ID: PMRREP32945| 196 Pages | 16 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

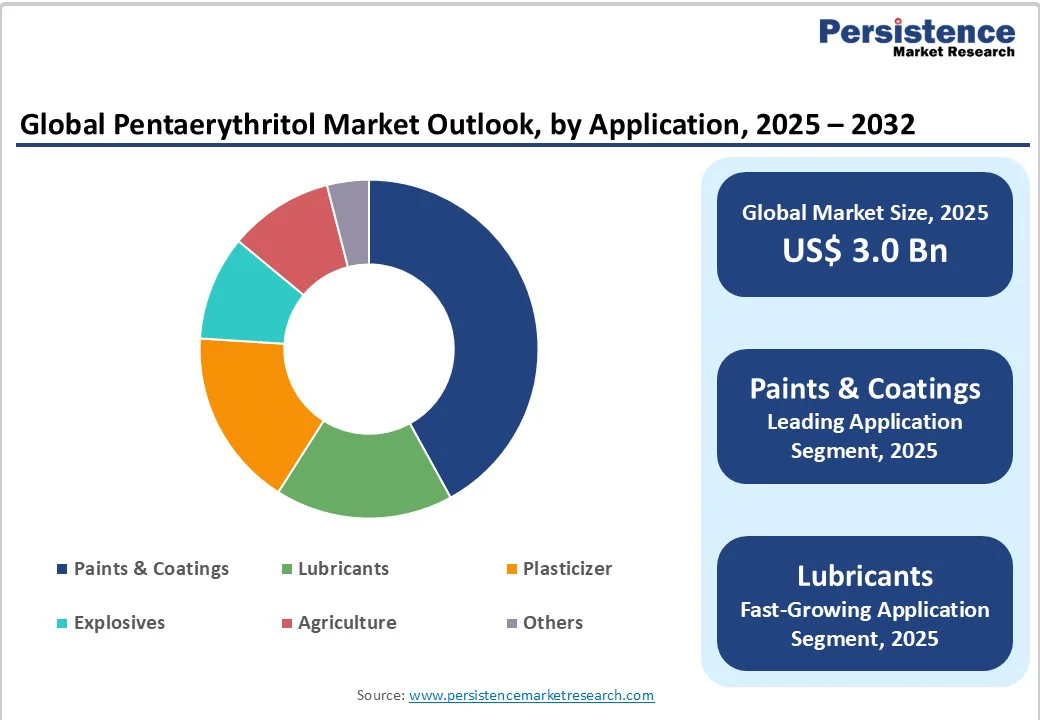

The global pentaerythritol market size is likely to be valued US$3.0 Billion in 2025, estimated to US$37.4 Billion by 2032, growing at a CAGR of 43.4% during the forecast period from 2025 to 2032. The pentaerythritol market is experiencing robust growth driven by the increasing demand for polyols in coatings, rising application in explosives and lubricants, and advancements in chemical synthesis. The need for high-performance additives, particularly in paints & coatings, has significantly boosted the adoption of polyol across various industries. The market is further propelled by innovations in mono and di-pentaerythritol grades, catering to preferences for versatile and durable options. The growing acceptance of polyol as a key intermediate in agriculture and plasticizers, particularly in emerging markets, is a key growth factor.

| Key Insights | Details |

|---|---|

| Pentaerythritol Market Size (2025E) | US$3.0 Bn |

| Market Value Forecast (2032F) | US$37.4 Bn |

| Projected Growth (CAGR 2025 to 2032) | 43.4% |

| Historical Market Growth (CAGR 2019 to 2024) | 43% |

The rising demand for polyols in coatings and the growing application in explosives and lubricants are primary drivers of the pentaerythritol market. Pentaerythritol-based polyols are widely utilized in alkyd paints, varnishes, and resins due to their superior resistance to UV radiation, chemicals, and water, ensuring durability and glossy finishes. This makes them ideal for industrial, automotive, and construction coatings, where performance and longevity are critical. The ongoing shift toward eco-friendly and low-VOC coatings further boosts polyol demand as it serves as a sustainable alternative in formulation.

Pentaerythritol’s chemical stability and high energy content make it suitable for manufacturing explosives such as pentaerythritol tetranitrate (PETN), which is used in mining, defense, and demolition applications. Its role in producing synthetic lubricants, particularly esters, enhances lubricity, thermal stability, and biodegradability, making it a preferred component in environmentally responsible lubrication solutions. As industries prioritize high-performance materials with reduced environmental impact, the dual-use of polyol across coatings, lubricants, and explosives significantly strengthens its global market outlook.

