ID: PMRREP24016| 190 Pages | 14 Nov 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

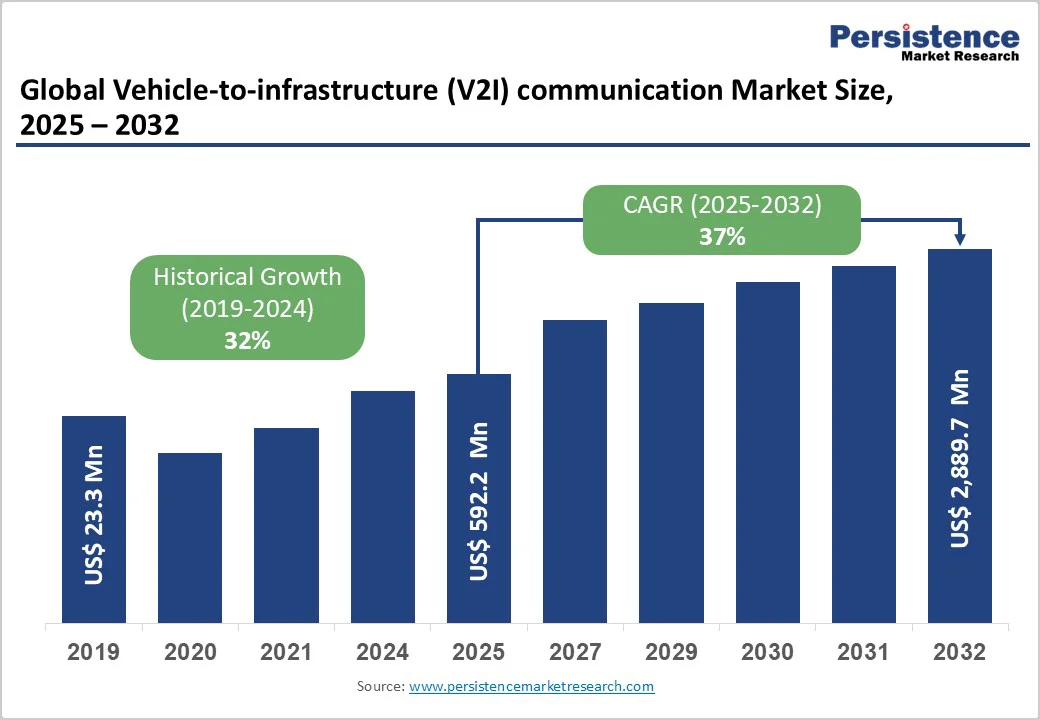

The global Vehicle-to-Infrastructure (V2I) communication market is likely to value at US$ 592.2 million in 2025 and projected to reach US$ 2,889.7 million, growing at a CAGR of 37% between 2025 and 2032. The market's expansion is primarily driven by accelerating urbanization, government-led smart city initiatives, heightened road safety imperatives, and the rapid proliferation of autonomous and connected vehicle ecosystems.

| Key Insights | Details |

|---|---|

| Vehicle-to-infrastructure (V2I) communication Market Size (2025E) | US$592.2 Mn |

| Market Value Forecast (2032F) | US$ 2,889.7 Mn |

| Projected Growth (CAGR 2025 to 2032) | 37% |

| Historical Market Growth (CAGR 2019 to 2024) | 32% |

Road traffic safety remains the most compelling driver for V2I market expansion. According to the World Health Organization (WHO), more than 1.19 million people die annually in road accidents, with an additional 20 to 50 million sustaining non-fatal injuries. Road traffic injuries represent the leading cause of death among children and young adults aged 5-29 years globally. This alarming public health crisis has prompted governments worldwide to mandate advanced safety technologies.

The U.S. National Highway Traffic Safety Administration (NHTSA) has proposed V2V communication mandates for new vehicles, while the European Union's C-ITS Directive promotes interoperable V2X systems across member states. These regulatory frameworks are accelerating V2I infrastructure deployment, with countries like China allocating over $200 million specifically for V2X infrastructure development and planning to equip more than 90,000 kilometers of roadways with V2X technology by 2025.

