- Executive Summary

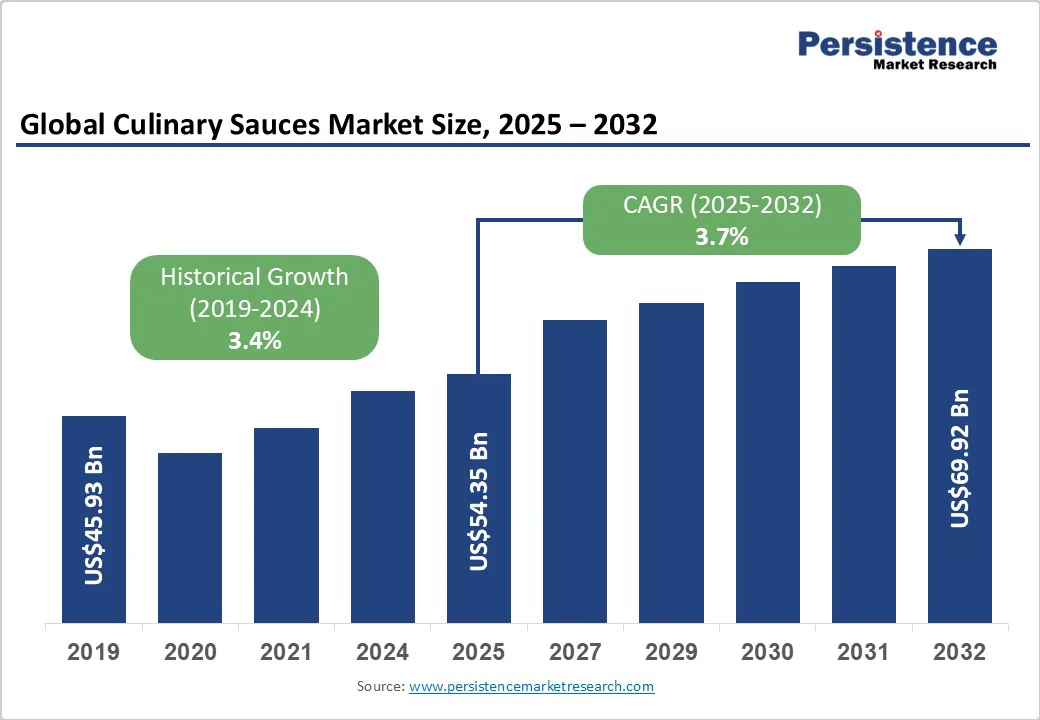

- Global Culinary Sauces Market Snapshot, 2025 and 2032

- Market Opportunity Assessment, 2025 - 2032, US$ Bn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Key Trends

- Macro-economic Factors

- Global Sectoral Outlook

- Global GDP Growth Outlook

- COVID-19 Impact Analysis

- Forecast Factors - Relevance and Impact

- Value Added Insights

- Tool Adoption Analysis

- Regulatory Landscape

- Value Chain Analysis

- PESTLE Analysis

- Porter’s Five Force Analysis

- Price Analysis, 2024A

- Key Highlights

- Key Factors Impacting Deployment Costs

- Pricing Analysis, By Component Type

- Global Culinary Sauces Market Outlook

- Key Highlights

- Market Volume (Units) Projections

- Market Size (US$ Bn) and Y-o-Y Growth

- Absolute $ Opportunity

- Market Size (US$ Bn) and Volume (Units) Analysis and Forecast

- Historical Market Size (US$ Bn) Analysis, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, 2025 - 2032

- Global Culinary Sauces Market Outlook: Service Type

- Introduction / Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis, By Service Type, 2019 - 2024

- Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Service Type, 2025 - 2032

- Wet Sauces

- Dry/Concentrate Sauces

- Market Attractiveness Analysis: Service Type

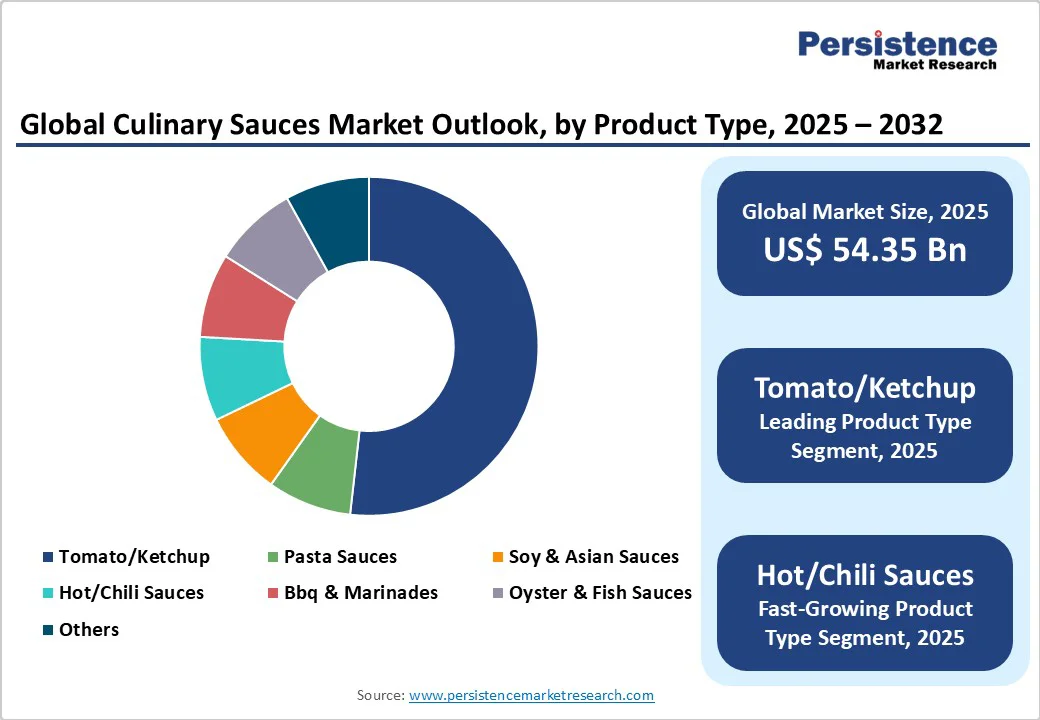

- Global Culinary Sauces Market Outlook: Product Type

- Introduction / Key Findings

- Historical Market Size (US$ Bn) Analysis, By Product Type, 2019 - 2024

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025 - 2032

- Tomato/Ketchup

- Pasta Sauces

- Soy & Asian Sauces

- Hot/Chili Sauces

- BBQ & Marinades

- Oyster & Fish Sauces

- Others

- Market Attractiveness Analysis: Product Type

- Global Culinary Sauces Market Outlook: End-user

- Introduction / Key Findings

- Historical Market Size (US$ Bn) Analysis, By End-user, 2019 - 2024

- Market Size (US$ Bn) Analysis and Forecast, By End-user, 2025 - 2032

- Household

- Foodservice

- Food Processors/Industrial

- Market Attractiveness Analysis: End-user

- Global Culinary Sauces Market Outlook: Packaging

- Introduction / Key Findings

- Historical Market Size (US$ Bn) Analysis, By Packaging, 2019 - 2024

- Market Size (US$ Bn) Analysis and Forecast, By Packaging, 2025 - 2032

- Bottles & Jars

- Pouches & Sachets

- Bulk/Industrial

- Market Attractiveness Analysis: Packaging

- Key Highlights

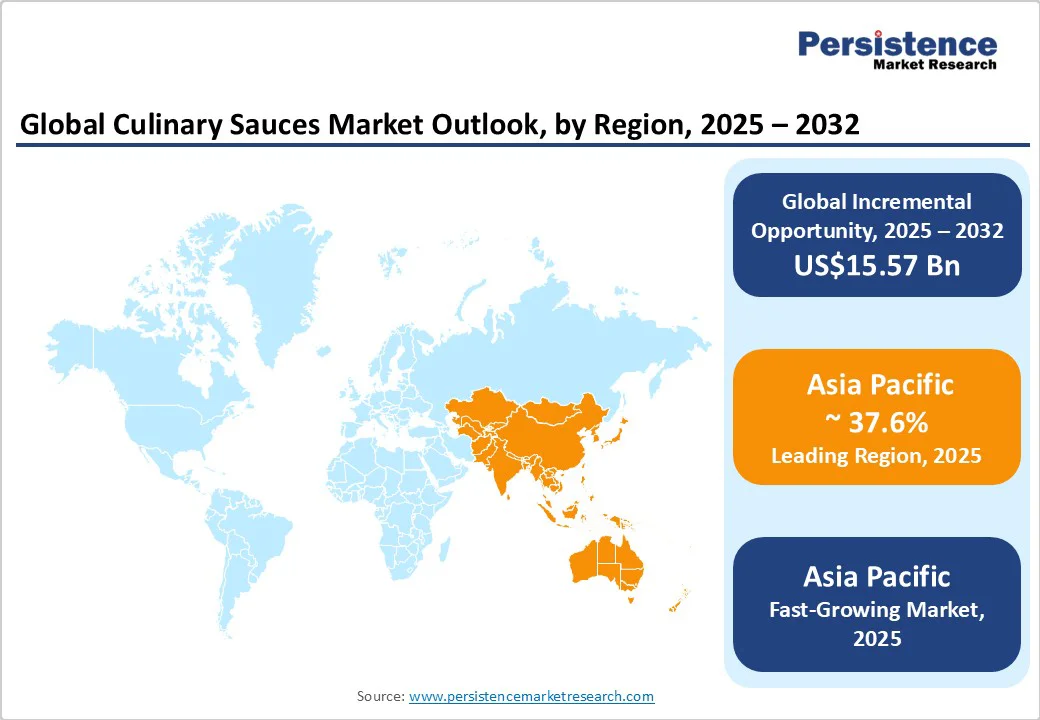

- Global Culinary Sauces Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Bn) and Volume (Units) Analysis, By Region, 2019 - 2024

- Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Region, 2025 - 2032

- North America

- Europe

- East Asia

- South Asia and Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Culinary Sauces Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019 - 2024

- By Country

- By Service Type

