ID: PMRREP32872| 299 Pages | 5 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

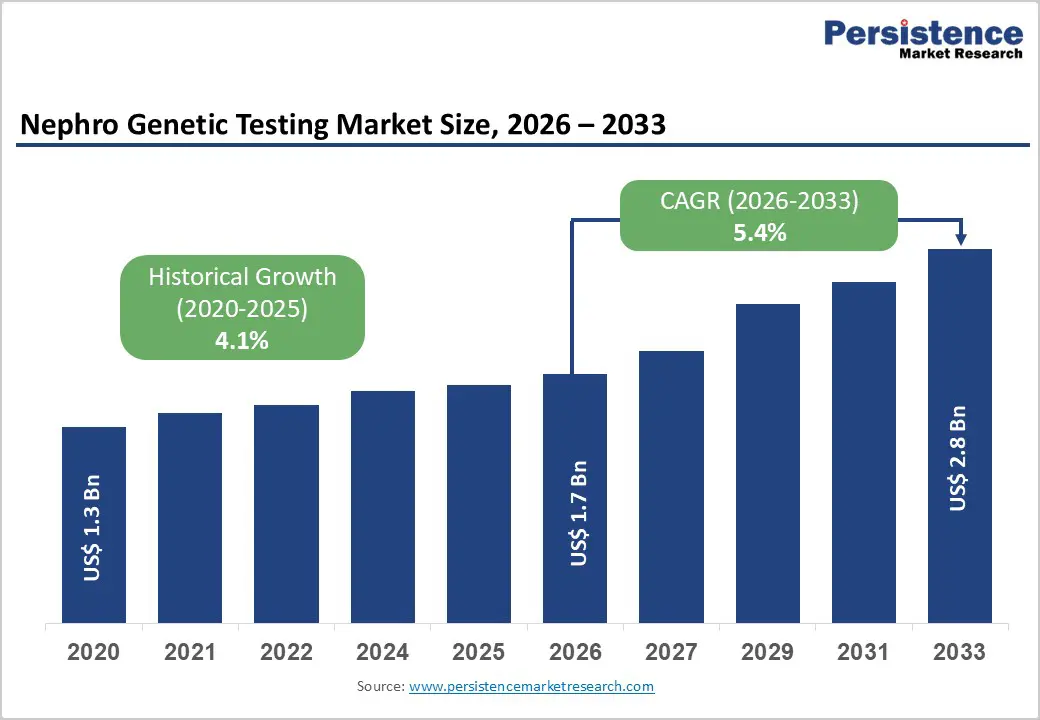

The global nephro genetic testing market size is estimated to grow from US$ 1.7 Bn in 2026 to US$ 2.8 Bn by 2033. The market is projected to record a CAGR of 5.4% during the forecast period from 2026 to 2033.

Global demand for nephro genetic testing is rising steadily, driven by the increasing prevalence of inherited kidney disorders, including polycystic kidney disease, Alport syndrome, congenital anomalies of the kidney and urinary tract (CAKUT), nephronophthisis, hereditary glomerulopathies, and syndromic renal conditions associated with systemic genetic abnormalities. The growing burden of rare genetic kidney diseases, combined with improved survival rates and longer life expectancy among pediatric and adult patients, is increasing long-term needs for diagnosis, prognostication, and disease monitoring. Expanding newborn and pediatric screening initiatives, improved access to molecular diagnostics, and rising awareness among nephrologists and genetic specialists are supporting sustained testing volumes. Rapid advances in genomic technologies particularly next-generation sequencing (NGS), whole-exome sequencing (WES), and whole-genome sequencing (WGS) are improving diagnostic accuracy, reducing turnaround times, and enabling earlier disease identification. Increasing integration of genetic testing into precision nephrology workflows, along with rising healthcare investments in specialized diagnostic laboratories and tertiary renal care centers, is accelerating global adoption. Concurrently, ongoing research into novel gene–phenotype correlations and renal disease pathways continues to reinforce long-term market expansion across both developed and emerging regions.

| Key Insights | Details |

|---|---|

| Nephro Genetic Testing Market Size (2026E) | US$1.7 Bn |

| Market Value Forecast (2033F) | US$2.8 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.4% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.1% |

Driver – Rising Prevalence of Inherited Kidney Disorders and Advancements in Genomic Technologies Driving Market Growth

The increasing global prevalence of inherited kidney disorders is a major driver accelerating demand for nephro genetic testing. Conditions such as Alport syndrome, autosomal dominant and recessive polycystic kidney disease (ADPKD/ARPKD), congenital anomalies of the kidney and urinary tract (CAKUT), nephronophthisis, and genetically linked glomerular diseases are being diagnosed with greater frequency across pediatric and adult populations. Improved awareness among nephrologists, expanded referral pathways, and better survival rates among patients with chronic kidney disease are contributing to a growing population requiring precise genetic diagnosis. Many inherited renal disorders present with overlapping clinical features, variable progression, and nonspecific laboratory findings, making molecular confirmation critical for accurate diagnosis, prognosis determination, and treatment planning.

Advancements in genomic technologies are significantly strengthening market growth. Rapid evolution of next-generation sequencing (NGS), whole exome sequencing (WES), and targeted gene panels has improved diagnostic yield while reducing turnaround times and testing costs. These technologies enable efficient identification of pathogenic variants across genetically heterogeneous kidney diseases. Integration of genomic testing into routine nephrology practice supports early disease detection, informed therapeutic decisions, transplant planning, and family screening. Collectively, increasing disease burden and continuous innovation in genomic diagnostics are driving sustained expansion of the global nephro genetic testing market.

Restraints – High Testing Costs and Limited Access to Specialized Genetic Infrastructure Restricting Market Adoption

High costs associated with nephro genetic testing remain a key restraint limiting broader market adoption, particularly in low- and middle-income regions. While sequencing costs have declined, significant expenses related to advanced laboratory infrastructure, sequencing platforms, bioinformatics pipelines, data storage, and confirmatory variant analysis continue to pose barriers. Comprehensive testing approaches such as WES and WGS incur additional costs for interpretation, variant classification, and longitudinal data management, making them less accessible for routine clinical use in resource-constrained settings. Limited reimbursement coverage and inconsistent payer policies across regions further restrict patient access, often delaying diagnosis and clinical intervention.

In addition to economic barriers, limited availability of specialized genetic expertise constrains effective market penetration. Shortages of trained clinical geneticists, nephrogenetic specialists, and genetic counselors hinder appropriate test selection, interpretation, and post-test counseling. In many emerging markets, fragmented healthcare systems and uneven diagnostic infrastructure result in delayed referrals and underutilization of genetic testing. Variability in testing standards, reporting frameworks, and follow-up protocols also impacts clinician confidence and adoption rates. These structural, financial, and workforce-related challenges continue to restrain the full clinical integration of nephro genetic testing despite its growing recognized value.

Opportunity – Expansion of Precision Nephrology and Early Diagnostic Programs Creating New Growth Avenues

The expanding adoption of precision nephrology presents a significant growth opportunity for the global nephro genetic testing market. Increasing emphasis on early and accurate diagnosis of inherited kidney disorders is driving integration of genetic testing into nephrology care pathways. Governments and healthcare systems are progressively recognizing the value of genetic diagnostics in improving disease stratification, slowing disease progression, and optimizing treatment decisions. Advances in high-throughput sequencing, automation, and cost-efficient testing workflows are making broader implementation more feasible, particularly within tertiary care hospitals and specialized renal centers.

Early diagnostic initiatives, including pediatric screening and family-based cascade testing, are gaining traction as tools to reduce long-term disease burden and healthcare costs. Genetic insights are increasingly guiding eligibility for emerging targeted therapies, clinical trials, and gene-based interventions in nephrology. Furthermore, growing investment in rare disease research, transplant genomics, and personalized medicine is expanding demand across both clinical and research settings. Strategic collaborations between diagnostic laboratories, academic institutions, and biotechnology companies are enhancing test availability and innovation. As precision nephrology continues to evolve globally, demand for accurate, scalable, and clinically actionable genetic testing is expected to grow significantly, supporting long term market expansion.

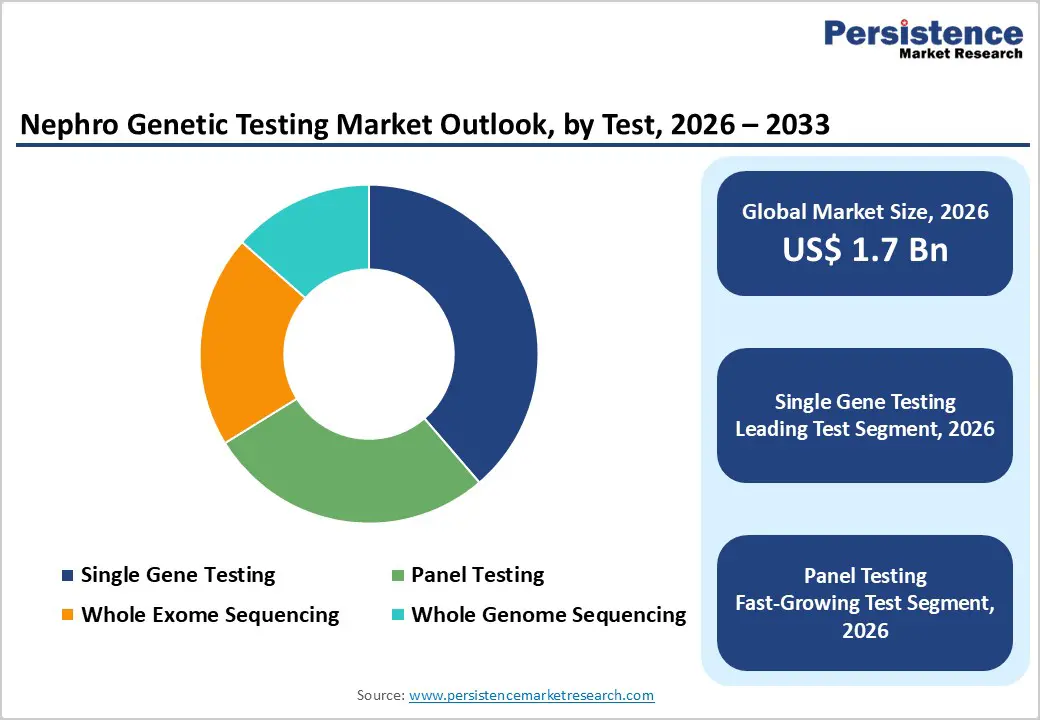

By Test Type, Single Gene Testing Maintains Leadership Due to Clinical Precision and Cost Advantages

The single gene testing segment is projected to lead the global nephro genetic testing market in 2026, accounting for a revenue share of 38.7%. Segment dominance is driven by the effectiveness of targeted genetic assays in identifying well-characterized monogenic kidney disorders such as Alport syndrome, autosomal dominant polycystic kidney disease (ADPKD), congenital nephrotic syndrome, and familial hematuria. Single gene testing offers high diagnostic accuracy, faster turnaround times, and lower costs compared to broader sequencing approaches, making it well suited for first-line diagnostics and confirmatory testing. Clinicians frequently adopt this approach when clinical presentation strongly suggests a specific inherited renal condition. Established testing protocols, increasing physician familiarity, and compatibility with routine laboratory workflows further support adoption. While panel testing and whole exome sequencing are increasingly used for complex or atypical cases, single gene testing remains a cornerstone in nephrology diagnostics due to its simplicity, affordability, and clinical reliability.

By Application, Chronic Kidney Disease Dominates Driven by High Genetic Burden and Diagnostic Demand

The chronic kidney disease (CKD) segment is expected to dominate the global nephro genetic testing market in 2026, accounting for a revenue share of 41.2%. This leadership reflects the growing recognition of genetic contributors to CKD, particularly in early-onset, familial, and treatment-resistant cases. Inherited conditions such as Alport syndrome, nephronophthisis, focal segmental glomerulosclerosis (FSGS), and cystic kidney diseases contribute significantly to CKD burden worldwide. Genetic testing plays a critical role in differentiating inherited CKD from acquired forms, enabling accurate diagnosis, prognostication, and personalized treatment planning. Increasing referrals from nephrologists, pediatricians, and transplant specialists are driving testing volumes in this segment. Moreover, genetic confirmation is increasingly required for eligibility in clinical trials and emerging targeted therapies. As precision nephrology advances and awareness of inherited CKD grows, demand for genetic testing within this application segment is expected to remain strong, reinforcing its dominant market position.

By End User, Hospitals Lead Due to Integrated Care Delivery and High Diagnostic Volumes

The hospitals segment is projected to hold the largest share of the global nephro genetic testing market in 2026, with a revenue contribution of 44.5%. Hospitals serve as primary referral centers for the diagnosis and long-term management of inherited kidney disorders, offering integrated access to nephrology, medical genetics, pediatrics, and transplant services. Advanced diagnostic infrastructure, availability of multidisciplinary expertise, and access to high-throughput sequencing technologies enable hospitals to manage complex genetic renal cases efficiently. High inpatient and outpatient volumes, combined with increasing adoption of in-house and affiliated genetic testing services, support segment leadership. Hospitals also play a central role in pediatric nephrology, newborn screening follow-up, and evaluation of unexplained CKD cases. Additionally, academic and tertiary hospitals frequently participate in rare disease research, registries, and clinical trials, further driving demand for genetic diagnostics. Ongoing investments in hospital-based genomics programs continue to strengthen this segment’s market dominance.

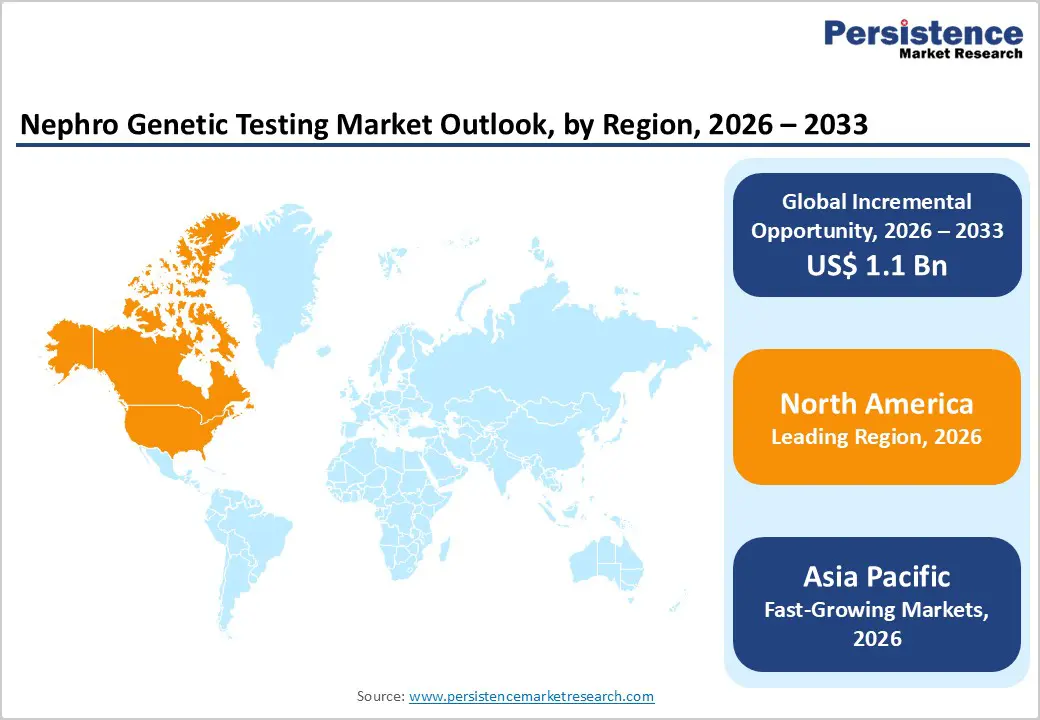

North America Nephro Genetic Testing Market Trends

The North America nephro genetic testing market is expected to dominate globally, accounting for a value share of 47.7% in 2026, led primarily by the United States. The region benefits from a highly developed healthcare ecosystem with strong integration of genetic testing into routine nephrology practice. Widespread access to advanced molecular diagnostic technologies, coupled with high awareness of inherited kidney disorders among clinicians, supports early diagnosis and sustained testing volumes. Favorable reimbursement frameworks and established payer coverage facilitate adoption of single gene tests, panel testing, and advanced sequencing approaches such as whole exome and whole genome sequencing.

