- Executive Summary

- Global Cantaloupe Market Snapshot, 2026 and 2033

- Market Opportunity Assessment, 2026 - 2033, US$ Bn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Key Trends

- Macro-economic Factors

- Global Sectoral Outlook

- Global GDP Growth Outlook

- COVID-19 Impact Analysis

- Forecast Factors - Relevance and Impact

- Value Added Insights

- Tool Adoption Analysis

- Regulatory Landscape

- Value Chain Analysis

- PESTLE Analysis

- Porter’s Five Force Analysis

- Price Analysis, 2025A

- Key Highlights

- Key Factors Impacting Deployment Costs

- Pricing Analysis, By Application

- Global Cantaloupe Market Outlook

- Key Highlights

- Market Volume (Units) Projections

- Market Size (US$ Bn) and Y-o-Y Growth

- Absolute $ Opportunity

- Market Size (US$ Bn) and Volume (Units) Analysis and Forecast

- Historical Market Size (US$ Bn) Analysis, 2020-2025

- Current Market Size (US$ Bn) Analysis and Forecast, 2026 - 2033

- Global Cantaloupe Market Outlook: Product Type

- Introduction / Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis, By Product Type, 2020 - 2025

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Product Type, 2026 - 2033

- Fresh

- Processed

- Frozen

- Dried

- Market Attractiveness Analysis: Product Type

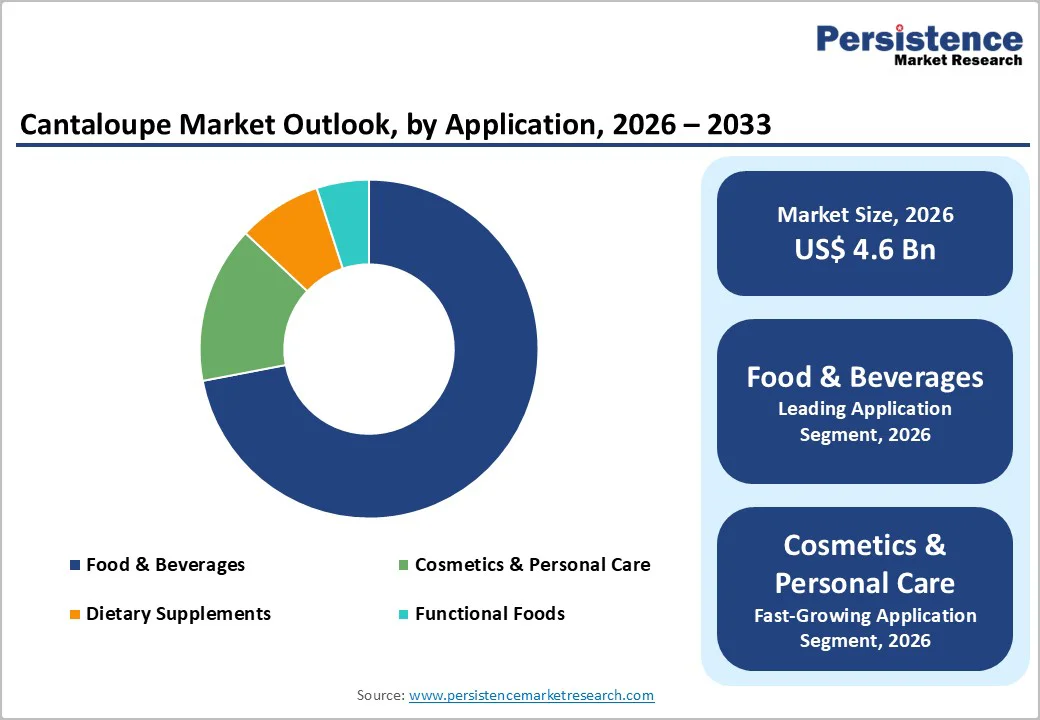

- Global Cantaloupe Market Outlook: Application

- Introduction / Key Findings

- Historical Market Size (US$ Bn) Analysis, By Application, 2020 - 2025

- Current Market Size (US$ Bn) Analysis and Forecast, By Application, 2026 - 2033

