ID: PMRREP29098| 254 Pages | 11 Jan 2026 | Format: PDF, Excel, PPT* | Automotive & Transportation

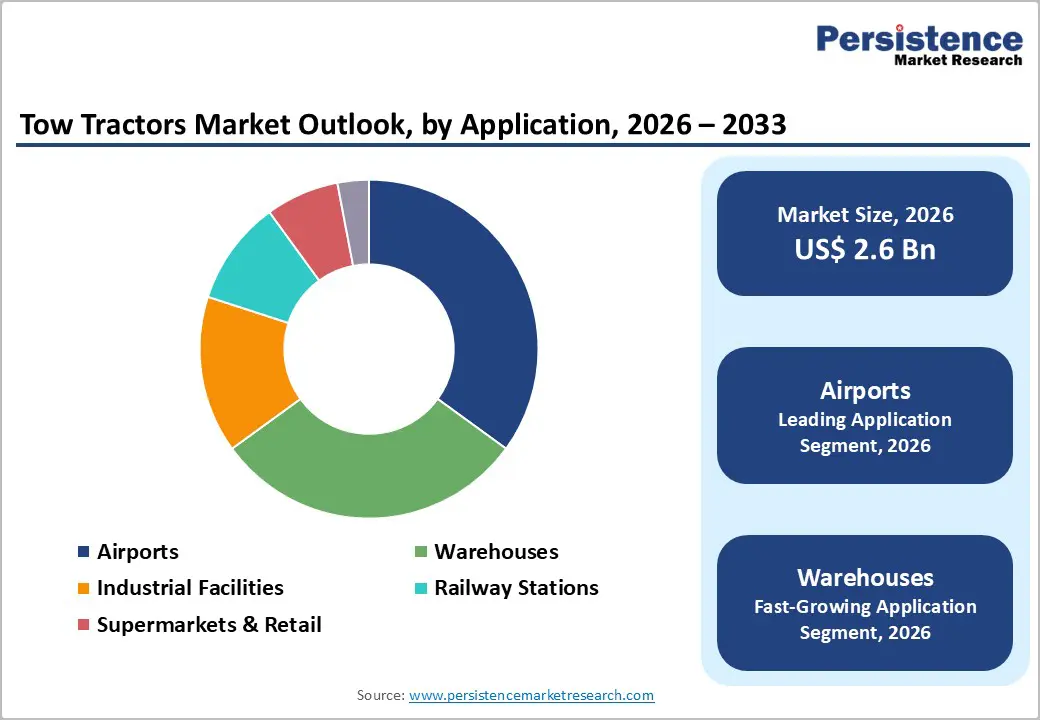

The global tow tractors market size is likely to be valued at US$ 2.6 billion in 2026, and is projected to reach US$ 3.7 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2026-2033.

This progression is being driven by escalating requirements for efficient intralogistics solutions across airports, industrial warehouses, supermarkets, and transportation hubs. Rising automation adoption, global manufacturing expansion, and warehouse modernization initiatives have been reinforcing baseline demand, while operators have prioritized equipment that enhances throughput without increasing labor intensity. Market momentum is also being supported by the transition toward electric and autonomous towing platforms, which deliver sustainability credentials alongside lower total cost of ownership. This dynamic environment has created opportunities to align fleet investments with environmental, social, & governance (ESG) commitments while capturing operational gains. Facilities that have integrated electric tow tractors into their ground support equipment (GSE) fleets have reduced emissions and noise, and reduced maintenance cycles, particularly when charging infrastructure has already been installed for other vehicle categories. Autonomous capabilities are enabling more predictable material flows and freeing operators to focus on higher-value tasks, thereby improving labor productivity in tight employment markets by 2033.

| Key Insights | Details |

|---|---|

| Tow Tractors Market Size (2026E) | US$ 2.6 Bn |

| Market Value Forecast (2033F) | US$ 3.7 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.2% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.5% |

The rapid growth of e-commerce and industrial logistics has led large operators such as Amazon, DHL Supply Chain, and UPS to invest heavily in automation-centric fulfillment and distribution centers, where internal material-flow efficiency is critical. These facilities increasingly integrate automated storage and retrieval systems, smart conveyors, and tow tractors to manage high-frequency, short-cycle internal transport. For instance, Amazon’s next-generation fulfillment centers emphasize reduced manual travel distances and continuous goods movement, directly increasing demand for towing solutions that can operate reliably across large footprints. As warehouse sizes expand and throughput expectations rise, tow tractors are becoming essential to sustaining productivity while managing labor availability and cost pressures.

