ID: PMRREP36038| 198 Pages | 22 Jan 2026 | Format: PDF, Excel, PPT* | Packaging

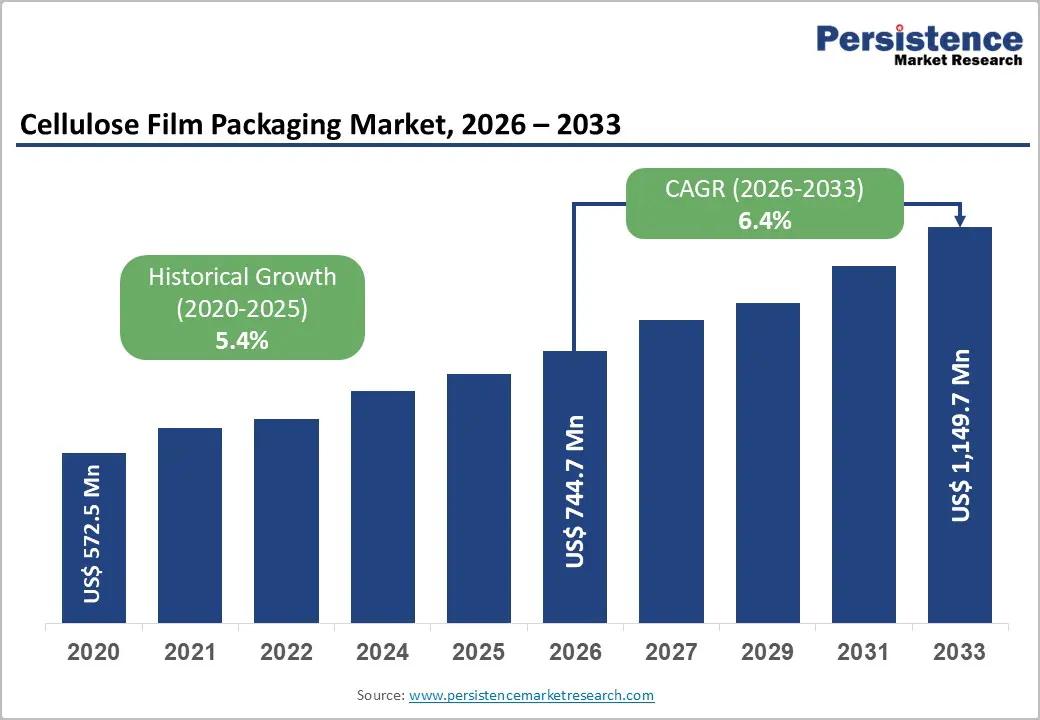

The global cellulose film packaging market is likely to be valued at US$ 744.7 million in 2026 and is expected to reach US$ 1,149.7 million by 2033, growing at a CAGR of 6.4% between 2026 and 2033, driven by rising regulatory pressure to reduce conventional plastic usage, increasing food & beverage and pharmaceutical demand for compostable and transparent flexible packaging, and manufacturing scale-up across Asia Pacific. Continuous innovation in coated cellulose films, which significantly enhances barrier performance, is accelerating substitution in perishables packaging.

| Key Insights | Details |

|---|---|

| Cellulose Film Packaging Market Size (2026E) | US$744.7 Mn |

| Market Value Forecast (2033F) | US$1,149.7 Mn |

| Projected Growth (CAGR 2026 to 2033) | 6.4% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.4% |

Governments and large consumer brands are increasingly tightening regulations on single-use plastics while implementing extended producer responsibility (EPR) frameworks and compostability mandates. These regulatory measures directly increase procurement of certified biodegradable substrates, including regenerated cellulose films, across retail, foodservice, and branded FMCG packaging. Many multinational brand owners have publicly committed to measurable packaging circularity targets, which accelerate material substitution toward renewable alternatives. Industry disclosures indicate rising adoption of cellulose-based sachets and pouches in food and personal care applications, as brands seek compliance with evolving environmental standards while protecting brand equity. As regulatory enforcement strengthens globally, cellulose film packaging continues to gain structural support for demand.