- Food & Beverages

- Cosmetics & Personal Care

- Dietary Supplements

- Functional Foods

- Market Attractiveness Analysis: Application

- Global Cantaloupe Market Outlook: Natural

- Introduction / Key Findings

- Historical Market Size (US$ Bn) Analysis, By Natural, 2020 - 2025

- Current Market Size (US$ Bn) Analysis and Forecast, By Natural, 2026 - 2033

- Organic

- Conventional

- Market Attractiveness Analysis: Natural

- Key Highlights

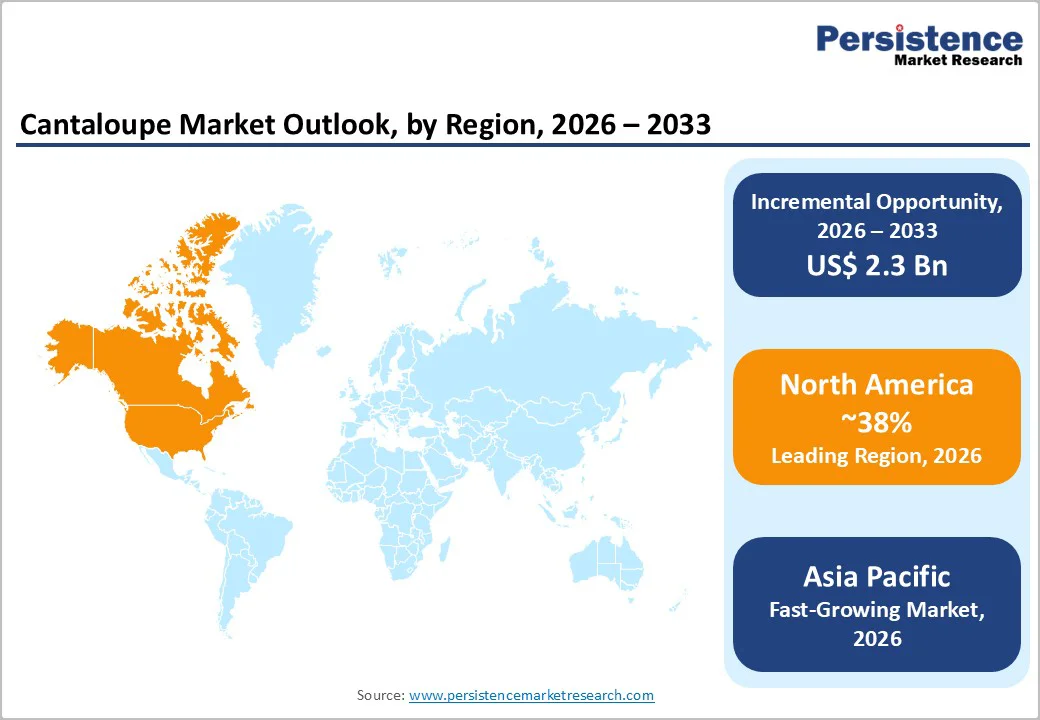

- Global Cantaloupe Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Bn) and Volume (Units) Analysis, By Region, 2020 - 2025

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Region, 2026 - 2033

- North America

- Europe

- East Asia

- South Asia and Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Cantaloupe Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2020 - 2025

- By Country

- By Product Type

- By Application

- By Natural

- Current Market Size (US$ Bn) Analysis and Forecast, By Country, 2026 - 2033

- U.S.

- Canada

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Product Type, 2026 - 2033

- Fresh

- Processed

- Frozen

- Dried

- Current Market Size (US$ Bn) Analysis and Forecast, By Application, 2026 - 2033

- Food & Beverages

- Cosmetics & Personal Care

- Dietary Supplements

- Functional Foods

- Current Market Size (US$ Bn) Analysis and Forecast, By Natural, 2026-2033

- Organic

- Conventional

- Market Attractiveness Analysis

- Europe Cantaloupe Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2020 - 2025

- By Country

- By Product Type

- By Application

- Natural

- Current Market Size (US$ Bn) Analysis and Forecast, By Country, 2026 - 2033

- Germany

- France

- U.K.