The high costs associated with development and sourcing of polyol pose a significant restraint on market growth. The production process involves multiple stages such as aldehyde condensation and formaldehyde reactions, requiring high-purity raw materials such as acetaldehyde and formaldehyde. Fluctuations in the prices of these feedstocks, driven by volatility in crude oil markets and global supply chain disruptions, directly impact overall production costs. In addition, the manufacturing process demands precise temperature control, catalysts, and advanced equipment, further increasing operational expenses.

Developing high-grade or specialty polyol derivatives, such as dipentaerythritol and tripentaerythritol, requires substantial R&D investment to achieve desired purity and performance standards for applications in coatings, lubricants, and explosives. Compliance with stringent environmental regulations on emissions and waste disposal also adds to production costs, especially in developed economies. Smaller manufacturers often struggle to compete due to limited capital for innovation and cost optimization.

Advancements in bio-derived and high-functionality polyols present significant growth opportunities for the Pentaerythritol Market. With growing environmental concerns and stricter sustainability regulations, manufacturers are shifting toward renewable feedstocks such as plant-derived glycerol and bio-based aldehydes. These innovations reduce dependency on petroleum-based raw materials and lower carbon footprints while maintaining comparable or superior performance characteristics. Bio-based polyols derived from polyol are increasingly used in producing eco-friendly coatings, lubricants, and resins with excellent mechanical strength, adhesion, and weather resistance.

The development of high-functionality polyols has enhanced the versatility of polyol derivatives in advanced applications. These polyols offer greater crosslinking density and improved heat and chemical resistance, making them ideal for high-performance coatings, energy-efficient insulation materials, and synthetic lubricants. Ongoing R&D focuses on optimizing molecular structures for enhanced reactivity, durability, and biodegradability.

Mono-Pentaerythritol dominates the market, accounting for 60% of the share in 2025. Its dominance is driven by purity, cost-effectiveness, and versatility, making it preferred for paints. Mono-pentaerythritol, such as those from Ercros SA, provides consistent reactivity, ensuring compatibility. Its simplicity and yield make it preferred for manufacturers.

Di-Pentaerythritol is the fastest-growing segment, driven by cross-linking strength and increasing adoption in lubricants. Di-pentaerythritol offers viscosity control, appealing for high-load. Focus on specialty innovation accelerates adoption in North America and Europe.

Paints & Coatings leads the market, holding 40% share in 2025, driven by its essential role in alkyd resin formulations. Its superior adhesion, gloss, and chemical resistance make it ideal for industrial, automotive, and construction applications. Rising demand for durable, eco-friendly coatings continues to strengthen its market leadership globally.

Lubricants is the fastest-growing segment, fueled by increasing demand for high-performance, anti-wear formulations in automotive and industrial engines. Their superior thermal stability, oxidation resistance, and biodegradability enhance efficiency and longevity of machinery.