The autonomous vehicle market is projected to grow from US$ 273.75 billion in 2025 to US$ 4,450.34 billion by 2034 at a CAGR of 36.3%. Autonomous driving systems fundamentally rely on V2I communication for environmental perception, route optimization, and safety-critical decision-making. Advanced Driver Assistance Systems (ADAS) penetration reached 8.3% in India during H1 2025, representing 33% growth year-over-year. Level 2 ADAS systems grew 70.8% in H1 2025, capturing 5.6% market share.

These systems require real-time infrastructure data exchange to execute cooperative adaptive cruise control, intersection movement assistance, and emergency vehicle warnings. Industry leaders including Tesla, Waymo, BMW, and Mercedes-Benz are integrating V2I capabilities into their autonomous driving stacks, with Qualcomm's Snapdragon Auto 5G Modem-RF Gen 2 (2023) supporting ultra-low latency communication essential for Level 3+ autonomy.

V2I infrastructure deployment entails substantial capital expenditure, representing a significant market restraint. According to the 5G Automotive Association cost analysis, pure cellular deployment in Europe and the U.S. demonstrates 40-45% lower costs compared to deployment options including roadside units (RSUs). However, comprehensive V2I deployment at scale could result in costs between EUR 5-8 billion in the EU and USD 7-12 billion in the U.S.

Individual DSRC site deployment costs average US$ 17,600 per location, including hardware (US$ 7,450), installation labor (US$ 3,550), and design/planning (US$ 6,600). Backhaul infrastructure connecting RSUs to traffic management centers adds additional recurring operational expenses. These substantial financial requirements pose challenges, particularly for municipalities with limited transportation budgets, potentially delaying widespread deployment timelines.

Cybersecurity represents a critical restraint as V2I systems exchange sensitive real-time data between vehicles and infrastructure. The automotive cybersecurity sector, estimated at $2.9 billion in 2022, could reach $10.3 billion by 2032, reflecting growing threat landscapes. V2I communication systems are vulnerable to distributed denial of service (DDoS) attacks, message spoofing, and unauthorized access to vehicle control systems. Research demonstrates that cyberattacks on V2I applications such as Stop Sign Gap Assist can create conflict situations at unsignalized intersections, potentially causing crashes.

Connected vehicles contain up to 40 million lines of code in Electronic Control Units (ECUs), creating extensive attack surfaces. Hackers could potentially send false information to vehicles, manipulate adaptive traffic signals, or disable emergency braking systems. These vulnerabilities necessitate robust encryption protocols, digital signature validation, and public key infrastructure (PKI) implementation, adding complexity and cost to V2I deployment

The global deployment of 5G networks presents transformative opportunities for V2I market growth. Cellular-V2X (C-V2X) technology leverages existing 4G LTE and 5G networks, eliminating requirements for dedicated short-range roadside infrastructure. C-V2X offers superior scalability, with the segment poised to hold 61.7% revenue share in the V2I market. As of 2023, 5G networks have been launched in over 60 countries, providing the low latency and high reliability required for effective V2X operations.

The European Commission's 5G Corridor initiatives allocated EUR 20.7 million for cross-border 5G infrastructure along major Trans-European Transport Network (TEN-T) corridors. China deployed over 2.6 million 5G base stations by 2024, creating extensive infrastructure supporting C-V2X implementations. This existing cellular infrastructure significantly reduces deployment barriers, enabling cost-effective V2I service delivery through network-based approaches.

The integration of edge computing with V2I infrastructure enables real-time data processing at roadside locations, reducing latency and minimizing cloud infrastructure dependence. AI-powered edge computing in RSUs allows local data processing, enhancing decision-making speed essential for autonomous driving systems. Qualcomm's C-V2X platform, deployed in smart city pilot programs in China and the U.S., integrates edge intelligence directly into roadside hardware enabling split-second interactions between vehicles and traffic signals.