The government-led decarbonization initiatives are accelerating the shift toward electric and digitally connected towing fleets. Policies such as the European Union’s “Fit for 55” climate package, the U.S. Federal Aviation Administration’s airport emissions reduction programs, and national clean-mobility incentives in countries such as Germany, India, and Japan are pushing airports and industrial sites to replace diesel ground equipment. Major international airports, including those in Frankfurt, Amsterdam, and Los Angeles, have announced timelines for transitioning ground support fleets toward zero-emission vehicles. Coupled with advances in telematics, battery management, and autonomous navigation, these regulatory and operational developments are structurally reinforcing long-term demand for electric, intelligent tow tractors across logistics, airport, and industrial environments.

The transition to electric, digitally connected, and autonomous logistics machinery and equipment is hindered by substantial upfront capital requirements and the complexity of infrastructure upgrades. Industrial charging installations, especially high-power units required for heavy material-handling fleets, can cost tens of thousands of dollars per station, with charging infrastructure and upstream electrical upgrades representing a significant portion of the total cost, particularly in older facilities with limited power capacity. This elevated initial expenditure discourages smaller warehouses and logistics operators from accelerating fleet modernization, even when long-term operating savings are attractive. The investment trade-off becomes a critical bottleneck in decision-making, affecting fleet replacement cycles and delaying technology adoption at scale.

The global supply chain's fragility in key components, notably lithium-ion batteries, semiconductors, and advanced sensors, heightens production and pricing uncertainty. Concentration of raw material sources in specific regions, such as cobalt from the Democratic Republic of Congo and lithium processing mainly in China, introduces geopolitical risk and price volatility that ripple through industrial equipment manufacturing. These dynamics have been exacerbated by pandemic-era logistics disruptions and ongoing geopolitical tensions, leading to extended lead times and constrained production capacity for battery cells and power electronics. As a result, manufacturers face challenges in scaling output predictably, which slows delivery timelines for fleet orders and places upward pressure on costs across the ecosystem.

Rapid infrastructure development across Asia Pacific, Latin America, and the Middle East is driving strong demand for tow tractors as governments and private investors build modern logistics parks, airports, and industrial corridors. For example, recent national logistics hub initiatives in India’s Logistics Ease Across Different States (LEADS) program and the ASEAN Supply Chain Connectivity Framework are accelerating warehouse construction and freight handling capacity. Large airport expansion projects, including new terminals and upgraded cargo zones at hubs such as Istanbul Airport and Delhi’s Terminal 2, are also increasing requirements for efficient internal transport solutions. These infrastructure developments are expanding the total addressable market for light, medium, and heavy-duty tow tractors across both established and emerging regions.

The growing installed base of electric and digitally enabled tow tractors is creating robust aftermarket and service opportunities that extend revenue beyond initial equipment sales. Industry developments, such as fleet electrification mandates at major North American airports and the increased adoption of telematics platforms across global 3PL networks, are driving demand for battery servicing, predictive maintenance, remote diagnostics, and software updates. Operators are also seeking tailored solutions that match specific operational needs, such as enhanced safety packages for airport ground support or compact configurations for urban distribution centers, which encourages original equipment manufacturers (OEMs) to offer bespoke configurations and lifecycle service contracts. This shift toward recurring service revenue models and customization strengthens customer retention while differentiating manufacturers in a competitive landscape.

Rider-seated towing tractors are expected to maintain leadership, capturing around 48% of the global market share in 2026 due to their high capacity and continuous-duty performance in airports, logistics parks, and industrial plants. Large ground support fleets at major airports, such as the fleet electrification initiatives at Los Angeles World Airports (LAWA) and Frankfurt Airport, are driving procurement of rider-seated electric towing fleets. Additionally, distribution giants such as Walmart and DHL Supply Chain have expanded their rider-seated tractor fleets as part of high-throughput logistics center upgrades, emphasizing operator comfort and reliability. These developments reinforce their dominance in high workload environments.

The pedestrian towing tractors are projected to register the highest CAGR of roughly 6.5% between 2026 and 2033, driven by their increasing adoption in compact warehouses and urban fulfillment hubs. Retailers such as Target and third-party logistics providers including XPO Logistics are deploying pedestrian models for tight aisle operations where larger vehicles are impractical. The rollout of micro-fulfillment centers by grocery chains and e-commerce specialists in major metropolitan areas further amplifies demand for maneuverable, cost-effective pedestrian tractors. Their ease of use and lower acquisition cost align with growth in last-mile distribution environments.

The medium-duty segment is projected to lead the tow tractors market, accounting for approximately 42% of revenue share in 2026, as it strikes a balance between power and flexibility across warehouses, manufacturing floors, and airport cargo zones. Operators such as Amazon Robotics and FedEx Logistics are integrating medium-duty electric towing fleets to support mixed operations that alternate between indoor and outdoor tasks. Strategic investments by logistics park developers, such as Prologis and GLP, across North America and Europe highlight the importance of medium-duty tractors in multi-purpose facilities, where diverse load profiles are common.

