ID: PMRREP30169| 260 Pages | 12 Jan 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

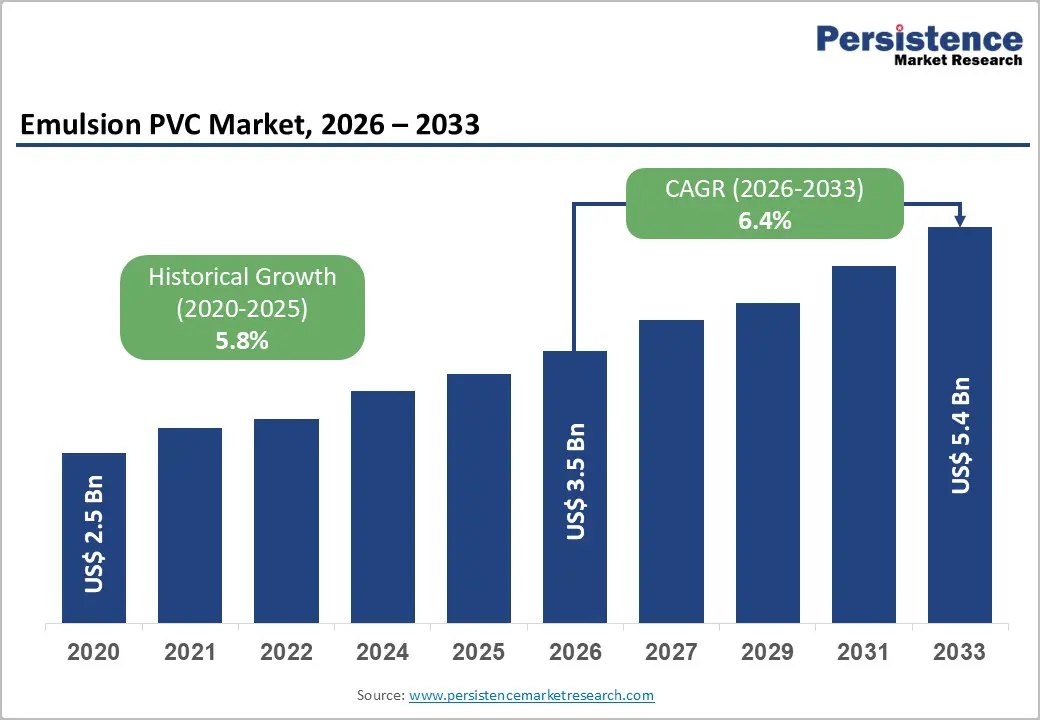

The global emulsion PVC market size is likely to be valued at US$3.5 billion in 2026 and is expected to reach US$5.4 billion by 2033, growing at a CAGR of 6.4% during the forecast period from 2026 to 2033, driven by increasing demand from the construction and automotive sectors, where emulsion PVC is widely used in coatings, adhesives, sealants, synthetic leather, and flooring applications due to its durability, flexibility, chemical resistance, and cost-effectiveness. Rapid urbanization and infrastructure development in emerging economies, particularly in Asia Pacific, are fueling consumption in building materials, paints, and flooring. Eco-friendly, water-based, and low-VOC formulations are encouraging the adoption of emulsion PVC in paints, coatings, textiles, and paper applications, meeting environmental regulations and consumer preferences.

| Report Attribute | Details |

|---|---|

|

Emulsion PVC Market Size (2026E) |

US$3.5 Bn |

|

Market Value Forecast (2033F) |

US$5.4 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

6.4% |

|

Historical Market Growth (CAGR 2020 to 2025) |

5.8% |

Expansion in Building and Construction Activities

Emulsion PVC is widely used in flooring, wall coverings, sealants, adhesives, coatings, and synthetic leather applications, offering superior durability, flexibility, moisture resistance, and chemical stability. The water-based and low-VOC formulations meet stringent environmental and sustainability regulations, making it a preferred material for residential, commercial, and industrial construction projects. The ongoing development of smart cities, commercial complexes, highways, bridges, and renovation projects has created significant demand for cost-effective and high-performance construction materials. Modern architectural trends, such as decorative finishes and interior designs requiring flexible and long-lasting materials, have further boosted emulsion PVC adoption.

Large-scale infrastructure initiatives, including highways, bridges, airports, and commercial complexes, are significantly boosting demand for high-quality construction materials. Emulsion PVC’s versatility across multiple applications, from wall coatings and adhesives to synthetic leather for interiors, enables manufacturers to cater to diverse construction needs efficiently. Governmental policies supporting smart city projects, urban housing developments, and public infrastructure improvements in emerging economies are expanding market opportunities. Manufacturers are increasingly investing in customized formulations, targeting durability, environmental compliance, and enhanced performance to meet the specific requirements of construction projects.

High Energy and Production Costs

The manufacturing process of emulsion PVC is energy-intensive, requiring substantial electricity and thermal energy to maintain precise polymerization conditions, temperature control, and drying processes. The production involves costly chemical additives and stabilizers, which escalate operational expenses. These high input costs can affect pricing competitiveness, particularly in regions where energy prices are volatile or manufacturing efficiency is lower. Smaller manufacturers in emerging markets often face challenges in maintaining economies of scale, limiting their ability to compete with established players. Fluctuations in energy costs or raw material availability can directly impact profit margins.

High production costs can restrict investment in research and development and limit capacity expansion for specialty emulsion PVC grades. Manufacturers striving to develop advanced low-VOC, eco-friendly, or high-performance formulations may face budget constraints due to elevated energy and operational expenditures. The cost-intensive nature of the process also affects the ability to scale production to meet growing demand in high-growth regions such as Asia Pacific. Environmental compliance measures, such as emission controls and waste treatment, increase operational costs. These high costs can slow the introduction of innovative products for automotive interiors, coatings, and adhesives applications, limiting market responsiveness.

Development of Sustainable and Bio-Based Variants

Increasing regulatory pressure and consumer awareness regarding volatile organic compounds (VOCs), plasticizers, and other harmful additives have pushed manufacturers to explore eco-friendly alternatives. Bio-based and sustainable emulsion PVC formulations, including water-based, low-VOC, and phthalate-free variants, are emerging as key solutions that meet stringent environmental standards. These variants not only reduce the environmental footprint but also align with the global trend toward green construction, eco-friendly packaging, and sustainable automotive interiors. The ability to produce high-performance PVC emulsions with lower ecological impact allows manufacturers to cater to environmentally conscious clients across building and construction, automotive, textiles, coatings, and adhesive applications.

The development of bio-based emulsion PVC products creates opportunities for innovation and differentiation within the competitive landscape. Manufacturers investing in sustainable formulations can target niche applications requiring environmentally compliant materials, such as residential interiors, industrial coatings, and synthetic leather products for the automotive and furniture industries. These products not only fulfill consumer demand for safer, greener alternatives but also help companies comply with regional regulations in North America, Europe, and Asia Pacific. Bio-based variants can improve process efficiency, reduce dependency on petrochemical feedstock, and support circular economy initiatives, strengthening long-term market resilience.