- By Product Type

- By End-user

- By Packaging

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025 - 2032

- U.S.

- Canada

- Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Service Type, 2025 - 2032

- Wet Sauces

- Dry/Concentrate Sauces

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025 - 2032

- Tomato/Ketchup

- Pasta Sauces

- Soy & Asian Sauces

- Hot/Chili Sauces

- BBQ & Marinades

- Oyster & Fish Sauces

- Others

- Market Size (US$ Bn) Analysis and Forecast, By End-user, 2025 - 2032

- Household

- Foodservice

- Food Processors/Industrial

- Market Size (US$ Bn) Analysis and Forecast, By Packaging, 2025 - 2032

- Bottles & Jars

- Pouches & Sachets

- Bulk/Industrial

- Market Attractiveness Analysis

- Europe Culinary Sauces Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019 - 2024

- By Country

- By Service Type

- By Product Type

- By End-user

- By Packaging

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025 - 2032

- Germany

- France

- U.K.

- Italy

- Spain

- Russia

- Türkiye

- Rest of Europe

- Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Service Type, 2025 - 2032

- Wet Sauces

- Dry/Concentrate Sauces

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025 - 2032

- Tomato/Ketchup

- Pasta Sauces

- Soy & Asian Sauces

- Hot/Chili Sauces

- BBQ & Marinades

- Oyster & Fish Sauces

- Others

- Market Size (US$ Bn) Analysis and Forecast, By End-user, 2025 - 2032

- Household

- Foodservice

- Food Processors/Industrial

- Market Size (US$ Bn) Analysis and Forecast, By Packaging, 2025 - 2032

- Bottles & Jars

- Pouches & Sachets

- Bulk/Industrial

- Market Attractiveness Analysis

- East Asia Culinary Sauces Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019 - 2024