Light-duty tow tractors are expected to grow the fastest, likely to exhibit a 6.8% CAGR through 2033, propelled by the surge of urban logistics and small distribution platforms. Companies such as Ocado Solutions and JD Logistics have accelerated the deployment of light-duty electric towing units in automated retail distribution clusters to improve turnover rates. Expansion of city-centric fulfillment centers, especially in the Asia Pacific and Western Europe, has elevated the need for compact, energy-efficient tractors capable of frequent short-distance moves. Lower maintenance and reduced energy consumption reinforce their attractiveness for cost-focused operators.

Airports are set to remain the dominant application with nearly 35% share in 2026, underpinned by consistent demand for baggage towing, cargo dollies, and ground support operations. Major ground handling operators such as Swissport International and Menzies Aviation have committed to modernizing their fleets with electric tow tractors in support of airport sustainability goals. Programs at hubs such as Changi Airport and Heathrow Airport have phased in low-emission towing equipment tied to ambitious net-zero timelines, making tow tractors a focal point of operational green strategies.

Warehousing & distribution centers are slated to be the fastest-growing application segment, with a 7.0% CAGR from 2026 to 2033, as e-commerce and third-party logistics expand. Prominent logistics operators such as FedEx Ground, UPS Supply Chain Solutions, and Rakuten Logistics are rolling out smart towing fleets equipped with telematics for real-time data and predictive maintenance. Investment by e-commerce leaders in sprawling fulfillment campuses, such as Amazon’s expansion in Central and South Asia, has intensified the demand for internal transport solutions that minimize downtime and improve order throughput. The integration of advanced fleet management systems further supports this rapid adoption trend.

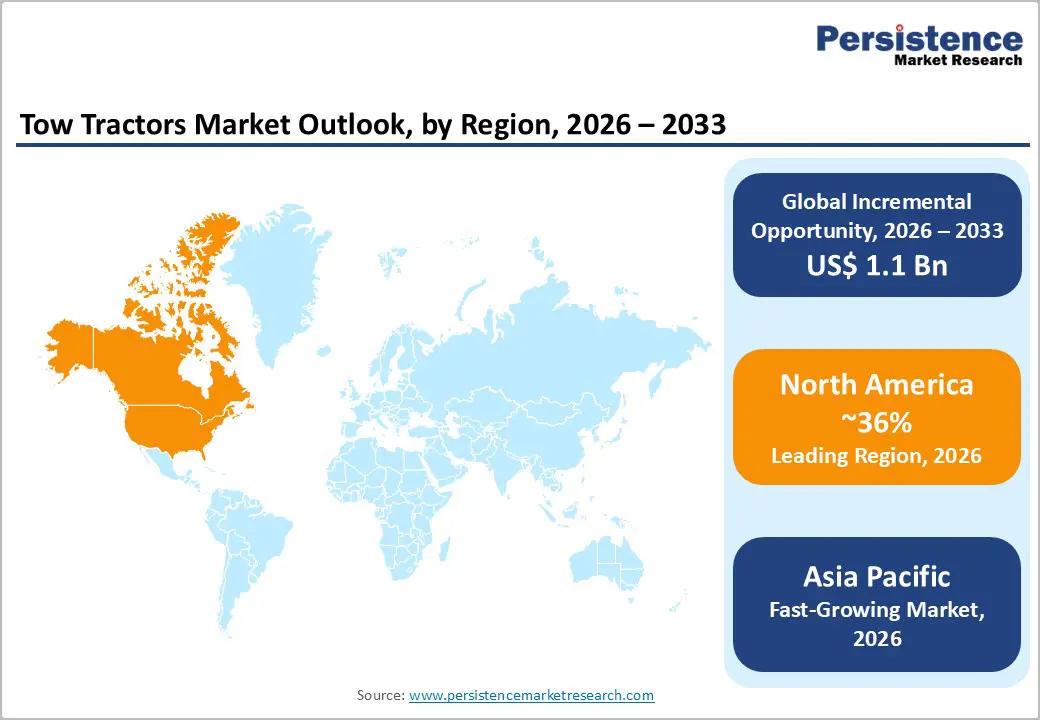

North America is poised to account for about 34% of the tow tractors market share in 2026, supported by advanced logistics infrastructure and early adoption of electric material handling equipment. The U.S. dominates regional demand, driven by large-scale warehouse automation, airport modernization programs, and strict emissions norms. Federal initiatives promoting electrification of ground support equipment at major airports such as LAX, JFK, and Dallas–Fort Worth continue to accelerate fleet upgrades. A strong domestic OEM base, including Toyota Material Handling and Crown Equipment, ensures product availability, customization, and aftersales support. High e-commerce penetration sustains consistent replacement and expansion demand.