Application Type Insights

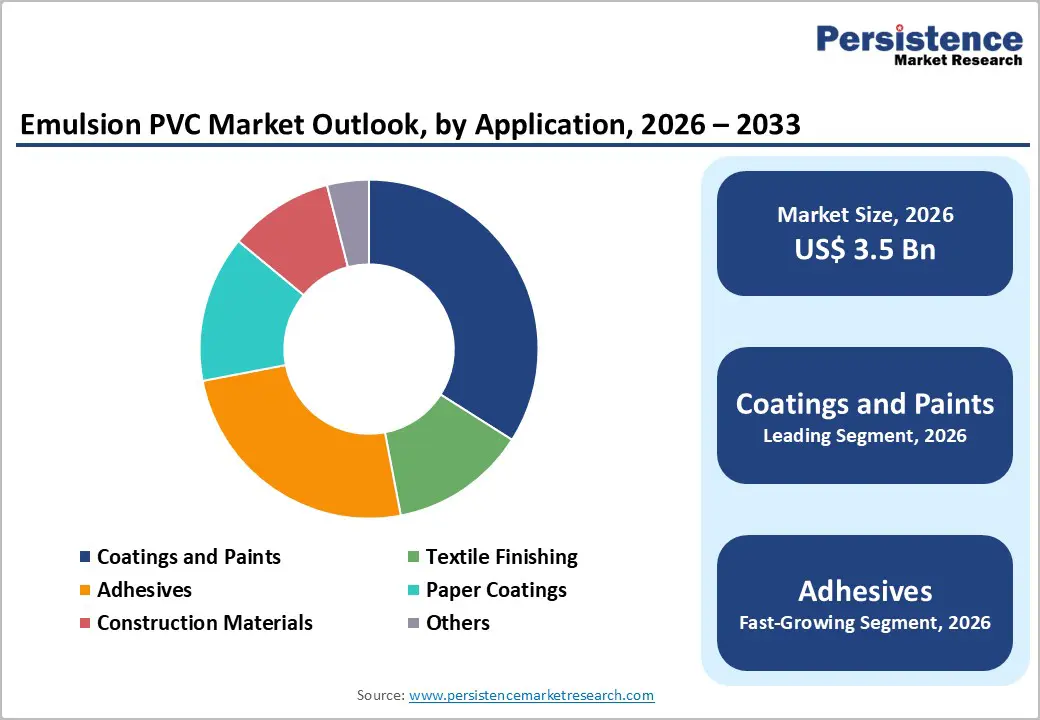

The coatings and paints segment is expected to lead the emulsion PVC market, accounting for approximately 40% of the total revenue in 2026, driven by its extensive use in architectural and industrial applications. Emulsion PVC is highly preferred in coatings due to its excellent film-forming properties, flexibility, moisture resistance, and durability, making it suitable for both interior and exterior surfaces. The growing emphasis on low-VOC and water-based formulations has strengthened demand, as regulatory bodies and end users increasingly favor environmentally compliant materials. For example, emulsion PVC is commonly used in architectural wall coatings for residential buildings, where durability and low emissions are critical performance requirements.

Adhesives are likely to represent the fastest-growing segment in 2026, driven by the shift toward water-based bonding solutions across multiple industries. Emulsion PVC adhesives offer strong adhesion, flexibility, and compatibility with diverse substrates, making them suitable for packaging, woodworking, textiles, and construction applications. Regulatory pressure to reduce solvent-based adhesive usage has accelerated the adoption of emulsion PVC formulations that meet environmental and workplace safety standards. For example, in the woodworking industry, emulsion PVC-based adhesives are increasingly used for laminating panels and furniture components, benefiting from their water-based nature and compliance with emission regulations, which supports the rapid growth of this application segment.

End-user Insights

The building and construction industry is projected to lead the market, capturing around 40% of the total revenue share in 2026, driven by widespread utilization across structural and interior applications. Emulsion PVC is extensively used in flooring, wall coverings, sealants, coatings, and adhesives, offering durability, flexibility, and resistance to moisture and chemicals. Rapid urbanization, infrastructure development, and rising housing demand in emerging economies have significantly increased consumption, while renovation activities continue to support steady demand in mature markets. For example, vinyl flooring systems for commercial buildings, where long service life, ease of maintenance, and compliance with environmental standards are essential, reinforce the segment’s leadership.

The automotive segment is likely to be the fastest-growing end-user in 2026, driven by rising demand for lightweight, durable, and aesthetically appealing interior materials. Emulsion PVC is increasingly used in synthetic leather, interior trims, sealants, and coatings, offering flexibility, abrasion resistance, and improved surface finish. The shift toward electric vehicles has increased demand for lightweight interior components that enhance energy efficiency while maintaining comfort and design quality. For example, Emulsion PVC-based synthetic leather seats are widely used in electric vehicles, where lightweight construction and environmental compliance are critical, contributing to the rapid growth of the automotive segment.