- Italy

- Spain

- Russia

- Türkiye

- Rest of Europe

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Product Type, 2026 - 2033

- Fresh

- Processed

- Frozen

- Dried

- Current Market Size (US$ Bn) Analysis and Forecast, By Application, 2026 - 2033

- Food & Beverages

- Cosmetics & Personal Care

- Dietary Supplements

- Functional Foods

- Current Market Size (US$ Bn) Analysis and Forecast, By Natural, 2026-2033

- Organic

- Conventional

- Market Attractiveness Analysis

- East Asia Cantaloupe Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2020 - 2025

- By Country

- By Product Type

- By Application

- By Natural

- Current Market Size (US$ Bn) Analysis and Forecast, By Country, 2026 - 2033

- China

- Japan

- South Korea

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Product Type, 2026 - 2033

- Fresh

- Processed

- Frozen

- Dried

- Current Market Size (US$ Bn) Analysis and Forecast, By Application, 2026 - 2033

- Food & Beverages

- Cosmetics & Personal Care

- Dietary Supplements

- Functional Foods

- Current Market Size (US$ Bn) Analysis and Forecast, By Natural, 2026-2033

- Organic

- Conventional

- Market Attractiveness Analysis

- South Asia & Oceania Cantaloupe Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2020 - 2025

- By Country

- By Product Type

- By Application

- By Natural

- Current Market Size (US$ Bn) Analysis and Forecast, By Country, 2026 - 2033

- India

- Southeast Asia

- ANZ

- Rest of South Asia & Oceania

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Product Type, 2026 - 2033

- Fresh

- Processed

- Frozen

- Dried

- Current Market Size (US$ Bn) Analysis and Forecast, By Application, 2026 - 2033

- Food & Beverages

- Cosmetics & Personal Care

- Dietary Supplements

- Functional Foods

- Current Market Size (US$ Bn) Analysis and Forecast, By Natural, 2026-2033

- Organic

- Conventional

- Market Attractiveness Analysis

- Latin America Cantaloupe Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2020 - 2025

- By Country

- By Product Type

- By Application

- By Natural

- Current Market Size (US$ Bn) Analysis and Forecast, By Country, 2026 - 2033

- Brazil

- Mexico

- Rest of Latin America

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Product Type, 2026 - 2033

- Fresh

- Processed

- Frozen

- Dried

- Current Market Size (US$ Bn) Analysis and Forecast, By Application, 2026 - 2033

- Food & Beverages

- Cosmetics & Personal Care

- Dietary Supplements

- Functional Foods

- Current Market Size (US$ Bn) Analysis and Forecast, By Natural, 2026-2033

- Organic

- Conventional

- Market Attractiveness Analysis

- Middle East & Africa Cantaloupe Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2020 - 2025

- By Country

- By Product Type

- By Application

- By Natural

- Current Market Size (US$ Bn) Analysis and Forecast, By Country, 2026 - 2033

- GCC Countries

- Egypt

- South Africa

- Northern Africa

- Rest of Middle East & Africa

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Product Type, 2026 - 2033

- Fresh

- Processed

- Frozen

- Dried

- Current Market Size (US$ Bn) Analysis and Forecast, By Application, 2026 - 2033

- Food & Beverages

- Cosmetics & Personal Care

- Dietary Supplements

- Functional Foods

- Current Market Size (US$ Bn) Analysis and Forecast, By Natural, 2026-2033

- Organic

- Conventional

- Market Attractiveness Analysis

- Competition Landscape

- Market Share Analysis, 2025

- Market Structure

- Competition Intensity Mapping By Market

- Competition Dashboard

- Company Profiles (Details - Overview, Financials, Strategy, Recent Developments)

- Dole Food Company

- Overview

- Segments and Deployments

- Key Financials

- Market Developments

- Market Strategy

- Fresh Del Monte Produce

- SunFed

- Southern Valley Fruit and Vegetable

- Melon Consortium

- Beijing Vegetable Research Center

- Honey Dew Farms

- Sakata Seed Corporation

- Nature’s Pride

- California Giant Berry Farms

- Grupo Alta

- Dole Food Company

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment