ID: PMRREP12520| 200 Pages | 15 Dec 2025 | Format: PDF, Excel, PPT* | Energy & Utilities

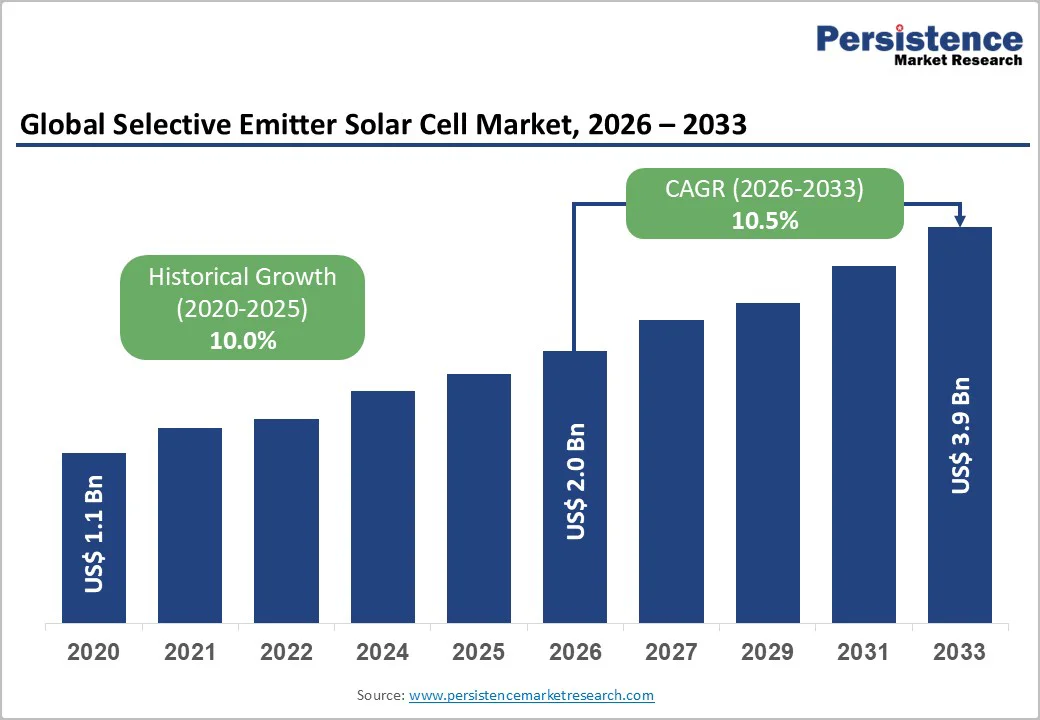

The global selective emitter solar cell market size is likely to be valued at US$2.0 billion in 2026 and is expected to reach US$3.9 billion by 2033, growing at a CAGR of 10.5% during the forecast period from 2026 to 2033, driven by increasing demand for efficiency gains in solar photovoltaic systems, with selective emitter designs reducing recombination losses and boosting output over standard cells.

Countries across Asia Pacific, particularly China, India, and South Korea, continue to dominate global installations due to large-scale solar projects, competitive manufacturing, and expanding grid modernization programs. Technological advancements in emitter doping techniques, such as laser doping and screen-printing optimization, are significantly reducing recombination losses, improving surface passivation, and increasing overall cell performance.

| Key Insights | Details |

|---|---|

|

Selective Emitter Solar Cell Market Size (2026E) |

US$2.0 Bn |

|

Market Value Forecast (2033F) |

US$3.9 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

10.5% |

|

Historical Market Growth (CAGR 2020 to 2025) |

10.0% |

The rising demand for renewable energy is a key driver of the market, fueled by increasingly ambitious national energy targets and decarbonization goals. Governments and organizations worldwide are prioritizing clean energy adoption, creating strong demand for efficient and sustainable solar technologies. Selective emitter solar cells, with their lightweight design, flexibility, and suitability for rooftop and building-integrated applications, are becoming increasingly favored. As solar deployment expands across residential and commercial segments, these advanced cells provide a cost-effective solution for achieving higher energy yields per square meter.

The focus on decarbonization and sustainable energy solutions is encouraging investments in advanced solar technologies. As renewable energy adoption accelerates, there is a growing emphasis on maximizing energy output while reducing material usage and installation complexity. This trend favors the use of selective emitter solar cells in utility-scale projects, urban rooftops, and off-grid applications, where efficiency, adaptability, and long-term performance are critical. Grid operators and energy planners are increasingly prioritizing high-efficiency modules to stabilize output and improve land-use optimization in densely populated areas.