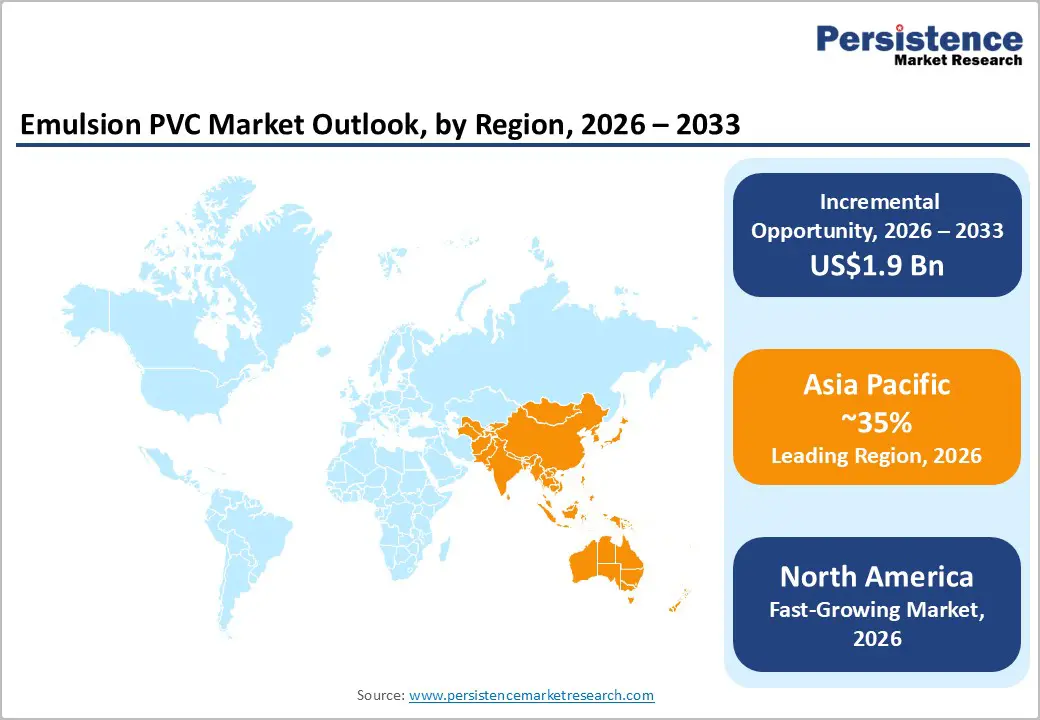

North America Emulsion PVC Market Trends

North America is likely to be the fastest-growing region in the emulsion PVC market in 2026, driven by sustained demand from construction, automotive, and industrial segments. Increasing emphasis on sustainable and low-VOC materials has shaped formulation trends, as architects, OEMs, and manufacturers seek products that comply with stringent environmental standards. In construction, emulsion PVC’s use in flooring, coatings, and sealants is rising, supported by green building initiatives and retrofit projects. The recovery in commercial construction post-pandemic has further strengthened demand, especially in urban centers where infrastructure upgrades and residential development continue.

In the automotive sector, manufacturers are increasingly specifying Emulsion PVC materials for interior applications, driven by trends in lightweighting, aesthetics, and low emissions. Technological advancements and R&D investments are the key trends, with major players focusing on high-performance and eco-friendly formulations to capture emerging opportunities. For example, Vinnolit GmbH & Co KG, with significant operations and partnerships in North America, has been advancing its portfolio of sustainable PVC solutions tailored to meet regional specifications for construction and industrial coatings, reinforcing its competitive position.

