ID: PMRREP32036| 201 Pages | 14 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

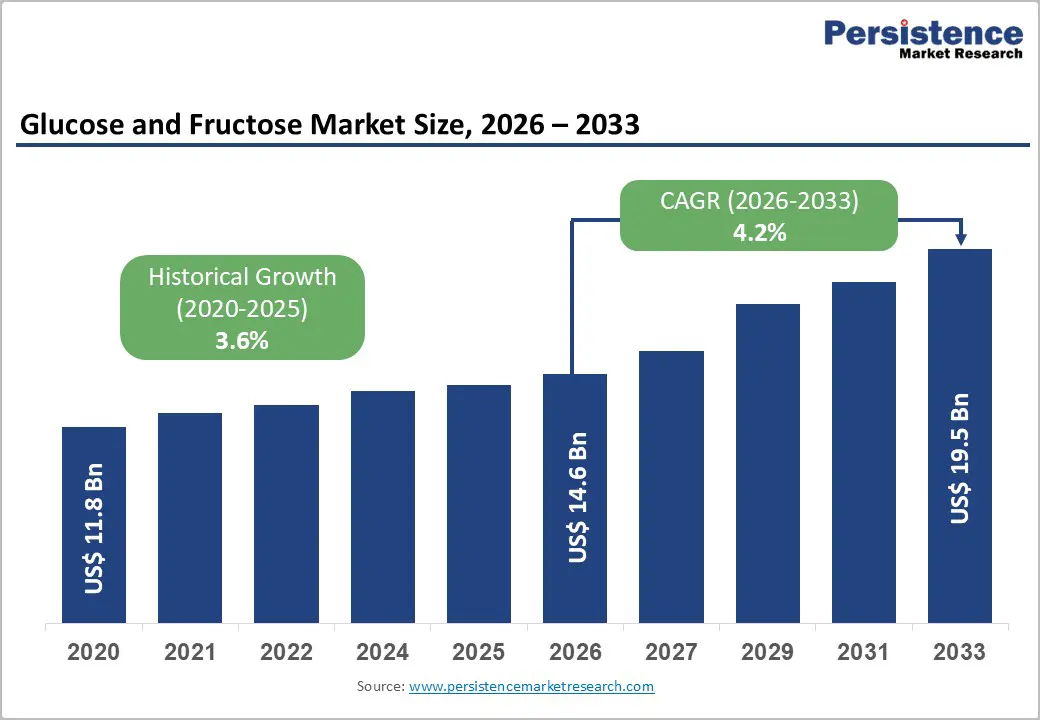

The global Glucose and Fructose market size is expected to be valued at US$ 14.6 billion in 2026 and projected to reach US$ 19.5 billion by 2033, growing at a CAGR of 4.2% between 2026 and 2033

The market expansion is fundamentally driven by the escalating global demand for cost-effective, high-functionality sweeteners that serve as versatile alternatives to traditional sucrose in the industrial food processing sector. As beverage and confectionery manufacturers face volatile sugar prices and fluctuating crop yields, the consistent availability of Corn and Wheat-derived syrups provides a strategic buffer for supply chain stability. Furthermore, the rising prevalence of lifestyle diseases has catalyzed a shift toward Fructose in specific dietary applications due to its lower glycemic index compared to table sugar, alongside the rapid integration of these monosaccharides into the burgeoning Sports & Clinical Nutrition segment for immediate energy replenishment.

| Global Market Attributes | Key Insights |

|---|---|

| Global Glucose and Fructose Market Size (2026E) | US$ 14.6 Bn |

| Market Value Forecast (2033F) | US$ 19.5 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.2% |

| Historical Market Growth (CAGR 2020 to 2025) | 3.6% |

A primary catalyst for the Glucose and Fructose Market is the accelerating structural shift in consumer dietary preferences toward functional ingredients that support metabolic health. While traditional sucrose remains a staple, Fructose is increasingly favored by the food processing industry for its unique ability to provide intense sweetness at lower usage levels, facilitating a significant reduction in total caloric intake without compromising sensory profiles. According to data from the World Health Organization (WHO), global obesity rates have nearly tripled since 1975, prompting regulatory bodies to advocate for sugar reduction. Manufacturers are responding by utilizing the synergistic properties of Glucose and Fructose blends to enhance the humectancy and shelf-life of products in the Bakery & Confectionery sector while appealing to the 23.2% of North American consumers now actively seeking low-calorie refreshments.

One of the most significant barriers to market growth is the mounting pressure from global health authorities regarding the overconsumption of free sugars, particularly high-fructose variants. The U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) have implemented rigorous "Added Sugar" labeling requirements that force transparency upon manufacturers, often resulting in a negative consumer perception of processed sweeteners. Regulatory frameworks, such as the UK Sugar Tax, have already forced massive reformulations across the beverage landscape. Furthermore, clinical studies published in medical journals linking excessive Fructose consumption to non-alcoholic fatty liver disease (NAFLD) and insulin resistance have fueled public skepticism, potentially slowing the adoption rate in health-conscious premium segments and driving a shift toward high-intensity natural sweeteners like Stevia.

The emergence of biotechnology-driven production methods offers a lucrative growth avenue for the Glucose and Fructose Market. Innovations in enzymatic technology have enabled manufacturers to achieve higher yields and purity levels while reducing the environmental footprint of starch-to-sugar conversion. The integration of Artificial Intelligence (AI) in processing plants a trend pioneered by leaders like Ingredion and Roquette Frères allows for real-time monitoring of fermentation parameters, ensuring consistent quality and optimizing resource allocation. Furthermore, the development of specialized enzymes that can efficiently convert non-traditional starches, such as those from Cassava, provides a strategic opportunity for regional manufacturers in Latin America and Africa to localize supply chains and reduce reliance on imported grains, effectively opening new high-growth revenue pockets.

