ID: PMRREP20227| 210 Pages | 11 Dec 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

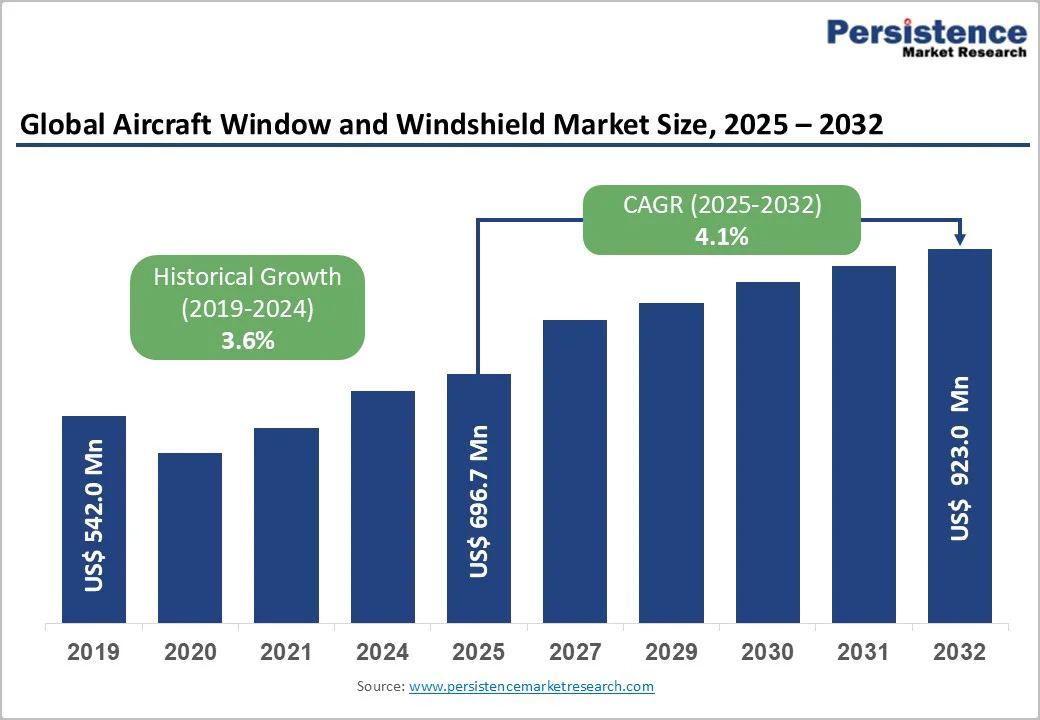

The global aircraft window and windshield market size is valued at US$696.7 million in 2025 and is projected to reach US$923.0 million by 2032, growing at a CAGR of 4.1% between 2025 and 2032.

This expansion reflects sustained commercial aviation recovery with 194 million additional U.S. passengers in 2022, representing 30% year-over-year growth, fleet modernization programs driving new aircraft deliveries averaging 1,200-1,500 units annually, and technological advancement in lightweight composite materials achieving 20-30% weight reduction through acrylic and polycarbonate adoption.

| Key Insights | Details |

|---|---|

| Aircraft Window and Windshield Market Size (2025E) | US$ 696.7 Mn |

| Market Value Forecast (2032F) | US$ 923.0 Mn |

| Projected Growth (CAGR 2025 to 2032) | 4.1% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.6% |

Global airline passenger traffic recovery is reaching pre-pandemic levels, with the U.S. Department of Transportation reporting 194 million additional passengers in 2022, representing a 30% year-over-year increase. This drives sustained aircraft production, supporting baseline window and windshield demand proportional to delivery volumes.

Commercial aircraft deliveries projected to average 1,200-1,500 units annually through 2032, including Boeing 737 MAX, Airbus A320neo family, widebody 787/A350 platforms, and regional jets, create proportional window demand with each narrowbody requiring 25-35 cabin windows plus 6-layer cockpit windshield assemblies commanding $80,000-150,000 per aircraft window package.