North America also hosts a dense network of reference laboratories, academic medical centers, and biotechnology companies actively engaged in renal genetics research. High participation in clinical trials for rare kidney diseases and emerging precision therapies further drives demand for accurate genetic diagnostics. Regulatory clarity, standardized testing guidelines, and continued investment in precision medicine initiatives reinforce the region’s leadership position.

Europe Nephro Genetic Testing Market Trends

The Europe nephro genetic testing market is expected to experience steady growth, supported by increasing recognition of inherited kidney diseases and a strong emphasis on early diagnosis and long-term disease management. Countries such as Germany, the United Kingdom, France, Italy, and the Nordic region are major contributors due to well-established public healthcare systems and broad access to genetic testing services. Expansion of national rare disease programs and improved integration of molecular diagnostics into nephrology and pediatric care are driving consistent demand. European healthcare systems prioritize evidence-based diagnostics, encouraging the use of targeted gene testing and panel-based approaches for inherited renal disorders.

Cross-border research collaborations, harmonized regulatory frameworks, and robust funding for rare disease initiatives further support market expansion. Growing awareness among nephrologists and genetic specialists, along with increased incorporation of genomic data into clinical decision-making, is strengthening adoption. Continued investments in genomics infrastructure and digital health platforms are expected to sustain long-term market growth across the region.

Asia Pacific Nephro Genetic Testing Market Trends

The Asia Pacific nephro genetic testing market is anticipated to register the fastest growth, with a CAGR of approximately 8.6% between 2026 and 2033, driven by rapid healthcare infrastructure development and a large undiagnosed population with inherited kidney disorders. Countries including China, India, Japan, South Korea, and several Southeast Asian nations are witnessing rising diagnosis rates due to improved access to molecular diagnostics and specialized nephrology services. Expansion of diagnostic laboratories, increasing availability of trained genetic professionals, and rising healthcare expenditure are improving test accessibility across the region.

Government-led rare disease policies and newborn screening initiatives are accelerating adoption of genetic testing. In addition, partnerships between regional laboratories and global diagnostic companies are enhancing technology transfer and local testing capabilities. Growing awareness of inherited kidney diseases and increasing focus on early intervention and precision nephrology are expected to sustain strong growth across Asia Pacific in the coming years.

The global nephro genetic testing market is highly competitive, with key players such as Illumina, Inc., Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd., QIAGEN N.V., and Agilent Technologies, Inc. leveraging advanced sequencing platforms, comprehensive renal gene testing portfolios, and strong global laboratory networks to sustain market presence. These companies emphasize expanding nephrology-specific gene panels, enhancing bioinformatics interpretation for inherited kidney disorders, and reducing turnaround times to improve clinical decision-making and physician adoption.

Competition is further intensified by ongoing investments in research collaborations, participation in rare renal disease and precision nephrology initiatives, and geographic expansion into emerging markets. Continuous innovation in next-generation sequencing, automation, and data analytics is reinforcing differentiation, supporting sustained market growth and long-term market evolution.

The global nephro genetic testing market is projected to be valued at US$ 1.7 Bn in 2026.

Increasing prevalence of hereditary eye disorders and technological advancements in genetic testing that enable early, precise diagnosis and personalized ophthalmic care.

The global nephro genetic testing market is poised to witness a CAGR of 5.4% between 2026 and 2033.

Expansion of advanced sequencing technologies and AI-enhanced genetic interpretation that broaden diagnostic scope and clinical utility.

Illumina, Inc., Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd., QIAGEN N.V., and Agilent Technologies, Inc. are some of the key players in the nephro genetic testing market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Test Type

By Application

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author