The market faces challenges from high manufacturing complexity and associated costs. Producing selective emitter cells involves precise doping techniques, such as masking and etching, laser doping, or self-alignment processes, which require specialized equipment and skilled labor. Maintaining uniform emitter profiles across wafers is critical to achieving high efficiency, making process control more demanding than conventional silicon solar cell production. These complexities increase capital expenditure and operational costs, particularly for small and mid-sized manufacturers seeking to scale production rapidly.

Although selective emitter cells offer higher energy yields and improved performance, their fabrication can involve additional processing steps and precision metallization, which raise production difficulty. The need for consistent quality and efficiency in large-scale manufacturing may slow broader adoption. Many manufacturers remain cautious about transitioning from established PERC lines to selective emitter architectures due to these technical and financial hurdles, particularly in cost-sensitive markets.

Expansion in automotive and electronics applications presents a significant opportunity for the market. In the automotive sector, these high-efficiency cells can be integrated into vehicle roofs, hoods, or other surfaces to enhance solar energy harvesting for electric and hybrid vehicles, supporting auxiliary power and improving overall energy efficiency. Their design allows better energy output under varying light conditions, making them suitable for on-the-go energy generation. EV manufacturers explore lightweight solar-assisted systems to extend driving range; selective emitter cells offer a practical pathway to increase onboard energy supply without adding significant weight.

In electronics, selective emitter solar cells can be incorporated into devices, portable chargers, and wearable technologies, where traditional cells may underperform. Their efficiency in partial shading and low-light conditions enables a consistent power supply for decentralized, off-grid, or portable applications. This versatility drives adoption in innovative automotive and electronics solutions, expanding the market beyond conventional rooftop and utility-scale installations while aligning with growing renewable energy and energy-efficiency trends. The increasing demand for self-charging consumer electronics and IoT devices is enhancing the relevance of selective emitter technologies.

The masking and etching segment is anticipated to lead the market, capturing around 45% of the total revenue share, due to cost-effective wet-chemical processes that allow precise doping of selective emitter solar cells. Its dominance is supported by established supply chains that reduce capital expenditure and the scalability of mass production, making it ideal for large-scale deployment. The process ensures uniformity and high efficiency in industrial solar cell fabrication, which has driven its widespread adoption in PERC upgrades at Trina Solar and utility-scale modules produced by Jinko Solar. Masking and etching enable consistent high performance in large-format wafers and support integration with advanced metallization techniques.

Self-alignment is likely to be the fastest-growing product type, driven by laser-assisted innovations and automation technologies. These techniques reduce recombination losses and improve efficiency, making it attractive for hybrid or next-generation solar modules. Example: SunPower’s next-gen hybrid selective emitter cells and LONGi Solar’s automated alignment-based modules. The trend toward high-throughput, automated fabrication ensures steady market growth, enabling manufacturers to meet the increasing global solar energy targets with efficient and cost-effective selective emitter solar cells. Self-alignment facilitates reduced labor costs, improved yield, and better scalability for emerging markets, strengthening its appeal for both rooftop applications.