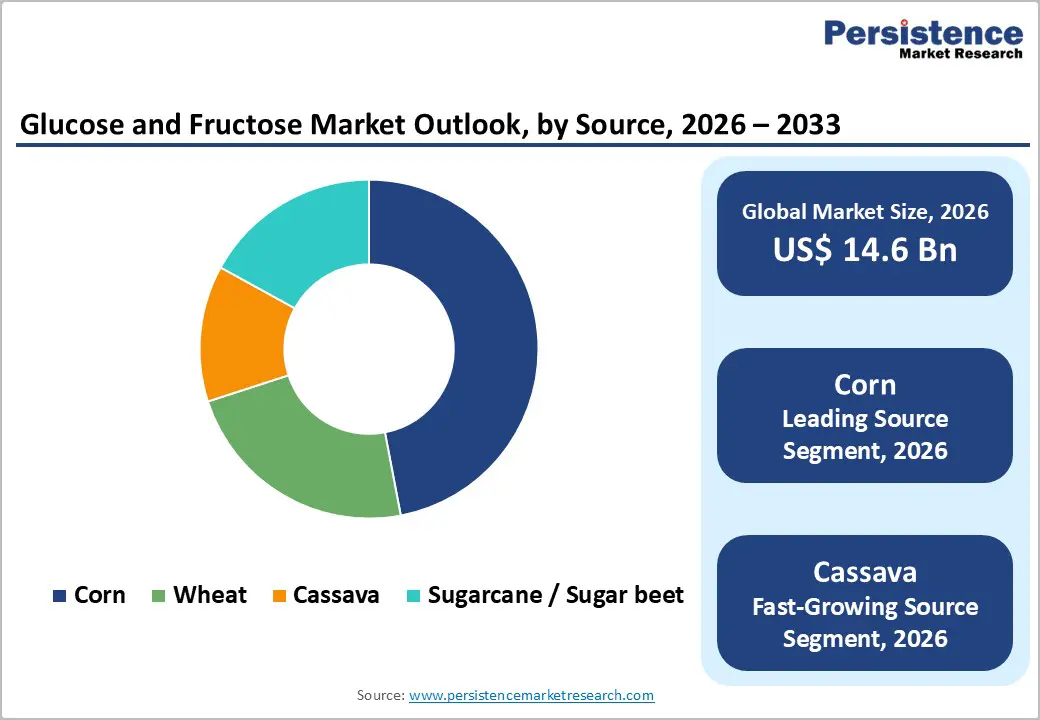

The Corn segment currently holds the dominant position in the Glucose and Fructose Market, accounting for a substantial 47% market share in 2025. This leadership is primarily attributed to the massive production hubs in the United States and China, where established wet-milling infrastructure and government agricultural subsidies make corn the most cost-effective feedstock for industrial sweeteners. Corn-derived syrups, particularly high-fructose corn syrup (HFCS), remain the industry benchmark for liquid sweeteners due to their versatile functionality in beverages. However, the Cassava segment is recognized as the fastest-growing source, projected to record an impressive CAGR between 2025 and 2032. This rapid growth is driven by the increasing industrialization of starch processing in Southeast Asia and Africa, where Cassava offers a resilient and sustainable alternative to cereal crops, appealing to regional manufacturers seeking to insulate themselves from global grain price fluctuations.

The Beverages segment stands as the preeminent end-use category, fueled by the massive global consumption of carbonated soft drinks, juices, and flavored waters. Liquid sweeteners are fundamental to this sector, providing not only sweetness but also mouthfeel and flavor enhancement. Meanwhile, the Bakery & Confectionery industry holds a significant market share of 23.8%, utilizing Glucose for its anti-crystallization properties and Fructose for its humectancy, which prevents products from drying out. The Pharmaceuticals segment is identified as one of the fastest-growing areas, as high-purity dextrose is increasingly utilized as a reliable excipient in tablet formulations and a primary component in life-saving rehydration fluids. The expanding clinical nutrition market is further bolstering this demand, as medical professionals prioritize bioavailable carbohydrate sources for geriatric and post-operative care.

