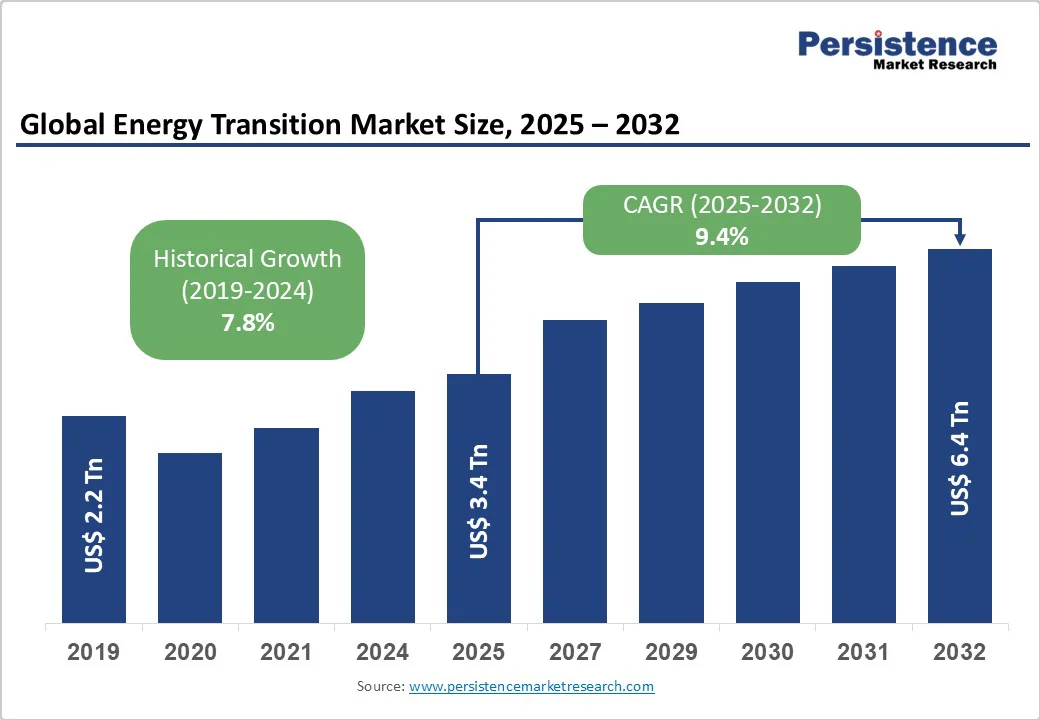

The global energy transition market size is likely to be valued at US$3.4 trillion in 2025. It is estimated to reach US$6.4 trillion by 2032, growing at a CAGR of 9.4% during the forecast period 2025−2032, driven by intensifying climate policies and rapidly declining costs of renewable technologies.

Structural energy shifts are driven by net-zero mandates covering over 70% of the global GDP by 2030 and US$1.3 trillion in annual corporate clean energy procurement. Advances in solar, wind, storage, and green hydrogen are cutting costs and accelerating adoption, fueling major capital flows into decarbonization and infrastructure.

| Key Insights | Details |

|---|---|

|

Energy Transition Market Size (2025E) |

US$3.4 Tn |

|

Market Value Forecast (2032F) |

US$6.4 Tn |

|

Projected Growth (CAGR 2025 to 2032) |

9.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

7.8% |

Governments worldwide are accelerating decarbonization policies, with frameworks such as the Green Deal of the European Union (EU), the U.S. Inflation Reduction Act (IRA), and China’s carbon neutrality goals driving transformative market conditions. Collectively covering over 70% of global emissions, these initiatives are setting aggressive renewable energy capacity additions, expecting a 25% annual increase in clean energy auctions. Carbon pricing is implemented in 55 jurisdictions, encompassing 22% of global emissions, thereby enhancing the investment environment for low-carbon technologies. The resultant policy-driven funding, exceeding US$600 billion annually, is de-risking projects and facilitating long-term power purchase agreements, enabling the market to grow with greater investor confidence and greater access to financing.