Widebody aircraft, including the 787, A350, and A380, require 40-60 cabin windows with larger dimensions (19×14 inches, typical, versus 11×16 inches for narrowbody aircraft) and advanced electrochromic dimming technology, and command a premium of $150,000-250,000 per aircraft, supporting market value growth.

Fleet modernization programs retiring aging 757, 767, and first-generation A320 aircraft accelerate replacement cycles, with new-generation aircraft incorporating larger windows, advanced materials, and enhanced passenger experience features, including electronically dimmable windows (EDW) deployed on 787 Dreamliner, eliminating mechanical shades.

Aviation industry lightweighting mandates targeting 15-25% aircraft empty weight reduction drive adoption of advanced acrylic and polycarbonate window materials achieving 20-30% weight savings versus traditional tempered glass while maintaining structural integrity and optical clarity requirements.

Stretched acrylic glass meeting MIL-PRF-5425 specifications for pressurized cabin and bird strike requirements enables "fail-safe" cockpit windshield designs incorporating multiple layers (typically 6-layer construction) with tempered glass outer ply, polycarbonate structural layers, and acrylic crew shield, achieving superior impact resistance.

Composite window construction combining mineral glass outer surfaces with polycarbonate and acrylic core layers optimizes strength-to-weight ratios, with PPG Solaron technology incorporating proprietary chemical compounds during manufacturing, achieving infrared heat rejection, blocking 73%+ of thermal radiation, improving cabin comfort while reducing air conditioning loads 8%.

Aircraft window and windshield manufacturing requires specialized autoclave processing, precision optical grinding, multi-layer lamination, and comprehensive testing, creating substantial capital investment barriers, with complete production facilities commanding an initial investment of $15-25 million.

FAA and EASA certification processes that demand extensive bird strike testing, pressure cycling validation (typical 50,000+ pressure cycles), optical clarity verification (92%+ light transmission), and environmental testing (-55°C to +70°C) extend development timelines by 24-36 months from initial design to production certification.

Material costs for aerospace-grade acrylic, polycarbonate, and tempered glass command a 40% premium versus commercial applications, reflecting purity requirements, traceability documentation, and batch testing mandates, with the complete cockpit windshield material cost ranging $8,000 to $15,000 before processing and assembly.

Limited supplier base with PPG, GKN Aerospace, Saint-Gobain, and Lee Aerospace commanding 60-70% combined market share creates supply chain concentration risk and pricing power, limiting cost reduction opportunities for aircraft OEMs.

Aircraft window operational lifespans exceeding 15-20 years with maintenance intervals of 3-5 years create extended replacement cycles limiting aftermarket revenue frequency, while a competitive aftermarket environment with multiple PMA (Parts Manufacturer Approval) suppliers drives pricing pressure below OEM rates.

Cabin window replacement is typically event-driven by bird strikes, hail damage, or scheduled heavy maintenance checks rather than time-based replacement, which creates unpredictable aftermarket demand patterns, with average aircraft experiencing 0.5-1.5 window replacements annually across the fleet.

Aftermarket pricing competition from PMA suppliers offering 30-50% discounts versus OEM list prices compresses margins for established manufacturers. At the same time, 24-hour AOG (Aircraft On Ground) support requirements necessitate global distribution networks and inventory investment, elevating operational costs.

Emerging electronically dimmable window (EDW) technology, eliminating mechanical window shades while providing passenger control over cabin lighting, creates premium retrofit opportunities for existing fleets and standard fitment on new-generation aircraft.

Boeing 787 Dreamliner, pioneering EDW deployment across all cabin windows utilizing PPG Alteos assemblies with Gentex electrochromic technology, demonstrates commercial viability, with passenger satisfaction surveys indicating 85%+ preference for dimmable windows versus mechanical shades.

Airbus planning EDW deployment on an unannounced new aircraft program creates an incremental market opportunity, with EDW assemblies commanding a 2-3x pricing premium versus conventional windows, reflecting integrated electronics, power supply requirements, and system integration complexity.