Market growth in North America is reinforced by rapid adoption of connected and telematics-enabled tow tractors, particularly across automated distribution centers operated by major retailers and logistics providers. OSHA safety standards and corporate sustainability mandates are influencing equipment choices toward electric and ergonomically optimized models. Continued investments in charging infrastructure and smart warehouses are supporting fleet electrification. While the region is mature, it continues to expand steadily, supported by technology upgrades rather than capacity additions.

The Europe tow tractors market is strongly influenced by European Union (EU)-wide decarbonization policies, emissions reduction targets, and sustainability initiatives. Countries such as Germany, the UK, France, and Spain lead adoption, supported by dense logistics networks, industrial clusters, and major ports. The EU Green Deal and national incentive programs have accelerated the transition from diesel to electric tow tractors. Airports such as Heathrow, Frankfurt, and Schiphol are actively upgrading their ground handling fleets to meet net-zero and sustainability commitments. Medium- and heavy-duty tractors are widely used in large-scale logistics operations and manufacturing facilities due to their versatility and capacity.

Regional market momentum is further driven by investments in automation, port expansion, and sustainable intralogistics solutions, particularly in Western Europe. Leading European OEMs, including Jungheinrich and KION Group, focus on energy-efficient designs, ergonomic improvements, and integration with warehouse management systems. Operators are increasingly adopting retrofit electrification programs and lifecycle service contracts to optimize cost and maximize uptime. Regulatory frameworks, combined with sustainability mandates, remain the primary driver for fleet modernization, supporting the continued deployment of electric and hybrid tow tractors across the region.

Asia Pacific is projected to be the fastest-growing regional market for tow tractors, expanding at an estimated 2026-2033 CAGR of 7.2%, on the back of rapid industrialization and logistics infrastructure development. The region accounted for a notable share, with strong momentum in China, Japan, India, and Southeast Asia. China’s manufacturing scale and warehouse automation investments are driving high demand for electric tow tractors, while Japan continues to adopt advanced, energy-efficient intralogistics solutions. India’s expansion of e-commerce fulfillment hubs and airport infrastructure is accelerating fleet additions across light- and medium-duty segments.

The tow tractors market growth in the region is further reinforced by rising third-party logistics activity, port modernization, and foreign direct investment (FDI) into large logistics parks across Vietnam, Indonesia, and Thailand. Governments across the region are tightening industrial safety and emissions standards, indirectly supporting electric tow tractor adoption. Global OEMs are expanding local production and service networks to remain cost-competitive, while domestic manufacturers focus on value-driven offerings. Asia Pacific’s strong pipeline of greenfield warehouses and smart logistics zones positions it as the primary growth engine of the market over the next decade.

The global tow tractors market structure has remained moderately consolidated, with Toyota Material Handling, Crown Equipment, Jungheinrich, KION Group, and Hyster-Yale continuing to lead through broad distribution reach, strong service coverage, and large fleet deployments across airports, warehouses, and industrial sites. These suppliers have been strengthening differentiation by investing in research and development (R&D) for electric platforms, autonomous operation, and telematics that support data-driven fleet decisions. Buyers have been favoring vendors that are pairing equipment uptime with lifecycle support, because towing fleets are directly affecting dock flow, baggage handling, and production logistics continuity. Emissions and safety compliance requirements have also been reinforcing adoption of newer models, especially where operators are tightening internal ESG targets alongside regulatory expectations.

Regional competitors such as Raymond, UniCarriers, and Hyundai Heavy Industries have been targeting niche use cases and value-oriented specifications to win share in cost-sensitive tenders. New entrants have been facing high capital requirements and complex integration demands, particularly when customers are connecting vehicles into warehouse management system (WMS) workflows and centralized maintenance planning. Consolidation has been continuing through acquisitions, partnerships, and technology collaborations, with a clear focus on fleet electrification and digital management capabilities. To protect total cost of ownership, companies are increasingly validating charging infrastructure readiness, operator training, and service-level agreements before committing, and by 2033 they will have favored suppliers that can deliver both equipment and measurable productivity outcomes.

Key Industry Developments

The global tow tractors market is projected to reach approximately US$ 2.6 billion in 2026.

Leading growth drivers include rapid warehouse and airport modernization, growing e-commerce and 3PL networks, adoption of electric and autonomous towing fleets, and regulatory mandates for low-emission equipment.

The market is poised to witness a CAGR of 5.2% from 2026 to 2033.

The opportunities exist in emerging markets, fleet electrification, aftermarket services, predictive maintenance solutions, and customization for sector-specific needs across logistics, airports, and industrial operations.

Toyota Material Handling, Crown Equipment, Jungheinrich, KION Group, Hyster-Yale, Raymond, UniCarriers, and Hyundai Heavy Industries are leading players globally, offering innovative, electric, and autonomous towing solutions.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Load Capacity

By Application

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author