Technological innovations and economies of scale continue to lower costs and improve the performance of critical technologies. Solar photovoltaic system costs have decreased by 85% over the last decade, while onshore wind costs have decreased by 56%, enhancing their competitiveness against fossil fuels. Lithium-ion battery costs have been declining around 12% annually, reaching approximately US$124/kWh and propelling grid-scale energy storage capacity to new highs. Electrolyzer efficiency gains have cut green hydrogen production costs by nearly 50% over the past two years, bringing prices down to US$3.20/kg and unlocking widespread applications in transportation and industry. These advancements are catalyzing new applications and expanding market boundaries through 2032.

Renewable energy deployment is outpacing grid capacity, causing major bottlenecks. In 2024, global grid investments hit US$180 billion, only half of what is needed for full renewable integration. Transmission congestion cuts generation efficiency by up to 12% and raises capital costs by 5-7%. In parts of the U.S., interconnection wait times have surged 90%, delaying projects by an average of 18 months. These challenges heighten financing risks, driving demand for solutions such as grid-forming inverters and advanced demand-side management.

Supply chain disruptions and volatility in raw materials constrain energy transition growth. Lithium, nickel, and cobalt prices have fluctuated over 35% annually amid geopolitical risks. Lithium carbonate rose from US$7,000/ton in 2022 to US$25,000/ton in 2024, cutting battery margins by 8-12%. Lead times for key components such as inverters now reach 24 months, delaying projects and raising working capital needs by US$50 million per GW. Strategic sourcing and long-term contracts are essential for managing risks and protecting profitability.

Green hydrogen production and export are emerging as a high-growth market segment, projected to expand from US$2 billion in 2024 to US$25 billion by 2032, growing at an astounding CAGR of 34%. Strategic initiatives in Australia, Chile, and the Middle East are leveraging abundant solar and wind resources to scale electrolyzer facilities to exceed 1 GW in capacity. Developing hydrogen export infrastructure to key European and Asian markets offers an estimated US$10 billion revenue potential by 2030. These developments not only accelerate decarbonization but also open new supply chains, benefiting engineering, procurement, & construction (EPC) contractors, utilities, and commodity traders positioned in the hydrogen ecosystem.

The DER aggregation market offers significant revenue growth, expanding from an estimated US$8 billion in 2024 to US$32 billion by 2032, with a CAGR of around 18%. Aggregators combine residential solar, battery storage, and flexible demand assets into virtual power plants (VPPs), providing grid services and reliability enhancements. Regulatory frameworks in advanced markets such as California and Germany are incentivizing market participation, generating ancillary service revenues averaging US$150/kW annually, which reflect internal rates of return (IRRs) of 12% for asset owners. As utility business models evolve, energy service companies can monetize these capabilities through white-labeled software platforms and outcome-based service contracts, diversifying revenue streams and enhancing customer engagement.

Renewable energy is expected to continue to dominate the solution category, with an approximate 62% market share estimated for 2025, driven primarily by solar power, which alone accounts for roughly 35%. Wind energy contributes approximately 18%. These segments are benefiting from substantial cost reductions and supportive governmental policies globally. Hydrogen-based solutions are projected to be the fastest-growing segment over 2025–2032, signaling rapid technology adoption and emerging infrastructure investments. The outstanding growth of hydrogen is driven by the scaling of electrolyzer capacity and the expansion of fuel-cell applications, especially in the transport and industrial sectors.