AI and machine learning algorithms enable predictive analytics for risk detection, adaptive signal control, and real-time traffic optimization. Cities like Hangzhou, China, have dropped from 5th to 57th on congestion rankings through AI-assisted traffic system implementation, demonstrating substantial operational benefits. This convergence of V2I with AI presents opportunities for municipalities to deliver transformative traffic management capabilities.

By Vehicle Type Insights

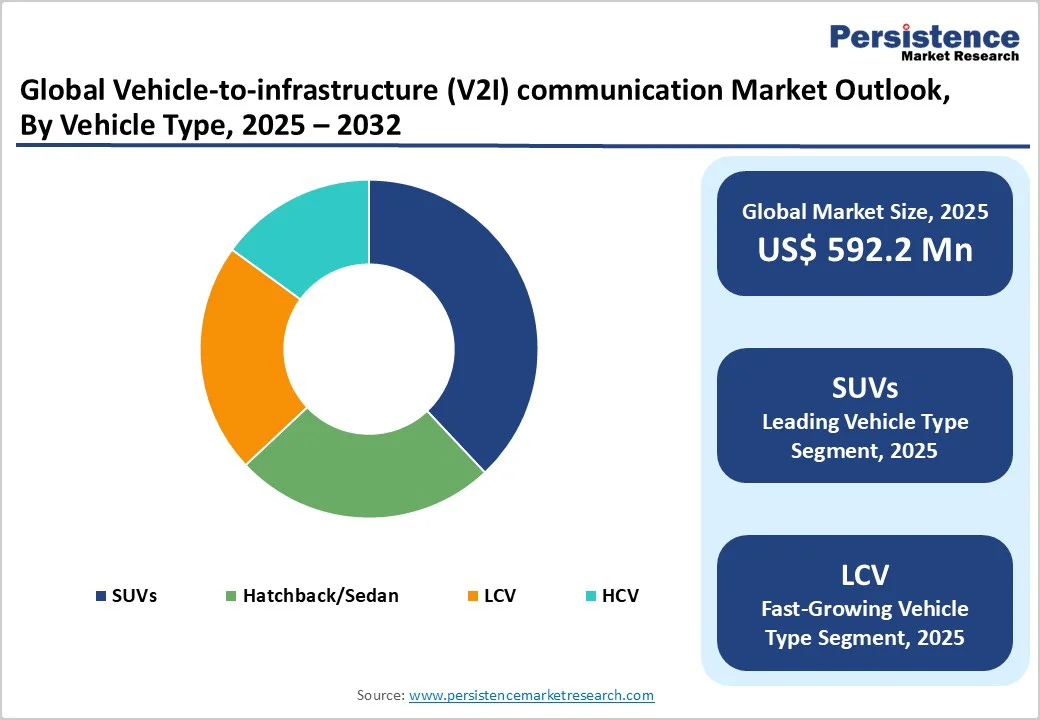

The SUV segment dominates the vehicle-to-infrastructure (V2I) communication market with a 42.3% share, driven by strong adoption of connected technologies, premium safety features, and consumer willingness to pay for advanced systems. Automakers such as Tesla and Mahindra are integrating V2V and V2I capabilities into electric and premium SUVs, reinforcing the segment’s leadership through technology-driven differentiation.

Conversely, Light Commercial Vehicles (LCVs) represent the fastest-growing category, supported by fleet modernization and logistics optimization initiatives. V2I-enabled route management, real-time cargo tracking, and regulatory mandates for telematics enhance operational efficiency and compliance. With e-commerce expansion accelerating delivery fleet deployment, LCV manufacturers are embedding V2I systems as strategic value propositions, ensuring continued growth across commercial vehicle applications.

By Component Insights

The hardware segment leads the Vehicle-to-Infrastructure (V2I) communication market with a 38.4% share, serving as the physical backbone through roadside units, sensors, and on-board modules. Its dominance reflects the large-scale infrastructure investments by governments and municipalities to build connected transport networks. Companies such as Qualcomm and Continental are advancing hardware sophistication through C-V2X and hybrid V2X platforms, while AI-enabled edge computing enhances real-time data processing and latency reduction.

