ID: PMRREP3017

Format: PPT*, PDF, EXCEL

Last Updated: 6 Jan 2025

Industry: Healthcare

Number of Pages: 183

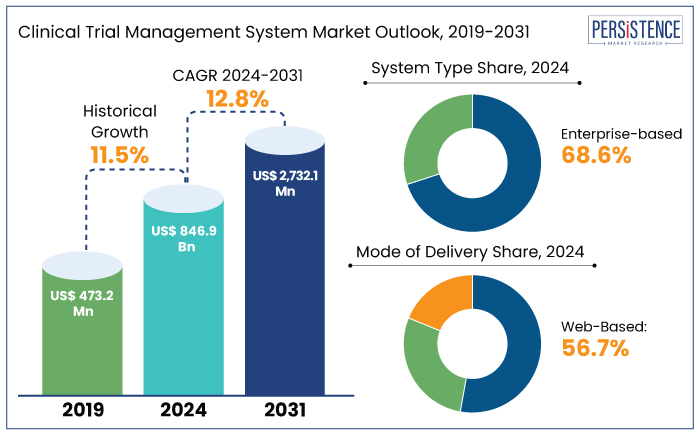

The global clinical trial management system market is projected to witness a CAGR of 12.8% during the forecast period from 2024 to 2031. It is anticipated to increase from US$ 846.9 Mn recorded in 2024 to a decent US$ 2732.1 Mn by 2031.

The global market for Clinical Trial Management Systems (CTMS) is rising due to increasing complexity of clinical trials and surging number of studies conducted globally. Pharmaceutical and biotechnology companies are adopting CTMS to improve trial efficiency and regulatory compliance.

Shift toward decentralized and virtual trials has boosted demand for cloud-based and AI-driven solutions. Rising investments in clinical research, coupled with a focus on reducing trial costs and timelines, are further driving market growth. Additionally, growing prevalence of chronic diseases and the need for quick drug development are creating a sustained demand for unique trial management systems.

In 2023, global research and development spending in the pharmaceutical industry exceeded US$ 300 Bn. The estimated median capitalized research and development cost per new drug is nearly US$ 985 Mn, accounting for expenditures on failed trials.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Clinical Trial Management System Market Size (2024E) |

US$ 846.9 Mn |

|

Projected Market Value (2031F) |

US$ 2732.1 Mn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

12.8% |

|

Historical Market Growth Rate (CAGR 2018 to 2023) |

11.5% |

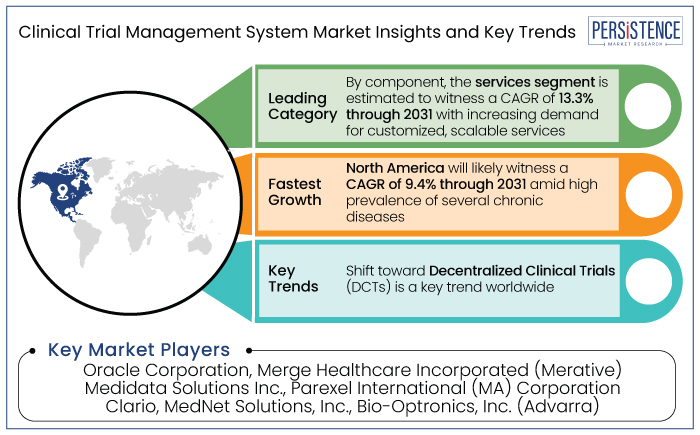

North America is set to account for around 48.9% of share in the global market in 2024. It is projected to witness a CAGR of 9.4% through 2031. The prevalence of several chronic diseases has increased, pushing the need for clinical trials and research projects to be carried out by key market players.

Clinical trial management systems are employed to manage these projects. The ability of market players to conduct high-quality research projects and clinical trials has been supported by government funding for research programs. It will likely increase demand for such systems.

The steadily rising aging demographic has significantly fueled the market’s expansion. Along with the steep growth in the average lifespan, the number of individuals suffering from chronic illnesses has significantly increased, thereby boosting demand.

Web-based clinical trial management systems will likely hold around 56.7% of the total market in 2024. A software program used to coordinate clinical trials in clinical research is known as a web-based Clinical Trial Management System (CTMS).

CTMS help assist clinical research investigations carried out either within or among different institutions as a unified, consolidated, web-based enterprise resource. It is a software system used by the biotechnology and pharmaceutical sectors to run clinical trials for clinical research. In addition to participant contact information and tracking deadlines and milestones remotely, the system maintains and administers planning, performing, and reporting activities.

Enterprise-based clinical trial management systems will likely hold around 68.6% of the total market in 2024. The main focus of CTMS is operational data. Clinical data is collected digitally using the enterprise-based system. The data, which largely consists of clinical and patient information, is utilized to conduct statistical analyses and decision-making.

CTMS is an excellent area for team members to collaborate as well as for teams from other organizations, such as sponsors, CROs, and sites. With the knowledge that everyone on the team has access to the most recent data, team members can work together on a single task related to the same investigation, such as study start-up. Collaboration among sponsors, CROs, sites, and other vendors is another way to share the burden of maintaining the accuracy of research data.

The clinical trial management system market is witnessing rapid growth, driven by the need for more efficient clinical trial processes and increasing complexity of drug development. CTMS solutions help streamline trial management by automating administrative tasks, improving data accuracy, and ensuring regulatory compliance.