Recent advancements in coated cellulose film technology have significantly enhanced moisture, oxygen, and grease barrier properties compared with traditional uncoated cellophane. These improvements enable cellulose films to serve higher-value applications, including frozen foods, liquid sachets, and pharmaceutical overwraps. The integration of bio-based coatings and ultra-thin functional laminates narrows the performance gap with fossil-based flexible films while maintaining compostability or industrial compostability under specific construction conditions. As barrier integrity and clarity become increasingly critical for packaged food films and healthcare products, coated cellulose films are being adopted faster than conventional grades, expanding the overall addressable market and supporting premium pricing.

Retailers and brand owners increasingly favor transparent, renewable packaging materials that clearly communicate sustainability credentials while maintaining high shelf appeal. Cellulose films combine exceptional clarity with renewable feedstocks and recognized compostability certifications, allowing brands to align packaging aesthetics with ESG commitments. Early adoption has been observed in premium food, cosmetics, and single-serve health products, where visibility and sustainability both influence purchasing decisions. This consumer-driven demand strengthens cellulose film penetration in higher-margin categories, reinforcing long-term market growth beyond regulatory compliance alone.

Cellulose film production remains structurally more expensive than commodity polyolefin films due to its pulp-based feedstock, solvent recovery requirements, and comparatively lower global production capacity. Fluctuations in pulp pricing and the capital-intensive nature of solvent-based manufacturing elevate unit production costs. As a result, cellulose films may carry selling prices 15-40% higher than comparable BOPP or BOPET films, depending on coating and lamination complexity. This pricing differential limits adoption in highly price-sensitive segments, particularly low-cost retail and mass-market packaging, where sustainability premiums are harder to justify.

Although many cellulose films are industrially compostable, composting infrastructure remains uneven across global markets. Limited access to industrial composting facilities in parts of North America and many emerging economies reduces the practical effectiveness of compostability claims. Where appropriate waste-collection systems are absent, brands face challenges in demonstrating real-world environmental benefits, increasing regulatory and procurement risk. This infrastructure mismatch constrains large-scale adoption in regions without established organic waste management systems.

The increasing adoption of coated cellulose films in high-margin food packaging applications presents a clear revenue opportunity. These applications include liquid and viscous food sachets, frozen food wraps, and premium pouches requiring enhanced barrier performance. If coated cellulose films capture 10-15% of existing flexible food pouch production in developed markets, the incremental opportunity could reach US$ 80-120 million by 2030, based on current packaging expenditure patterns. Continued investment in water- and oil-barrier bio-coatings will further improve functionality and accelerate commercial adoption.

Asia Pacific’s expanding manufacturing capacity and improving regulatory alignment create an opportunity to establish cost-efficient, export-oriented cellulose film production hubs. Capacity expansion across China, India, and Southeast Asia can reduce per-unit production costs and enable selective price parity with conventional flexible films. Over time, capacity-driven cost reductions of 5-10% per tonne could significantly improve competitiveness in global markets, supporting exports to Europe and North America while strengthening regional supply security.