Conversely, the software segment is the fastest-growing category, propelled by cloud integration, AI algorithms, and over-the-air updates. Software facilitates analytics, security, and application management, supporting subscription-based revenue models. As V2I systems evolve, software-defined architectures and intelligent applications for congestion prediction and emergency coordination are driving rapid digital transformation.

By Application Insights

Bluetooth technology leads the Vehicle-to-Infrastructure (V2I) communication market with a 36.8% share, driven by its low power consumption, affordability, and broad device compatibility for short-range applications such as parking assistance and vehicle-to-pedestrian alerts. Despite these strengths, limited range and lower data rates restrict its use in advanced safety systems.

In contrast, Wi-Fi-based Dedicated Short-Range Communication (DSRC) represents the fastest-growing segment, offering high-speed, low-latency data exchange up to 1 kilometer. Proven deployments by Toyota, Cadillac, and Volkswagen underscore its automotive readiness. The introduction of IEEE 802.11bd standards enhances performance and backward compatibility, supporting next-generation connected mobility and establishing Wi-Fi as a pivotal enabler of scalable, infrastructure-independent V2I communication.

North America remains a pivotal region in the Vehicle-to-Infrastructure (V2I) communication market, underpinned by robust regulatory initiatives, federal funding, and technological leadership. The U.S. Department of Transportation’s ATTAIN program has allocated over $52 million to advance smart mobility projects, while the FCC’s 2021 designation of C-V2X as the national standard established regulatory certainty accelerating adoption. The region benefits from leading technology innovators such as Qualcomm, Savari, and Danlaw, driving ecosystem maturity.

Despite a projected $280 billion U.S. Highway Trust Fund shortfall by 2035, emerging V2X-enabled tolling and connected infrastructure initiatives offer viable funding alternatives. With deployments across Michigan, Virginia, and Arizona, and strong support from autonomous vehicle developers like Tesla, Waymo, and Cruise, North America is poised for sustained V2I growth.

Europe stands at the forefront of Vehicle-to-Infrastructure (V2I) communication adoption, driven by cohesive regulatory alignment and large-scale cross-border initiatives. The EU’s Cooperative Intelligent Transport Systems (C-ITS) Directive ensures interoperability across member nations, while 5G-PPP projects—such as the Mediterranean Corridor (€5.2 million) and Northern European Transport Corridor (€15.5 million)—strengthen seamless connectivity across borders. Germany spearheads deployment through the A9 Autobahn Digital Testbed, backed by the Federal Ministry for Digital and Transport. Automakers including BMW, Audi, Mercedes-Benz, and Volvo are integrating V2I capabilities into new models, supported by semiconductor leaders Infineon and NXP. With regulatory frameworks expanding in France and the U.K. and growing emphasis on emission reduction, Europe’s commitment to sustainable, connected mobility continues to accelerate V2I adoption.