Europe Emulsion PVC Market Trends

Europe is likely to be a significant market for emulsion PVC in 2026, due to stringent environmental regulations, sustainability initiatives, and advanced manufacturing practices. Countries such as Germany, France, and the U.K. are witnessing steady growth supported by energy-efficient building programs and infrastructure upgrades. The shift toward sustainable materials has encouraged manufacturers to integrate bio-based additives and recyclable components into PVC emulsions. For example, Kem One, a major European PVC producer, is focused on developing environmentally compliant emulsion PVC grades for construction and industrial coatings, aligning its product portfolio with EU sustainability standards and reinforcing its market presence across Europe.

Technological innovation and application-specific product development are the key trends shaping the Europe emulsion PVC market. Manufacturers are increasingly investing in advanced emulsion polymerization techniques to enhance adhesion strength, surface finish, durability, and thermal performance, supporting broader adoption in coatings, textiles, and synthetic leather applications. The automotive sector remains an important growth area, particularly for interior trims, upholstery, and sealants, as OEMs seek lightweight and low-emission materials to meet regulatory and consumer expectations. Growing demand from the packaging and consumer goods industries is driving the use of high-purity and specialty PVC emulsions.

Asia Pacific Emulsion PVC Market Trends

The Asia Pacific region is anticipated to be the leading region, accounting for a market share of 35% in 2026, driven by rapid urbanization, large-scale infrastructure investments, and expanding industrial activities in key economies such as China, India, Japan, and ASEAN countries. As governments continue to prioritize smart city initiatives, transportation networks, housing development, and commercial construction projects, demand for construction-related emulsion PVC products, including flooring, wall coverings, coatings, and sealants, has surged. For example, SCG Chemicals Co. Ltd has significantly expanded its production footprint in Southeast Asia, offering advanced PVC emulsion products tailored to local construction and industrial needs, reinforcing its competitive position while addressing regional demand dynamics.

The Asia Pacific emulsion PVC market is characterized by rising technological innovation and value-added product development. Manufacturers are increasingly focusing on producing high-performance grades with enhanced adhesion, durability, chemical resistance, and aesthetic properties for use in automotive interiors, industrial coatings, and specialty adhesives. The adoption of eco-friendly and safer materials is becoming a competitive differentiator, as international OEMs and regional end-users prioritize compliance with evolving environmental standards. Foreign direct investment and strategic partnerships are enhancing local technological capabilities, leading to better market penetration and faster introduction of innovative products.

The global emulsion PVC market exhibits a moderately fragmented structure, driven by the presence of multiple regional and international manufacturers competing across products, applications, and geographic footprints. Several well-established chemical and polymer companies maintain significant influence, leveraging extensive product portfolios, strong distribution networks, and broad industrial customer bases to sustain market positions. The market features both multinational giants and regional specialists that address diverse needs in coatings, adhesives, construction materials, automotive interiors, textiles, and packaging applications.

With key leaders including Vinnolit GmbH & Co. KG, Formosa Plastics Corporation, Kem One, Mexichem (Orbia), and Solvay S.A., the competitive landscape is characterized by strategic investments in technology, capacity expansion, and sustainability initiatives. These players compete through continuous research and development to enhance performance characteristics such as adhesion, durability, and environmental compliance, as well as by expanding production facilities and entering new regional markets to capture growth opportunities.

Key Industry Developments:

The global emulsion PVC market is projected to reach US$3.5 billion in 2026.

Rising demand from construction, automotive, and coatings industries, supported by urbanization, infrastructure growth, and increasing adoption of water-based, low-VOC formulations.

The emulsion PVC market is expected to grow at a CAGR of 6.4% from 2026 to 2033.

The development of sustainable and bio-based formulations, growing construction and automotive applications in emerging economies, and rising demand for low-VOC coatings, adhesives, and synthetic leather products.

Kem One, Kaneka Corporation, Mexichem, Vinnolit GmbH & Co KG, and Nissin Chemical Co., Ltd. are the leading players.

| Report Attribute | Details |

|---|---|

|

Historical Data |

2020 – 2025 |

|

Forecast Period |

2026 – 2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Application Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author