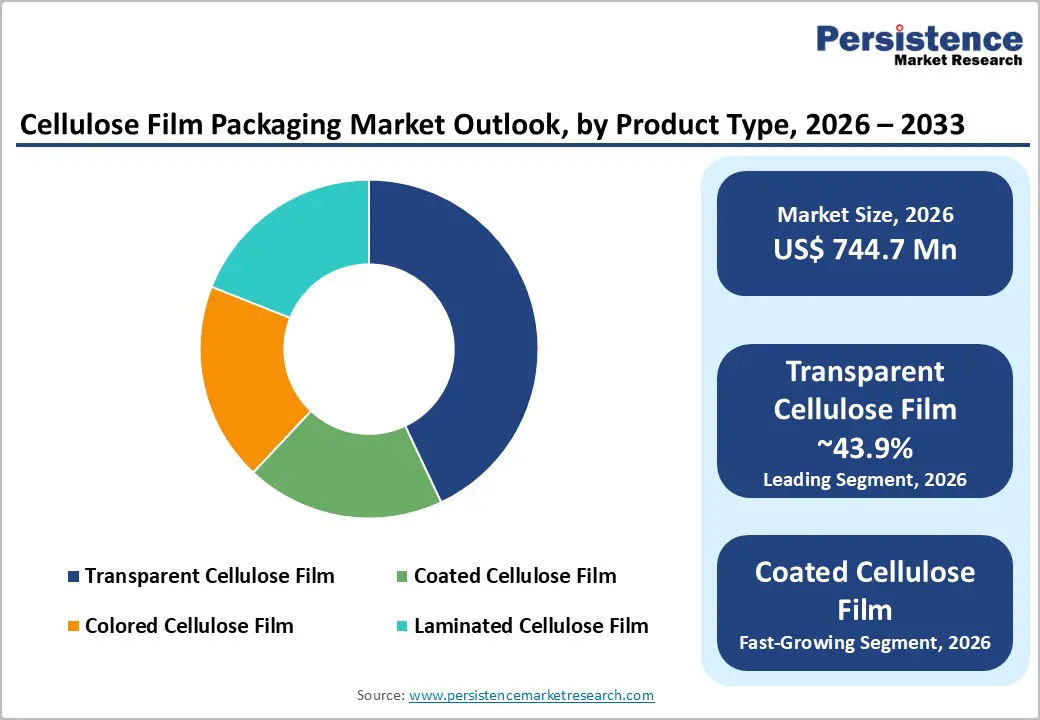

Transparent cellulose films are anticipated to maintain a 43.9% share of the cellulose film packaging market, supported by superior optical clarity, consistent tensile strength, and compatibility with retail-facing packaging formats. These films are extensively used in premium confectionery wraps, bakery overwraps, cosmetic cartons, and window packaging, where high product visibility directly influences consumer purchase decisions. Major food and personal care brands in Europe and Asia increasingly favor transparent cellulose films to balance shelf appeal with compostability requirements under tightening sustainability mandates. The combination of renewable sourcing, home-compostable certifications, and strong machinability enables higher average selling prices, reinforcing the segment’s value dominance in both developed and emerging markets.

Coated cellulose films are the fastest-growing product type, driven by performance enhancements that expand their use into moisture- and oxygen-sensitive applications. Advanced coatings, such as water-based, bio-polymer, and dispersion coatings, enable cellulose films to replace fossil-based laminates in frozen foods, dairy, pharmaceutical blister lidding, and medical sachets. Growth is supported by investments from leading manufacturers such as Futamura and Innovia Films, which are expanding coated film portfolios to meet food safety and pharmaceutical compliance standards. Higher technical complexity, improved barrier reliability, and compatibility with mono-material recycling and composting streams support a stronger CAGR and improved margin profile, positioning this segment as a core long-term growth driver.

The food & beverage sector is anticipated to account for 38.2% of market share, making it the largest end-user industry. Demand is driven by widespread use in snacks, confectionery, bakery items, single-serve beverage powders, and portion packs, where clarity, grease resistance, and protection against short- to medium-term shelf-life are critical. Retailers and multinational food brands increasingly specify cellulose films to meet plastic-reduction targets and compostability commitments, particularly across Europe and parts of the Asia Pacific. Applications such as twist wraps, flow wraps, and inner liners benefit from cellulose film’s machinability and renewable profile, reinforcing its dominance in high-volume food packaging formats.

Pharmaceuticals and healthcare represent the fastest-growing end-user segment, supported by rising regulatory scrutiny of packaging materials and growing adoption of sustainable alternatives in both primary and secondary packaging. Coated and laminated cellulose films deliver reliable moisture and oxygen barriers suitable for OTC medicines, nutraceutical sachets, diagnostic kits, and unit-dose packaging, while aligning with renewable material sourcing policies. Growth is particularly strong in Europe and Japan, where regulatory frameworks and procurement guidelines increasingly favor bio-based packaging solutions. As pharmaceutical companies integrate sustainability into supplier qualification processes, cellulose films are gaining traction as compliant, low-carbon packaging substrates.

North America represents a high-value demand market in cellulose film packaging, supported by premium brand adoption, regulatory movement toward sustainable alternatives, and targeted investments in material innovation and supply-chain integration. The U.S. leads regional consumption, driven by strong interest from food, personal care, and specialty product brands seeking to reduce plastic dependence. For example, major American and multinational producers are expanding their cellulose film portfolios and investing in R&D and facility upgrades to enhance eco-friendly film production, with reports of millions of dollars in capital committed to new transparent and compostable film lines for flexible packaging and industrial uses. This reflects broader industry prioritization of sustainable materials into mainstream packaging platforms.

Corporate sustainability commitments and state-level environmental regulations, such as California’s packaging mandates and Canada’s plastics bans, are encouraging brand owners to trial and adopt viable cellulose packaging solutions. Partnerships between North American converters and Asia Pacific manufacturers also balance cost and performance, ensuring that supply chains can deliver both quality and scalability for high-volume formats such as snack pouches and retail overwraps. Pilot composting programs and specialty brand launches underscore North America’s transition from proof-of-concept phases to broader commercial deployment, particularly where food safety and environmental claims intersect.

Europe remains a critical and highly active market for cellulose film packaging due to stringent environmental regulations, well-developed composting infrastructure in many countries, and strong sustainability mandates from leading retail chains. Countries such as Germany, the U.K., France, and Spain continue to drive adoption across food, confectionery, and cosmetic packaging, reshaping procurement practices in major grocery and specialty retail channels.

European regulatory frameworks, especially packaging waste directives and extended producer responsibility systems, create structural demand for certified compostable and renewable materials, prompting brands and converters to integrate cellulose films into mainstream packaging portfolios. Manufacturers have responded with targeted product launches and capacity expansions to serve these markets, with premium retail chains awarding multi-year supply contracts for certified cellulose films for fresh produce and packaged foods.

European retail experimentation also includes prominent supermarket groups adopting cellulose materials to phase out fossil-based films in select private-label products. These initiatives, widely publicized across Western European markets, demonstrate how regulatory alignment with consumer sustainability expectations accelerates the adoption of cellulose films and sets a high bar for material performance and labeling clarity, reinforcing brand accountability and consumer trust.