One of the key trends in the market is the rising adoption of cloud-based CTMS platforms, which offer cost savings, scalability, and real-time data access for distributed teams. Additionally, the integration of Artificial Intelligence (AI) and data analytics is enhancing trial design and participant management. It is helping to predict outcomes and optimize recruitment and retention strategies.

Another notable trend is the shift toward Decentralized Clinical Trials (DCTs), which leverage digital tools to conduct trials remotely, making them more flexible and accessible. As these technologies evolve, the CTMS industry is poised for continued growth, addressing the evolving demands of the healthcare and pharmaceutical industries.

The global clinical trial management system industry recorded a decent CAGR of 11.5% in the historical period from 2019 to 2023. Use of modern technology is playing a pivotal role in accelerating medical research by enhancing clinical trials and medical education.

Through the effective application of digital tools, significant improvements can be made in participant recruitment and retention, as well as in data gathering and analysis. These are considered critical components of clinical trials. These technologies not only streamline communication with participants but also accelerate data collection, thereby improving the validity of the research analysis.

The COVID-19 pandemic highlighted the importance of digital technologies in addressing global health challenges. These included case forecasting, information sharing, and collaborative research for vaccine development. This global crisis further accelerated the adoption of digital tools for healthcare and research.

In medical research, scholars have increasingly focused on how digital technologies influence diagnosis, treatment, and surgery. Engineering researchers, on the other hand, have concentrated on the management, security, and integration of data, emphasizing the importance of data synchronization and interface design. This ongoing integration of digital technology into medicine is essential for improving the speed, efficiency, and scope of medical innovations.

Need to Streamline Trial Processes to Bolster Demand for Novel Systems

Digital technology is revolutionizing clinical trials by enhancing efficiency and reliability through real-time data collection, analytics, and AI-driven recruitment. Tools like wearable devices and mobile sensors boost participant engagement and enable remote monitoring, while AI optimizes data analysis and predictive modeling. For instance,

Digital twin technology and virtual reality bridge the gap between theoretical medical education and practical clinical trial skills. These developments create immersive learning opportunities, such as 3D surgery simulations, equipping researchers for innovation. Collectively, these technologies drive demand for scalable, efficient solutions, presenting substantial growth opportunities for the clinical trial management system market.

Constant Development of Pharmaceutical and Biotechnology Sectors to Fuel Demand

Rapid growth of the pharmaceutical and biotechnology sectors has led to a significant increase in clinical trials worldwide. For example,

The growth necessitates unique CTMS to manage multiple trial sites, enhance communication between stakeholders, and reduce time-to-market for drugs. Companies like Pfizer and Moderna have adopted novel CTMS to manage large-scale vaccine trials efficiently during the COVID-19 pandemic.

Complexity and High Costs Combined with Low Participation Rates to Hinder Demand

Clinical trials are vital to medical research, offering essential insights into the safety, efficacy, and diagnostic capabilities of new therapies and devices. However, inefficiencies in participant recruitment, data collection, and analysis often lead to low enrollment rates.

It is posing significant challenges to trial execution. Factors like geographical distance from trial sites and scheduling conflicts further limit participation, increasing costs. For example,

While developments have improved certain aspects, the clinical research environment remains costly and complex. Market freedom plays a pivotal role in enhancing resource distribution and minimizing informational gaps.

In economically underdeveloped regions, inadequate digital infrastructure, poor healthcare systems, and limited internet access may hinder participation. These challenges restrict access to medical expertise and essential trial information, further reducing enrollment rates.

Adoption of Cloud-based Systems for CTMS to Create Novel Opportunities

The adoption of cloud-based solutions for Clinical Trial Management Systems (CTMS) is revolutionizing the clinical trial landscape, driving efficiency, scalability, and accessibility. Cloud-based CTMS platforms offer real-time data access, seamless collaboration across geographically dispersed teams, and streamlined workflows, reducing operational complexity.

The systems help enhance data security and compliance with regulatory standards, a critical requirement in clinical research. The flexibility to scale resources based on trial demands and integration with unique analytics tools also enable faster decision-making and cost savings. As the clinical trial management system market rises, driven by increased clinical research and digitization, cloud-based solutions are becoming indispensable.

The Clinical Trial Management System (CTMS) industry features a competitive landscape dominated by key players such as Medidata Solutions, Oracle Corporation, Veeva Systems, Parexel International, and IBM Watson Health. These companies compete by offering unique CTMS solutions that integrate cloud-based technologies, Artificial Intelligence (AI), and data analytics to streamline trial management. Small-scale and regional players are also entering the market with niche offerings tailored for specific trial phases or therapeutic areas.

Strategic initiatives such as partnerships with Contract Research Organizations (CROs), acquisitions to broaden portfolios, and collaborations with pharmaceutical companies are common competitive tactics. Innovations like Decentralized Clinical Trials (DCTs) and AI-powered tools for predictive analysis and patient engagement further differentiate competitors. This intense competition fosters continuous innovation, driving market growth and enhancing the efficiency of clinical trials.

Recent Industry Developments

Yes, the market is set to reach US$ 2732.1 Mn by 2031.

The U.S. is estimated to hold a high market share in 2024.

Oracle Corporation and Merge Healthcare Incorporated (Merative) are considered the leading players.

The global industry is estimated to witness a CAGR of 12.8% from 2024 to 2031.

It ensures compliance with regulatory requirements, which strictly control trials to protect participants and ensure the validity of the research.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Component

By Mode of Delivery

By System Type

By End User

By Region

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author