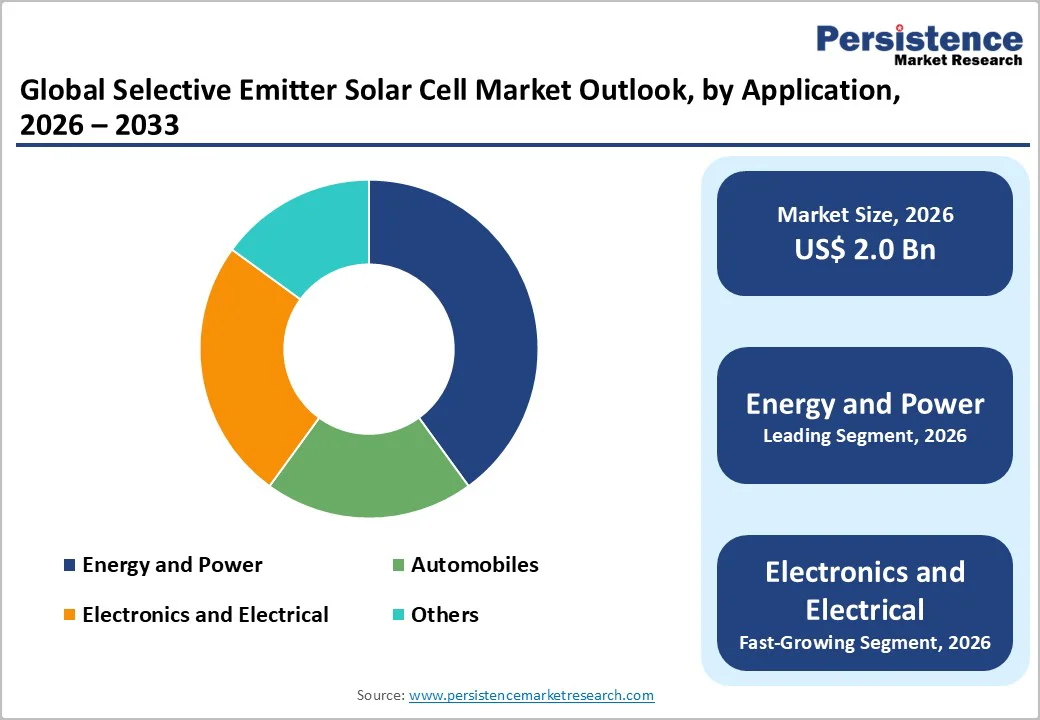

Energy and power applications are expected to lead the selective emitter solar cell market, capturing around 55% of the total revenue share. Dominating utility-scale and grid-connected deployments. Selective emitter solar cells enhance output by reducing recombination losses and improving energy conversion, making them highly suitable for large-scale solar farms. Example: First Solar’s integrated selective emitter modules in U.S. utility projects and Canadian Solar’s high-efficiency PV installations in Europe. Their deployment supports national renewable energy targets and contributes to grid stability, making them a preferred choice for developers investing in high-efficiency modules. Energy and power applications benefit from advancements in module reliability and long-term performance, reinforcing their dominance in large-scale solar projects.

Electronics and electrical applications are likely to be the fastest-growing applications, driven by the proliferation of smart devices and IoT ecosystems. Selective emitter technology allows efficient power generation even in partial shading or low-light conditions, enabling broader adoption in wearables, portable chargers, and small-scale electronics. Examples include Enphase Energy’s solar-powered microinverters for smart homes and SunPower’s mini-modules integrated into remote monitoring devices. Technological advancements in miniaturization, integration, and manufacturing automation drive growth, making electronics a dynamic and expanding market for selective emitter solar cells.

Market growth in North America is driven by R&D and pilot-scale commercialization efforts that enhance cell efficiencies while remaining compatible with existing silicon manufacturing lines. Research institutions and manufacturers are combining selective emitter designs with passivated contacts and laser-based patterning to minimize recombination losses and boost module output. Multiple pilot projects and technology-transfer initiatives are accelerating the transition from lab to production. Rising demand for high-efficiency solar solutions in residential and commercial sectors further supports market adoption.

North America is the strongest market for selective emitter solar cells, where they provide clear system-level advantages in rooftop and BIPV installations, vehicle-integrated photovoltaics (VIPV), and high-value commercial projects. Market growth is supported by automation improvements, enhanced quality-control infrastructure, and targeted manufacturing incentives. Increasing investment in advanced fabrication facilities is further strengthening adoption, while federal and state renewable energy programs accelerate deployment. For example, new U.S. manufacturing initiatives under federal clean-energy programs offer performance-linked tax credits for companies implementing high-efficiency selective emitter processes, driving greater interest in this technology.

Market growth in Europe is driven by a strong focus on high-efficiency photovoltaic technologies, stringent energy standards, and accelerated decarbonization policies. The region’s solar sector benefits from significant investments in advanced cell architectures that boost performance without major changes to existing manufacturing processes. Rising R&D funding and pilot programs are fueling innovation in selective emitter designs. For example, Fraunhofer ISE is collaborating with European module manufacturers to integrate selective emitter concepts with passivated contacts and laser doping techniques, aiming to achieve commercial cell efficiencies above 22%.

Europe’s rising energy costs, supportive regulatory frameworks, and interest in building-integrated and aesthetic solar applications further boost the demand for selective emitter technology. Collaborations between European research centers and module producers are accelerating technology transfer and enabling smoother scale-up. Government incentives and policy support for domestic module production are facilitating faster commercialization. Strategic partnerships between manufacturers and utilities are enabling large-scale deployment and integration into smart grid projects. The region prioritizes supply-chain resilience and domestic solar manufacturing. Selective emitter cells are increasingly positioned as a strategic technology in Europe’s advancement toward a high-efficiency solar ecosystem.

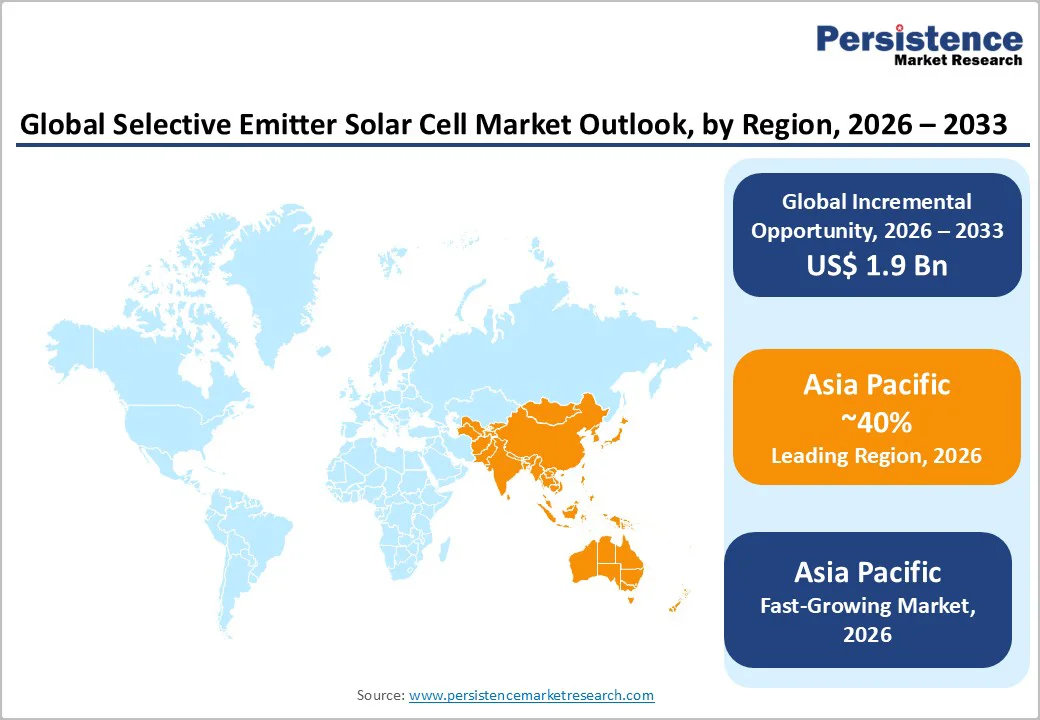

The Asia Pacific region is anticipated to be the leading region with a 40% share in 2026, driven by rapid solar deployment, strong manufacturing ecosystems, and aggressive national renewable energy targets. Countries such as China, Japan, South Korea, and India are prioritizing high-efficiency cell architectures to meet rising demand for advanced photovoltaic technologies. Manufacturers in the region are expanding the adoption of selective emitter processes due to their ability to enhance conversion efficiency while integrating smoothly into existing crystalline silicon production lines. R&D in laser doping and passivation techniques is improving yield and performance. Government incentives and subsidies for high-efficiency PV modules are encouraging faster commercialization. For example, China’s National PV Industrial Innovation Center recently collaborated with leading module manufacturers to implement selective emitter designs in upgraded PERC lines, achieving notable efficiency improvements in large-scale production.

Asia Pacific is also likely to be the fastest-growing region in the market in 2026. Adoption is strongest in utility-scale plants, rooftop installations, and emerging distributed generation models, where higher energy yield per module plays a critical role. The region’s large-scale solar manufacturing capacity also supports cost-efficient production and rapid scale-up of selective emitter technologies. The growing use of high-efficiency modules in industrial facilities, smart cities, EV charging infrastructure, and urban solar projects creates new demand pockets. Collaborations between manufacturers and local utilities are facilitating the deployment of selective emitter systems in smart grids. Increasing integration with BIPV and rooftop solutions is expanding opportunities in both residential and commercial segments.

The global selective emitter solar cell market exhibits a moderately fragmented structure, driven by rapid technology diffusion across incumbent silicon manufacturers and a mix of regional specialists pushing pilot-to-fab upgrades. Leading module and cell producers, legacy silicon OEMs, and specialized equipment suppliers together shape the landscape. With key leaders including Tata Power Solar Systems, Trina Solar, JinkoSolar, Suniva, and SolarWorld, that balance R&D momentum with commercial manufacturing scale.

Investment waves and national manufacturing incentives in Asia and North America are enabling numerous mid-tier players to close technology gaps and capture niche high-efficiency segments. These players compete through laser-doping patents, automated inline patterning, strategic OEM alliances, and targeted vertical integration to shorten time-to-market. Rising capacity investments and specialized rooftop, BIPV, and VIPV offerings are heightening competition while still allowing room for innovators.

The global selective emitter solar cell market is projected to reach US$2.0 billion in 2026.

The selective emitter solar cell market is primarily driven by the rising demand for high-efficiency photovoltaic technologies.

The selective emitter solar cell market is expected to grow at a CAGR of 10.5% from 2026 to 2033.

The selective emitter solar cell market has significant growth potential through increased adoption in automotive and electronics applications.

Tata Power Solar Systems, Trina Solar, SolarWorld, Suniva, JinkoSolar, Pionis Energy, Alps Technology, and Itek Energy are the leading players.

| Report Attribute | Details |

|---|---|

|

Historical Data |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author