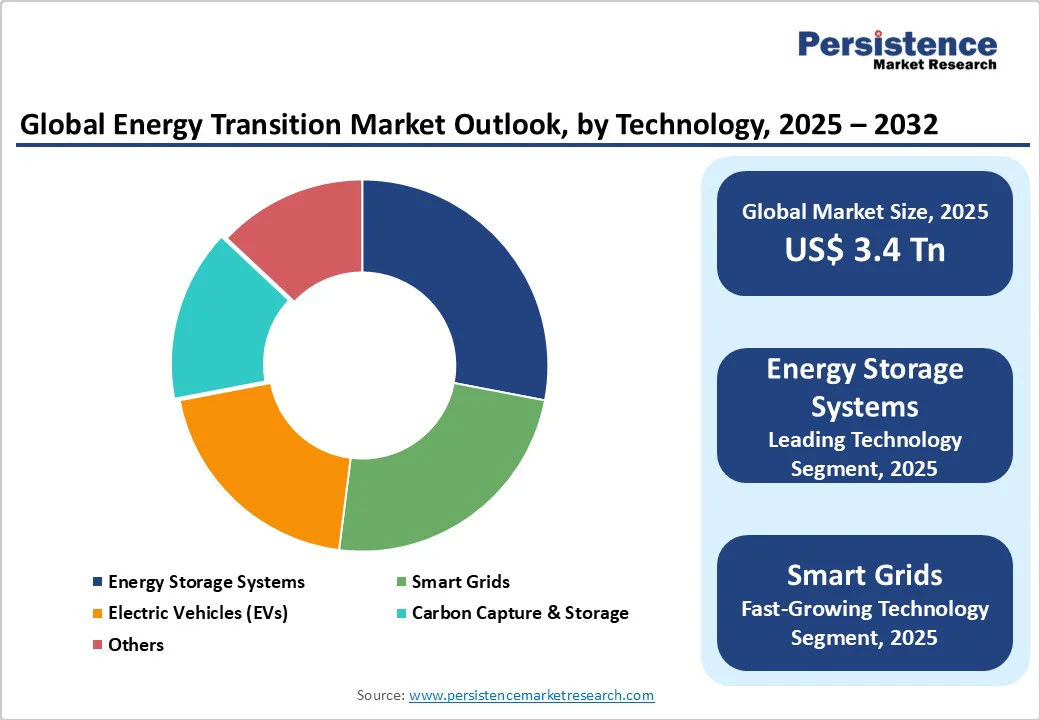

Energy storage systems represent the leading technology segment, set to hold an estimated 28% of the market share in 2025, underpinning grid stability and facilitating the integration of renewables. This market is supported by 20 GW of annual battery installations globally, with a growing emphasis on utility-scale and behind-the-meter storage projects. Smart grids are rapidly gaining adoption and are expected to exhibit the fastest growth from 2025 to 2032. Investments in digital grid modernization, such as IoT sensors, AI-enhanced demand forecasting, and advanced metering infrastructure, are enabling utilities to optimize grid operations and improve the integration of variable renewable energy sources.

Utility-scale deployments are expected to dominate in 2025, capturing an estimated 48% of energy transition market revenue share, driven by economies of scale and institutional investment appetite for large-scale solar and wind projects. These assets benefit from mature financing mechanisms and established power purchase agreements (PPAs). The transportation sector is also anticipated to lead growth, registering an approximate 22% CAGR between 2025 and 2032. This expansion is propelled by the electrification of commercial fleets, extensive rollouts of electric vehicle charging infrastructure, and growing adoption of hydrogen fuel-cell vehicles, representing a critical end-user market for clean energy technologies.

North America is estimated to command a 31% share of the market share in 2025, with projected growth through 2032. The U.S. leads globally with approximately 25% of renewable energy installations, driven by the comprehensive incentives provided under the Inflation Reduction Act (IRA), which allocates US$369 billion in tax credits and grants for clean energy investments.

Canada's advancing hydrogen strategy and Mexico’s expanding renewable auctions complement the regional profile. The regulatory environment is advancing initiatives to alleviate interconnection backlogs and prioritize grid resilience. The competitive landscape features dominant utilities such as NextEra Energy and renewables-focused developers, supported by a robust innovation ecosystem and US$45 Billion in private equity infusions.

Europe is projected to hold a 29% market share by 2025. Germany is a key driver, having added 35 GW of renewable capacity in 2024, complemented by the U.K.’s leadership in offshore wind and France’s nuclear asset extensions. Regulatory alignment via the EU’s REPowerEU and Fit-for-55 initiatives is facilitating cross-border grid projects and harmonizing renewable subsidies.

The market features leading utilities such as Enel and EDF, which are pivoting to green hydrogen and battery storage solutions. Capital markets have supported the transition with US$63.5 billion in sustainable debt issuances, underlining strong investor confidence in offshore wind and regional interconnectors.