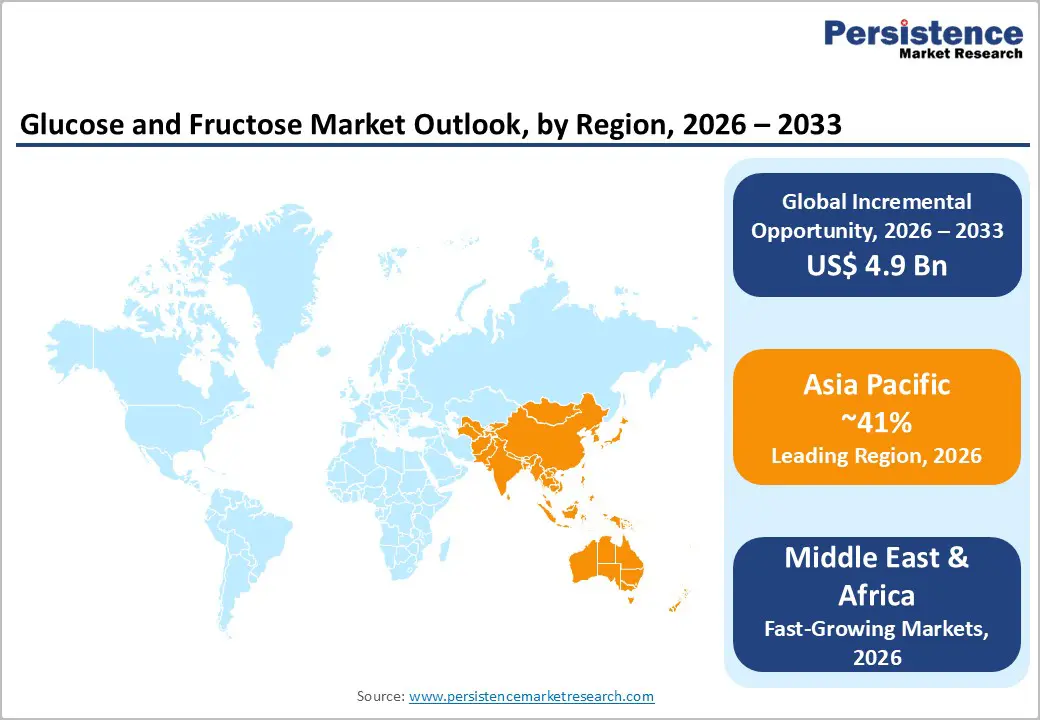

The Asia Pacific region stands as the dominant regional market, holding a 41% market share in 2025, and is expected to remain the primary engine of global volume growth. This leadership is propelled by rapid urbanization, increasing disposable incomes, and the presence of massive food manufacturing hubs in China, India, and ASEAN countries. In China, the government’s focus on industrial modernization and food security has led to a skyrocketing demand for starch-derived sweeteners to replace expensive imported sugar.

The region's growth dynamics are further characterized by a significant manufacturing advantage, with vast agricultural bases for corn, wheat, and cassava production. According to reports from the Food and Agriculture Organization (FAO), India and Thailand are becoming major global suppliers of cassava-based glucose, catering to both domestic and export markets. The rising middle class in Southeast Asia is driving the consumption of Western-style snacks and bottled drinks, creating a perennial requirement for standardized industrial sweeteners. Furthermore, the expansion of the pharmaceutical and healthcare sectors in the region is opening new high-value opportunities for medical-grade dextrose, supported by ongoing infrastructure investments in the healthcare supply chain.

Middle East & Africa Glucose and Fructose Market is expected to grow at a CAGR of 7.5%, shaped by rising food processing capacity, beverage localization, and shifting sweetener economics. In the GCC, demand is moving toward liquid glucose and fructose syrups for carbonated drinks, dairy desserts, and confectionery, supported by investments in regional blending and formulation facilities aimed at reducing import dependence and improving supply security.

In Egypt, expanding bakery, pharmaceutical, and beverage manufacturing is driving steady uptake of glucose syrups as cost-stable functional sweeteners and excipients. Across African countries, growth is increasingly linked to cassava-based glucose production, supported by local crop availability and government-backed agro-processing initiatives. Sports nutrition and fortified foods are emerging niche drivers, reflecting urbanization and rising focus on affordable energy sources within developing consumer markets.

The Glucose and Fructose Market exhibits a moderately consolidated structure, where a small number of global agricultural giants control a significant portion of the primary processing and global distribution of sweeteners. Companies like Cargill, Incorporated, ADM, and Ingredion maintain their dominance through extensive vertical integration controlling the supply chain from the procurement of raw grains to the manufacturing of finished ingredient solutions. Their strategies for expansion often involve significant investments in R&D to develop proprietary enzymatic blends that enhance yield and purity. Simultaneously, the market remains fragmented at the regional level, with numerous smaller players like Gulshan Polyols Ltd. and niche starch processors in Asia and Latin America catering to localized food and beverage needs. Emerging business model trends show an increasing shift toward "Traceability and Sustainability," where companies leverage digital platforms to provide transparent sourcing data to ethically conscious food brands.

The global Glucose and Fructose Market is expected to be valued at approximately US$ 14.6 billion in 2026, following a steady historical growth trajectory.

The demand is primarily driven by the rising consumption of convenience foods and beverages, combined with the shift toward cost-effective sweeteners with functional properties like high humectancy and flavor stability.

The Asia Pacific region is the leading market, holding a 41% share in 2025, supported by massive industrial food processing scale in China and India.

A significant opportunity lies in the Sports & Clinical Nutrition segment, where high-purity monosaccharide blends are increasingly used for performance optimization and healthcare support.

Key players include Cargill, Incorporated, ADM, Ingredion, Tate & Lyle PLC, Wilmar International Limited, Associated British Foods plc, Tereos Group, Roquette Frères, and others

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Source

By Form

By End Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author