Retrofit market potential for widebody fleets, including 777, A330, and A350, is estimated at $400-700 million opportunity through 2032 as airlines pursue cabin modernization supporting premium passenger experience differentiation.

Asia Pacific aviation expansion with China, India, and ASEAN nations, projected to add 3,000+ commercial aircraft through 2032, creates substantial window and windshield demand serving regional fleet growth and supporting localized MRO capabilities.

India's aviation market expansion, requiring 1,750+ aircraft through 2045, supporting domestic connectivity and international growth, creates proportional window demand, with domestic MRO facilities requiring certified window repair and replacement capabilities supporting aftermarket localization.

China COMAC C919 narrowbody program ramping production toward 150+ annual deliveries requires domestic window supply chain development, with PPG and Saint-Gobain establishing regional partnerships serving the Chinese aviation market. Southeast Asian LCC (low-cost carrier) expansion, including AirAsia, Lion Air, and VietJet, operating 500+ narrowbody aircraft, creates a concentrated aftermarket opportunity for regional distributors and repair stations.

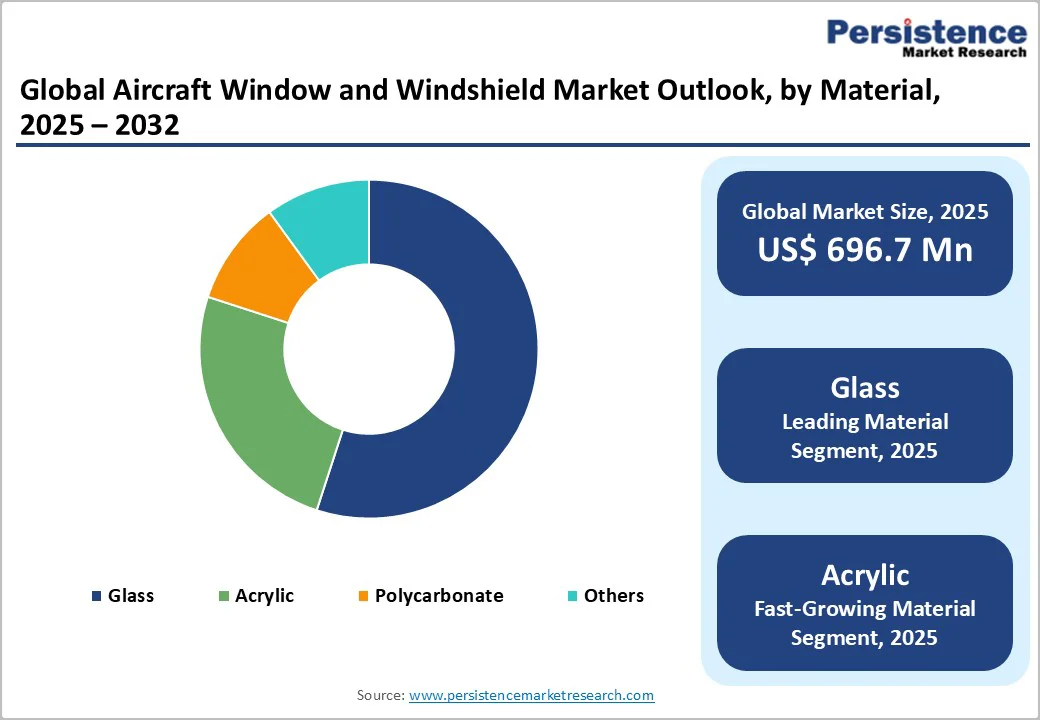

Glass materials hold a 52.7% share due to 95% optical clarity, strong scratch resistance, and proven certification for cockpit windshields and premium cabin windows. Tempered and chemically tempered glass delivers high durability, UV protection, and 15-20 years of optical stability, while hybrid glass-polymer constructions balance clarity, impact resistance, and weight reduction.

Acrylic is the fastest-growing material at a positive CAGR, driven by 25% weight savings, cost efficiency, and flexible manufacturing for complex shapes. Stretched acrylic (MIL-PRF-5425) offers fail-safe crack-arrest properties essential for pressurized cabins, while cast acrylic provides excellent clarity and moldability. Advanced solutions like CoolView acrylic enhance passenger comfort by blocking over 73% of infrared radiation.

Cabin windows hold a 60.1% application share due to their higher quantity per aircraft, typically 25-60 units, versus 6-10 cockpit windshield panels, resulting in greater total revenue despite lower unit pricing. Growing focus on passenger experience and larger window designs, such as the Boeing 787’s 30% larger windows, further increases content value. Premium aircraft increasingly adopt electrochromic dimmable windows, priced 2-3× higher than conventional designs.

Cockpit windshields are the fastest-growing segment at 5% CAGR, supported by complex multi-layer assemblies priced at $30,000-60,000 each, frequent replacements due to bird-strike exposure, and integration of advanced technologies. Typical six-layer structures, along with heating elements and rain-repellent electrical systems, add significant engineering complexity and $8,000-15,000 in additional component cost.

Widebody aircraft command 63% market share through larger window inventory (40-60 cabin windows) than narrowbody aircraft (25-35 units), larger window dimensions, and premium features, including electronically dimmable windows on the 787 and future Airbus platforms. Long-haul operations averaging 8-12 flight hours daily create accelerated window stress cycles versus short haul narrowbody operations supporting higher replacement frequency.

Widebody aircraft is the fastest-growing segment, with a 6% CAGR, driven by advancing technology deployment, including EDW standardization, composite material adoption, and premium cabin features that support higher per-aircraft content value. Next-generation widebody programs, including Boeing 777X and Airbus A350 variants, incorporating advanced window technologies and larger dimensions, create an incremental market opportunity.

OEM channel commands 90% market share through primary demand from new aircraft production, integrated supply relationships with Boeing, Airbus, and regional manufacturers, and long-term supply agreements. Line-fit window packages specified during aircraft manufacturing enable optimized installation processes, quality control, and warranty support, justifying premium pricing versus aftermarket alternatives.

Aftermarket represents the fastest-growing channel at 5% CAGR through replacement demand driven by bird strikes (15,000+ annual U.S. incidents), maintenance requirements, cabin upgrade retrofits, and aging fleet population.

Independent repair stations, including Lee Aerospace, offering FAA-approved window replacement, repair, and distributio,n capture growing market share through 24-hour AOG support, competitive pricing 30-50% below OEM, and global distribution networks

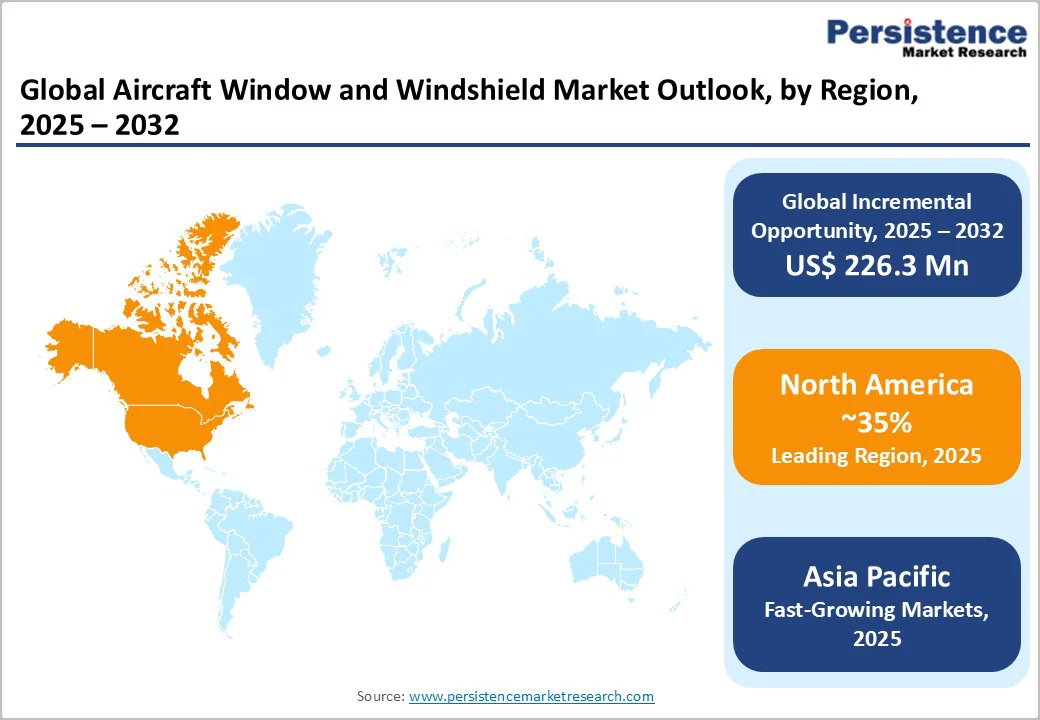

North America generates approximately US$237 million market value in 2025, representing 35% global market share, growing at 4.5% CAGR through 2032, driven by the established aviation industry, Boeing commercial aircraft production, and extensive MRO infrastructure.

The United States dominates the regional market with an 82-86% North American share through domestic OEM presence, including Boeing producing 737 MAX and 787 platforms, a comprehensive aftermarket support network, and FAA regulatory leadership.

Commercial aviation recovery with 194 million additional passengers in 2022, supporting fleet-expansion drives and sustained window demand. The Canadian aerospace sector is contributing a 10% regional share through Bombardier's regional aircraft production and MRO capabilities.

Europe represents US$195 million market in 2025 capturing 25% global market share growth at 3.8% CAGR through 2032, characterized by Airbus production leadership, advanced material manufacturing, and comprehensive certification infrastructure. France leads the European market with 32-38% regional share through Airbus headquarters and final assembly facilities producing A320neo family and A350 widebody platforms.

Germany is contributing 22-28% of the European share through Saint-Gobain and GlassTrosch's aerospace glazing manufacturing, while the United Kingdom maintains MRO capabilities supporting the European fleet. EASA certification harmonization supporting cross-border manufacturing and distribution creates an integrated European supply chain.

Asia Pacific represents the fastest-growing region at approximately 8.2% CAGR through 2032, with an estimated market value reaching US$285 million by 2032, comprising 30% global market share by 2032, driven by Chinese aircraft production, emerging market aviation expansion, and MRO localization.

China dominates Asia Pacific with 42-48% regional share through COMAC C919 production, Boeing 737 completion center, and domestic aviation market expansion adding 3,000+ aircraft through 2032. Japan, representing 16% regional share, maintains technology leadership through advanced materials and precision manufacturing.

India is emerging as a high-growth market at a 12% CAGR through aviation expansion requiring 1,750+ aircraft and domestic MRO development. Southeast Asia contributed 12% regional growth through LCC fleet expansion and regional aircraft demand.

Over the past few years, a rise in acquisition and expansion activities has surfaced to improve the supply chain of aircraft windows and windshields. Major manufacturers are providing a wide range of customized aircraft windows and windshields according to the requirements of end users and provide services that are customized for each unique customer. The emergence of various manufacturers has also been witnessed in this space.

The Aircraft Window and Windshield market is estimated to be valued at US$ 696.7 Mn in 2025.

The key demand driver for the Aircraft Window and Windshield market is the increasing global aircraft production and fleet modernization, which directly boosts demand for new, lightweight, durable, and safety-certified window and windshield systems.

In 2025, the North America region will dominate the market with an exceeding 35% revenue share in the global Aircraft Window and Windshield market.

Among the Material Type, Glass holds the highest preference, capturing beyond 52.7% of the market revenue share in 2025, surpassing other Material.

The key players in the Aircraft Window and Windshield market are GKN Plc, PPG Industries, Inc., Gentex Corporation, The NORDAM Group, Inc., and Saint-Gobain S.A.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Bn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material

By Application

By Aircraft

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author