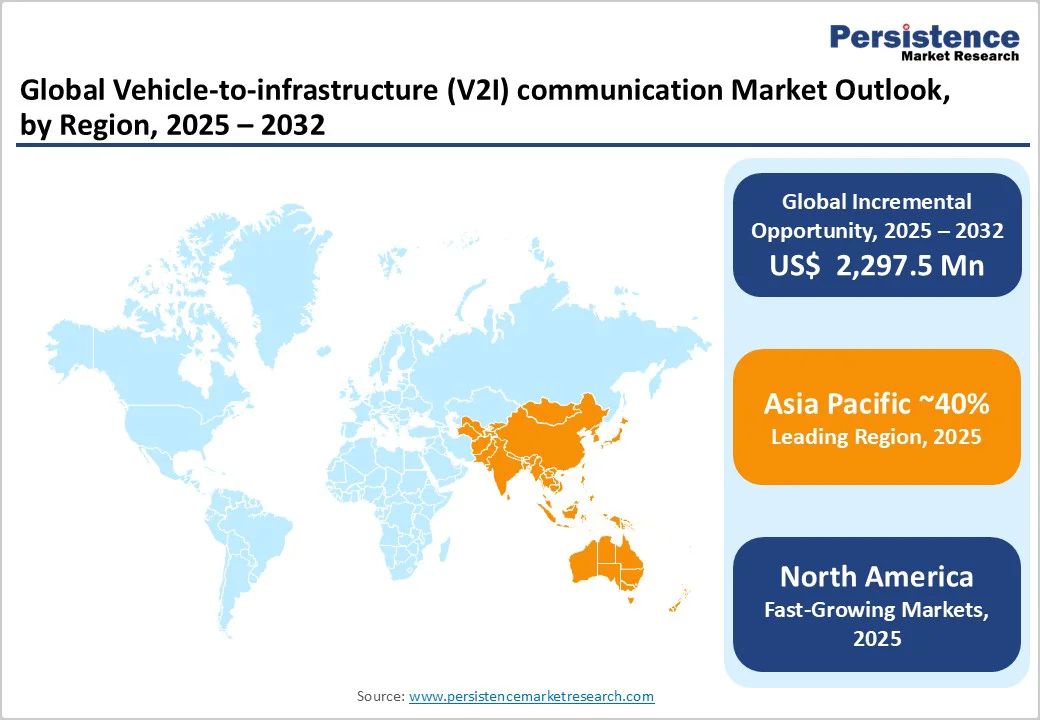

Asia Pacific represents the fastest-growing region in the Vehicle-to-Infrastructure (V2I) communication market, accounting for 42.6% of global V2X revenue in 2024. Growth is driven by large-scale smart city initiatives, cost-efficient manufacturing, and strong government investment in digital infrastructure. China leads with over 500,000 5G-connected vehicles and 2.6 million base stations by 2024, supported by its Intelligent and Connected Vehicles Plan promoting C-V2X leadership.

Japan continues technological advancement through DSRC adoption and comprehensive V2I solutions from DENSO. India’s Smart Cities Mission—valued at INR 47,652 crore (US$ 5.7 billion)—and rising ADAS penetration underscore expanding connected mobility. Regional collaboration, such as the India-Japan Next-Generation Mobility Partnership, further accelerates deployment, positioning Asia Pacific as the global hub for V2I innovation and scalable infrastructure development.

The V2I communication market exhibits moderate fragmentation with semiconductor leaders, Tier-1 automotive suppliers, and specialized communication technology providers competing across value chain segments. Qualcomm and NXP Semiconductors dominate the chipset layer, leveraging economies of scale and reference design platforms to secure original equipment manufacturer (OEM) sockets.

Tier-1 suppliers including Continental AG, Robert Bosch GmbH, and HARMAN International integrate chipsets into comprehensive end-to-end systems combining sensor fusion, middleware, and cybersecurity capabilities. Market concentration analysis indicates leading players collectively hold approximately 36% market share in 2024, suggesting opportunities for smaller specialized providers in niche application areas and regional markets.

The Vehicle-to-infrastructure (V2I) communication market is estimated to be valued at US$592.2 Mn in 2025.

The key demand driver for the Vehicle-to-Infrastructure (V2I) Communication Market is the rapid expansion of smart transportation systems and connected vehicle ecosystems aimed at improving road safety, traffic efficiency, and autonomous driving capabilities.

In 2025, the Asia Pacific is poised to dominate the market with an exceeding 40% revenue share in the global Vehicle-to-infrastructure (V2I) communication market.

Among the Vehicle Type, SUVs holds the highest preference, capturing beyond 42.4% of the market revenue share in 2025, surpassing other parts.

The key players in Vehicle-to-infrastructure (V2I) communication are Qualcomm, Intel Corporation, NXP Semiconductor, Broadcom and AT&T, Inc.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 – 2024 |

| Forecast Period | 2025 – 2032 |

| Market Analysis | Value: US$ Mn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Vehicle Type

By Component type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author