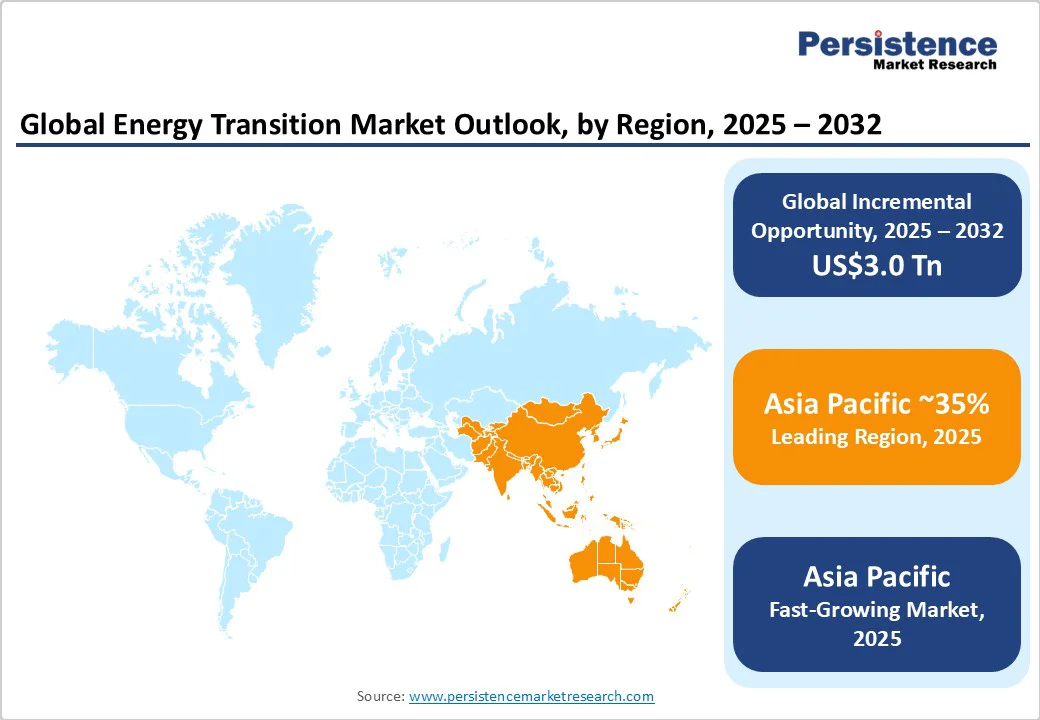

Asia Pacific commands the largest regional share of the energy transition market, estimated to reach 35% through 2032. China's ambitious goal of 1 TW of solar capacity by 2030, Japan’s development of its hydrogen supply chain, and India’s target of 500 GW of renewables are propelling regional growth. Manufacturing cost advantages for photovoltaic modules and electrolyzers further bolster competitiveness.

Regulatory drivers include China's national carbon market and India’s renewable purchase obligations, which stimulate domestic demand and vertically integrated supply chains. The market structure is dense with local engineering, procurement, and construction players, while global technology firms are entering through joint ventures. Investment volumes exceeded US$80 Billion in 2024, fueling transmission upgrades and battery gigafactory constructions.

The global energy transition market exhibits moderate consolidation, with the top five players, NextEra Energy, Ørsted, Enel, EDF, and Iberdrola, collectively accounting for about two-fifths of market revenues. These players have been strategically utilizing large asset portfolios, integrated service offerings, and technological innovation to maintain a competitive advantage.

The remainder of the market is served by a fragmented array of regional developers, EPC contractors, and technology entrants, especially within nascent segments such as green hydrogen and distributed energy resources aggregation. The overall market structure encourages strategic partnerships and acquisitions as companies seek scale and diversification.

The energy transition market is projected to reach US$3.4 Trillion in 2025.

Intensifying climate policies and rapidly declining costs of renewable technologies are driving the market.

The energy transition market is poised to witness a CAGR of 9.4% from 2025 to 2032.

Structural shifts in energy systems propelled by government mandates targeting net-zero emissions, technological advancements in solar photovoltaics, wind, battery storage, and green hydrogen, and significant capital flows toward decarbonization solutions are key market opportunities.

NextEra Energy, Ørsted, and Enel are some of the key players in the energy transition market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Solution Type

By Technology

By End-user Sector

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author