- By Country

- By Service Type

- By Product Type

- By End-user

- By Packaging

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025 - 2032

- China

- Japan

- South Korea

- Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Service Type, 2025 - 2032

- Wet Sauces

- Dry/Concentrate Sauces

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025 - 2032

- Tomato/Ketchup

- Pasta Sauces

- Soy & Asian Sauces

- Hot/Chili Sauces

- BBQ & Marinades

- Oyster & Fish Sauces

- Others

- Market Size (US$ Bn) Analysis and Forecast, By End-user, 2025 - 2032

- Household

- Foodservice

- Food Processors/Industrial

- Market Size (US$ Bn) Analysis and Forecast, By Packaging, 2025 - 2032

- Bottles & Jars

- Pouches & Sachets

- Bulk/Industrial

- Market Attractiveness Analysis

- South Asia & Oceania Culinary Sauces Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019 - 2024

- By Country

- By Service Type

- By Product Type

- By End-user

- By Packaging

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025 - 2032

- India

- Southeast Asia

- ANZ

- Rest of South Asia & Oceania

- Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Service Type, 2025 - 2032

- Wet Sauces

- Dry/Concentrate Sauces

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025 - 2032

- Tomato/Ketchup

- Pasta Sauces

- Soy & Asian Sauces

- Hot/Chili Sauces

- BBQ & Marinades

- Oyster & Fish Sauces

- Others

- Market Size (US$ Bn) Analysis and Forecast, By End-user, 2025 - 2032

- Household

- Foodservice

- Food Processors/Industrial

- Market Size (US$ Bn) Analysis and Forecast, By Packaging, 2025 - 2032

- Bottles & Jars

- Pouches & Sachets

- Bulk/Industrial

- Market Attractiveness Analysis

- Latin America Culinary Sauces Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019 - 2024

- By Country

- By Service Type

- By Product Type

- By End-user

- By Packaging

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025 - 2032

- Brazil

- Mexico

- Rest of Latin America

- Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Service Type, 2025 - 2032

- Wet Sauces

- Dry/Concentrate Sauces

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025 - 2032

- Tomato/Ketchup

- Pasta Sauces

- Soy & Asian Sauces

- Hot/Chili Sauces

- BBQ & Marinades

- Oyster & Fish Sauces

- Others

- Market Size (US$ Bn) Analysis and Forecast, By End-user, 2025 - 2032

- Household

- Foodservice

- Food Processors/Industrial

- Market Size (US$ Bn) Analysis and Forecast, By Packaging, 2025 - 2032

- Bottles & Jars

- Pouches & Sachets

- Bulk/Industrial

- Market Attractiveness Analysis

- Middle East & Africa Culinary Sauces Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019 - 2024

- By Country

- By Service Type

- By Product Type

- By End-user

- By Packaging

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025 - 2032

- GCC Countries

- Egypt

- South Africa

- Northern Africa

- Rest of Middle East & Africa

- Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Service Type, 2025 - 2032

- Wet Sauces

- Dry/Concentrate Sauces

- Market Size (US$ Bn) Analysis and Forecast, By Product Type, 2025 - 2032

- Tomato/Ketchup

- Pasta Sauces

- Soy & Asian Sauces

- Hot/Chili Sauces

- BBQ & Marinades

- Oyster & Fish Sauces

- Others

- Market Size (US$ Bn) Analysis and Forecast, By End-user, 2025 - 2032

- Household

- Foodservice

- Food Processors/Industrial

- Market Size (US$ Bn) Analysis and Forecast, By Packaging, 2025 - 2032

- Bottles & Jars

- Pouches & Sachets

- Bulk/Industrial

- Market Attractiveness Analysis

- Competition Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping By Market

- Competition Dashboard

- Company Profiles (Details - Overview, Financials, Strategy, Recent Developments)

- Kraft Heinz Company

- Overview

- Segments and Service Types

- Key Financials

- Market Developments

- Market Strategy

- Unilever PLC

- Nestlé S.A.

- McCormick & Company, Inc.

- Kikkoman Corporation

- Conagra Brands, Inc.

- Del Monte Foods, Inc.

- Campbell Soup Company

- Hormel Foods Corporation

- General Mills, Inc.

- B&G Foods, Inc.

- Lee Kum Kee

- McIlhenny Company (Tabasco)

- Ajinomoto Co., Inc.

- Yamasa Corporation

- Hain Celestial Group, Inc.

- Mizkan Holdings Co., Ltd.

- Otafuku Sauce Co., Ltd.

- Tilda Foods Limited

- Goya Foods, Inc.

- Kraft Heinz Company

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment