ID: PMRREP32589| 239 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

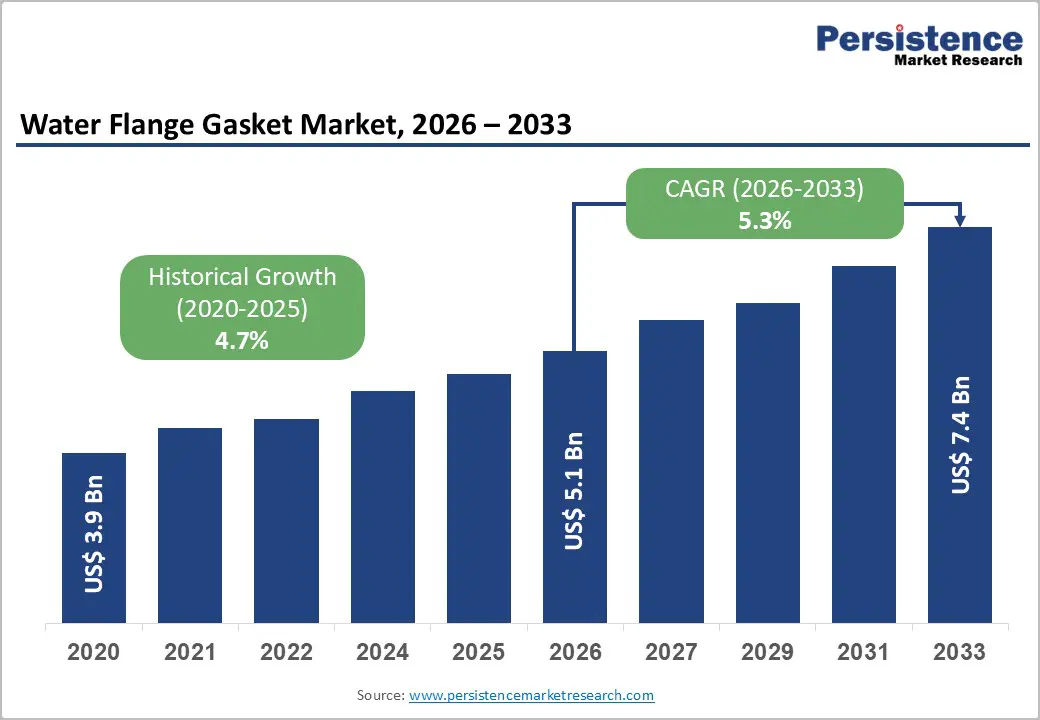

The global Water Flange Gasket Market size is likely to be projected at US$ 5.1 Billion in 2026 and is projected to reach US$ 7.4 Billion by 2033, growing at a CAGR of 5.3% between 2026 and 2033. Market expansion is driven by systematic infrastructure modernization in water treatment and wastewater management systems requiring advanced sealing technologies preventing fluid leakage, rapid petrochemical and oil & gas industry growth with processing capacity expanding 4.2% annually necessitating reliable flange sealing solutions, and technological advancement enabling specialized rubber and metal gasket formulations delivering superior chemical resistance, temperature tolerance, and extended operational lifespan across diverse industrial applications.

| Key Insights | Details |

|---|---|

| Water Flange Gasket Market Size (2026E) | US$5.1 Bn |

| Market Value Forecast (2033F) | US$7.4 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.3% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.7% |

Market Drivers

Water treatment systematically drives flange gasket demand, as the global wastewater treatment market grows at a 5.1% CAGR, requiring advanced sealing solutions across treatment facility operations. Annual water infrastructure investments exceeding USD 300 billion worldwide, combined with emerging market wastewater expansion at a 6.8% CAGR, demonstrate sustained adoption momentum supporting consistent market expansion, particularly within municipal utilities and industrial treatment facilities. Membrane filtration, biological treatment, and advanced oxidation systems increasingly require specialized, chemically resistant gasket solutions, creating an emerging high-performance water treatment segment estimated at USD 1.5–1.8 billion annually and reinforcing long-term demand visibility across regulated global infrastructure development cycles.

Oil and gas and petrochemical sectors systematically drive flange gasket demand, as global oil demand is projected at 104.1 million barrels per day by 2026 and petrochemical processing expands at 4.2% annually, reflecting sustained capital investment momentum worldwide. Refinery operations, chemical processing units, and downstream facilities require high pressure, high temperature sealing solutions, while crude oil desalting, catalytic cracking, hydroprocessing, and polymerization processes increasingly demand specialized, corrosion resistant gaskets. These operating conditions create an expanding premium industrial sealing segment, supporting higher value gasket adoption, longer replacement cycles, and consistent aftermarket demand across upstream, midstream, and downstream energy infrastructure globally today.

Market Restraints

Market expansion is constrained by rubber and metal price volatility, causing 12–18% quarterly cost variations that directly impact manufacturer profitability and pricing stability. Strong correlation with petroleum derivatives and recurring geopolitical supply chain disruptions, particularly affecting natural rubber and synthetic elastomer availability, create persistent raw material uncertainty. These fluctuations limit long term contract visibility, restrict margin consistency, and challenge cost pass through strategies, especially within budget sensitive end use segments and price competitive municipal and industrial procurement environments globally today.

Market expansion is constrained by global gasket standardization that reduces differentiation opportunities, combined with intense price competition from emerging manufacturers offering USD 5–8 per unit versus USD 15–25 for premium brands. Chinese and Indian suppliers increasingly capture market share through aggressive cost leadership, challenging established players’ value propositions. This dynamic accelerates margin compression, limits pricing power, and pressures premium suppliers to justify performance advantages, innovation investment, and service differentiation across cost sensitive industrial and municipal procurement environments globally today worldwide.

Market Opportunities

Advanced material integration represents a major opportunity, as eco friendly and recyclable gasket materials combined with reduced environmental footprint manufacturing support an emerging sustainability focused segment. Rising adoption of pharmaceutical grade gaskets and food processing applications requiring strict FDA and EU regulatory compliance further expands a regulated industry premium segment. These applications demand superior chemical resistance, hygiene performance, and traceability, encouraging specialized product development. Manufacturers investing in compliant materials, cleaner production processes, and certification capabilities gain pricing power, differentiation, and long term contracts, reinforcing premium positioning while aligning flange gasket portfolios with global sustainability and safety driven procurement priorities worldwide.

Renewable energy represents a significant opportunity, as wind turbine and hydroelectric facility development increasingly require specialized, high performance sealing solutions capable of operating under variable pressure, vibration, and environmental conditions. Global energy transition investments exceeding USD 500 billion annually, combined with large scale grid modernization and cross border transmission projects, are accelerating renewable infrastructure deployment worldwide. These developments create an emerging green energy infrastructure segment demanding durable, corrosion resistant, and low maintenance gasket solutions. As renewable assets scale, specialized flange gaskets gain strategic importance, supporting long term demand growth, premium pricing potential, and diversified application exposure across energy value chains.

Full face gaskets command 42% of global market share, representing dominant product type with comprehensive sealing coverage on entire flange surface and suitability for larger diameter flanges. Full face gaskets accounting for 45% of industrial flange applications supporting consistent demand particularly for water treatment facilities and large-capacity industrial equipment where comprehensive sealing coverage remains critical providing stable revenue base and predictable market anchor.

Ring type gaskets expand at 5.6% CAGR driven by superior performance under extreme pressures, efficient material usage, and cost-effectiveness supporting emerging high-pressure industrial applications. Ring type gasket adoption in oil & gas, petrochemical, and power generation sectors expanding at 5.6% CAGR with specialized high-pressure equipment enables emerging premium performance segment, supporting specialized high-pressure market positioning.

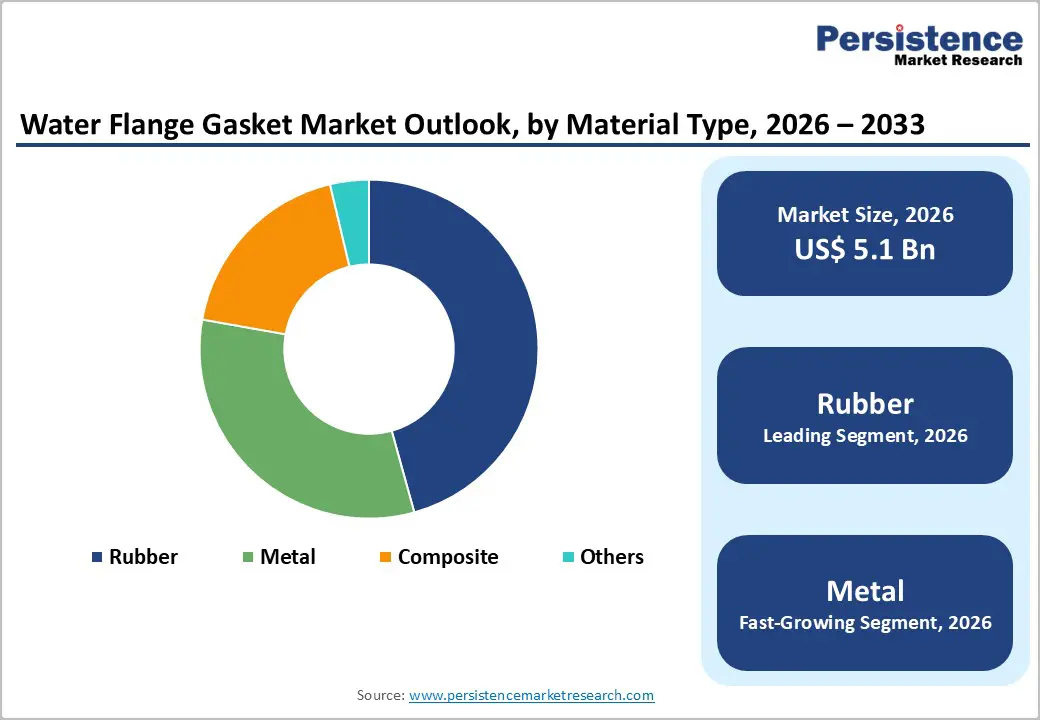

Rubber commands 46% of market share, driven by flexibility, chemical compatibility, cost-effectiveness, and diverse compound options (EPDM, Nitrile, FKM). Rubber gaskets accounting for 50% of water treatment applications with superior sealing performance supporting consistent stable demand particularly for wastewater facilities and general industrial applications where cost-efficiency and flexibility remain priorities providing market stability anchor.

Metal gaskets expand at 5.5% CAGR driven by superior high-pressure tolerance, thermal stability, and compatibility with extreme conditions. Metal composite and spiral-wound gaskets adoption in petrochemical, refining, and power generation expanding at significant pace supports emerging premium high-performance segment, enabling premium market positioning and specialized industrial targeting.

Water treatment commands 32% of market share, driven by municipal wastewater facilities, industrial treatment systems, and membrane filtration operations requiring reliable sealing solutions. Water treatment market expanding at 5.1% CAGR globally with emerging market infrastructure investment supporting consistent strong demand particularly for municipal utilities and industrial treatment operations providing market stability anchor and steady revenue foundation.

Chemical & petrochemical expands at 5.3% CAGR driven by production capacity growth, crude oil processing, and polymer synthesis applications requiring chemical-resistant specialized gaskets. Petrochemical processing expansion combined with desalting, catalytic cracking, and catalytic reforming operations supports emerging specialized chemical segment, enabling premium performance and specialized targeting.

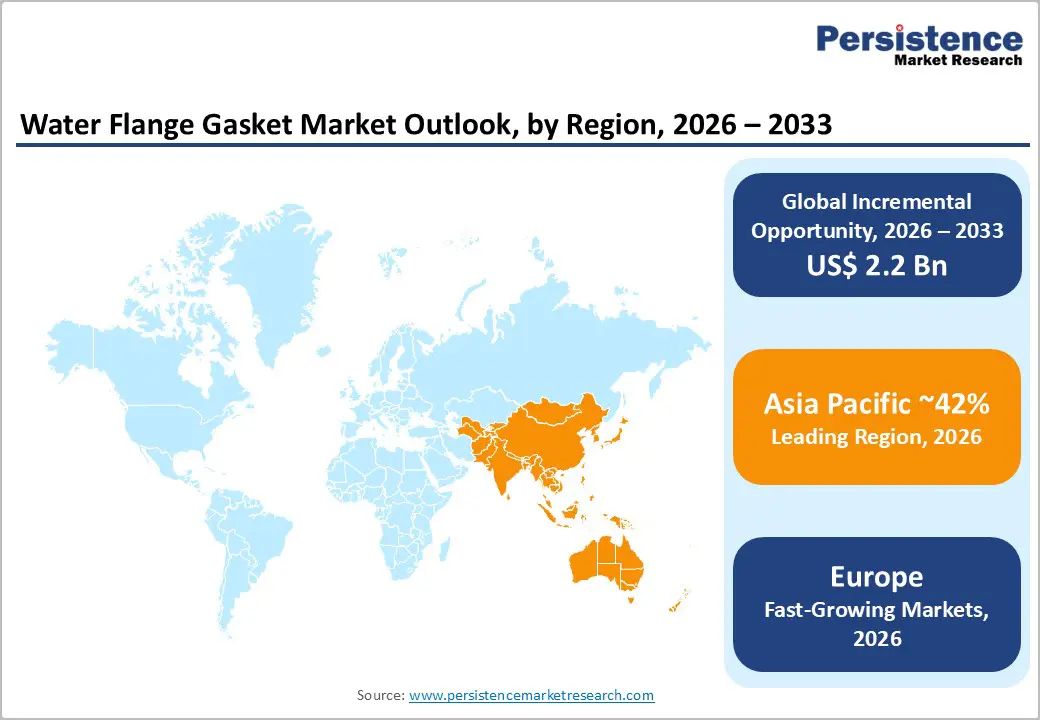

North America maintains 22% market share with consistent growth pace supported by established petrochemical infrastructure, water treatment modernization, and regulatory compliance emphasis. USA market featuring premium gasket demand with advanced material adoption and specialized sealing solutions supporting technology leadership enabled by EPA regulations and stringent water quality standards combined with established industrial base driving innovation-focused market dynamics. Stringent environmental and safety regulations driving advanced product development. Established OEM partnerships and supply chain integration supporting reliable delivery. Focus on sustainability and regulatory compliance advancing eco-friendly material adoption.

Europe maintains 25% market share with 4.9% CAGR growth driven by strict EU environmental regulations, water quality directives, and advanced industrial standards. Europe commanding leadership in specialized gasket solutions with Germany, United Kingdom, France, and Spain demonstrating advanced technical expertise supporting premium material adoption and specialized gasket positioning particularly in pharmaceutical, food, and chemical processing where quality standards and regulatory compliance remain paramount. Advanced regulatory framework (EU 2024/3190 BPA ban) driving material innovation. Strong emphasis on sustainability and circular economy principles. Established manufacturer presence supporting innovation and premium quality differentiation.

Asia Pacific dominates with 42% market share and significant growth trajectory driven by rapid industrialization, water treatment expansion, and petrochemical capacity growth. China, India, and Southeast Asia demonstrating fastest regional growth with India water treatment expansion at 7.1% CAGR and China petrochemical production leading globally supporting emerging high-volume market development at fastest regional growth pace enabling localized production ecosystem development and cost-competitive emerging supplier opportunities particularly in water treatment and industrial segments. Rapid water infrastructure investment and treatment facility development. Emerging manufacturing capabilities supporting cost-competitive solutions and localization. Growing petrochemical and industrial expansion driving gasket demand across segments.

Market leaders employ innovation-focused product development advancing high-performance materials and regulatory-compliant solutions, geographic expansion targeting Asia-Pacific water treatment and petrochemical growth, sustainability positioning through eco-friendly materials and BPA-free alternatives, strategic partnerships strengthening technical capability, and premium segment development targeting specialized industrial and regulated applications. Cost leadership strategies critical for volume markets.

The Water Flange Gasket Market is anticipated at US$ 5.1 Billion in 2026 and projected to reach US$ 7.4 Billion by 2033.

Market growth is fueled by rising water and wastewater investments, expanding oil & petrochemical capacity, advancements in high-performance gasket materials, and stringent regulatory mandates such as the EU BPA ban effective 2025.

The market expands at 5.3% CAGR between 2026 and 2033.

Key opportunities lie in Asia-Pacific water treatment expansion, eco-friendly and BPA-free gasket innovation, and renewable energy infrastructure, collectively creating significant incremental addressable demand.

Leading players include Freudenberg Sealing Technologies, Flowserve Corporation, Dana Holding, Smiths Group, Federal-Mogul, Datwyler, Garlock, John Crane, and Victor Gaskets India, supported by continuous innovation, sustainability-focused product launches, and emerging-market expansion strategies.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Material Type

End Use Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author