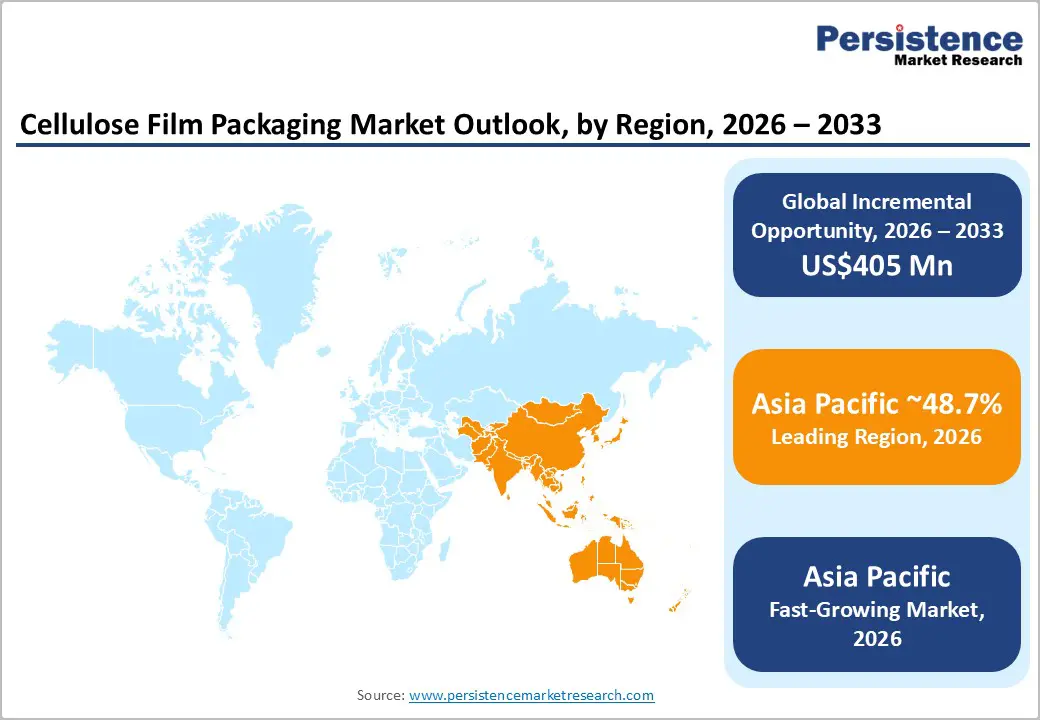

Asia Pacific is expected to lead the cellulose film packaging market with approximately 48.7% of share in 2026, and is also the fastest-growing region due to rapid industrialization, booming consumer goods demand, and strategic capacity expansions anchored in cost competitiveness. Countries such as China and India drive volume growth, supported by expanding packaged food and e-commerce sectors that increasingly demand renewable and compostable packaging alternatives to conventional plastics. Japan maintains technological leadership in advanced cellulose film formulations and barrier coatings, with significant local investment in enhanced performance films for food and consumer goods.

Manufacturing scale and cost advantages are particularly strong in China and Southeast Asia, where companies are establishing regional supply chains to serve domestic and export markets and securing government support for greener manufacturing practices. Collaborative industry moves, such as strategic partnerships between regional packaging firms and global cellulose film suppliers, are enabling broader distribution and competitive pricing. These developments strengthen Asia Pacific’s role not just as a consumption hub, but as a production and export platform for cellulose films, capable of supplying Europe and North America with sustainable flexible packaging at scale.

Rapidly growing economies in the region are also seeing regulatory initiatives aimed at reducing plastic pollution, which reinforce adoption momentum. Combined with manufacturing investments and supply chain integration, Asia Pacific is uniquely positioned to shape the global cost curve and accelerate cellulose film integration across end-user industries.

The global cellulose film packaging market is moderately fragmented, with a limited number of technology leaders controlling significant value share alongside numerous regional manufacturers. Competitive positioning depends on coating expertise, solvent recovery efficiency, certification capability, and production scale. Innovation and operational efficiency remain key differentiators.

Leading companies prioritize vertical integration, technology differentiation through coatings, and geographic expansion across the Asia Pacific and North America. Certification credibility and strategic brand partnerships remain central to winning commercial contracts.

The global cellulose film packaging market is likely to be valued at US$744.7 million in 2026.

The cellulose film packaging market is expected to reach US$1,149.7 million by 2033.

Key trends include rising adoption of coated cellulose films with enhanced barrier properties for perishables and pharmaceuticals and increased use of transparent cellulose films for premium food, cosmetics, and retail applications.

Transparent cellulose film is the leading product type, accounting for an anticipated 43.9% of the market, due to high clarity, compostability, and suitability for premium retail packaging.

The cellulose film packaging market is expected to grow at a CAGR of 6.4% between 2026 and 2033.

Some of the major players include Futamura Group, Eastman Chemical Company, Celanese Corporation, Sappi Limited, and Weifang Henglian Cellophane Co., Ltd.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By End-user Industry

By Packaging Format

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author