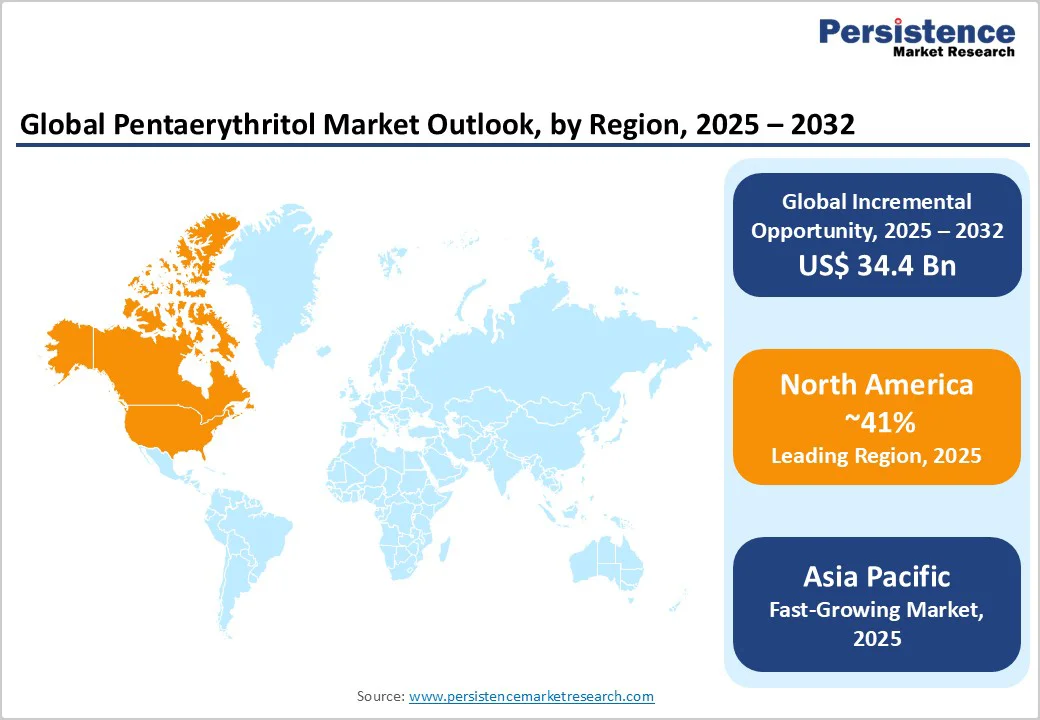

North America is account for nearly 41% share in 2025, driven by strong demand from established industries such as coatings, automotive, construction, and lubricants. The compound’s extensive use in alkyd resin formulations enhances the performance and durability of paints, varnishes, and surface coatings, supporting high-quality applications across the U.S. and Canada.

Rising consumption of synthetic lubricants in the automotive and industrial sectors boosts market expansion due to polyol’s superior stability, oxidation resistance, and eco-friendly nature. The region’s focus on sustainable manufacturing and the transition toward bio-based polyols further strengthen its market position. Advanced R&D infrastructure and stringent quality standards encourage innovation in high-purity derivatives, ensuring product consistency and performance.

Europe is accounting 18% share in 2025, driven by performance-chemistry applications and sustainability trends. In 2023, the region held approximately 18.4% of the global market. Growth is anchored in key end-use industries high-performance coatings, automotive lubricants, and bio-based materials. Under the European Green Deal and strict regulatory frameworks, demand for low-VOC resins and eco-friendly polyols is rising polyol derivatives fit well into this shift.

Energy and feedstock cost pressures loom large: industrial electricity prices in Europe rose by around 18% in 2022-23, increasing production cost burdens. Supply chain disruptions and weak construction activity have temporarily weighed on demand.

Asia Pacific is the fastest-growing market, hold 25% share in 2025, rapid industrialization, urbanization, and infrastructure expansion. Key economies such as China, India and Southeast Asian nations are driving demand for paints & coatings, automotive lubricants and specialty resins, all of which rely on polyol derivatives for enhanced performance. In particular, the construction boom in the region has raised demand for durable, weather-resistant coatings capitalizing on polyol’s compatibility with alkyd resins and powder coatings. The automotive sector’s expansion, including increased vehicle production and aftermarket activities, supports uptake in synthetic lubricants and polyol intermediates derived from polyol. Competitive advantages in Asia Pacific such as lower production costs, availability of feedstocks, and favourable government policies further lift the region’s appeal for manufacturers.

The global pentaerythritol market is highly competitive, mix of chemical leaders and specialists. In developed regions such as North America and Europe, companies such as Celanese Corporation and Perstorp dominate through strong R&D capabilities, advanced production technologies, and well-established distribution networks. Their focus on innovation, high-quality derivatives, and sustainable formulations strengthens their competitive positioning. In the Asia Pacific, players such as U-Jin Chemical and other local producers leverage cost-effective manufacturing, access to raw materials, and proximity to growing end-user industries SUCH construction, coatings, and automotive to expand their footprint.

The competitive landscape is further intensified by rising emphasis on bio-based and environmentally friendly technologies, prompting companies to invest in cleaner production processes and renewable feedstocks. Strategic initiatives such as mergers, acquisitions, and long-term partnerships are becoming central to enhancing global presence and product diversification.

Key Developments

The global Pentaerythritol Market is projected to reach US$3.0 Billion in 2025.

The rising demand for polyols in coatings and rising application in explosives and lubricants are key drivers.

The market is poised to witness a CAGR of 43.4% from 2025 to 2032.

Advancements in bio-based and high-functionality polyols are key opportunities.

Mitsui Chemicals Inc., Celanese Corp, Perstorp, Ercros SA, and Henan Pengcheng Group are key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 – 2024 |

| Forecast Period | 2025 – 2032 |

| Market Analysis | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author