ID: PMRREP36037| 200 Pages | 22 Jan 2026 | Format: PDF, Excel, PPT* | Packaging

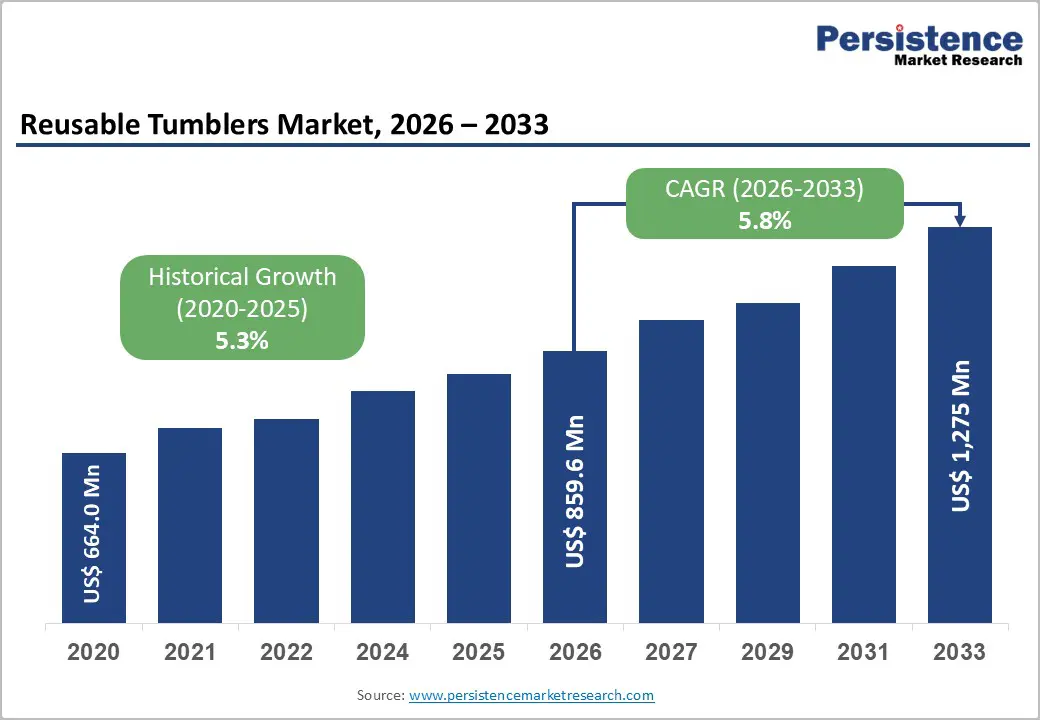

The global reusable tumblers market size is likely to be valued at US$ 859.6 million in 2026 and is expected to reach US$ 1,275.5 million by 2033, growing at a CAGR of 5.8% between 2026 and 2033, driven by sustainability regulations, consumer shifts away from single-use cups, rising on-the-go beverage consumption, and the rapid expansion of e-commerce and custom-branded drinkware.

Growth is further supported by improved manufacturing scale, particularly in the Asia Pacific, premiumization through insulated stainless steel products, and increasing corporate and event-based procurement of reusable drinkware programs.

| Key Insights | Details |

|---|---|

| Reusable Tumblers Market Size (2026E) | US$859.6 Mn |

| Market Value Forecast (2033F) | US$1,275.5 Mn |

| Projected Growth (CAGR 2026 to 2033) | 5.8% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.3% |

Governments, municipalities, and large public venues are increasingly implementing reuse targets, deposit-return systems, and procurement policies that favor reusable drinkware over disposable alternatives. These initiatives directly reduce the addressable single-use cup market while stimulating demand for durable, multi-use tumblers. Quantitatively, pilot reuse systems in controlled environments such as stadiums, festivals, and universities have demonstrated the ability to reduce single-use cup consumption by 40-80%, creating predictable, recurring procurement demand. This regulatory momentum shortens payback periods for venue operators investing in reusable systems, encouraging bulk and contract-based purchases from stadiums, educational institutions, and large retailers.

Consumer behavior across beverage and drinkware categories increasingly reflects a willingness to pay price premiums for durable, insulated, and environmentally responsible products. Rising consumption of specialty beverages such as cold brews, iced teas, and blended drinks has accelerated the adoption of insulated stainless steel tumblers, particularly among commuters and remote workers. The expansion of e-commerce and brand collaborations with retailers and coffee chains has scaled distribution and enabled product personalization, driving higher average selling prices and repeat purchases. Industry performance indicators suggest that premiumization and personalization trends contribute a mid-single- to low-double-digit uplift to category growth.

The use of durable materials such as stainless steel and borosilicate glass, along with double-wall insulation technologies, significantly increases manufacturing costs compared with single-use or low-cost plastic tumblers. In price-sensitive consumer segments and developing markets, higher retail prices and perceived replacement risk limit adoption. In many emerging economies, price elasticity indicators show that a 10-15% price premium over low-cost alternatives can reduce purchase intent by 8-12%, constraining penetration in high-volume channels until economies of scale or corporate procurement subsidies reduce effective costs.

Reusable systems require reliable reverse logistics, sanitization processes, and quality assurance protocols. In the absence of such infrastructure, venues often default to disposable solutions. For mass events and retail settings, upfront investment requirements and operational complexity create adoption friction. When venues absorb cleaning and collection costs, unit economics become highly sensitive to return rates. A 20% non-return or loss rate can materially increase per-use costs and extend payback periods, reducing the financial attractiveness of reuse programs without well-managed systems.

The growing preference for insulated stainless steel tumblers, driven by superior thermal performance and durability, creates a strong upgrade pathway from basic drinkware. This shift also supports an expanding aftermarket for accessories such as lids, sleeves, and replacement components. Performance trends in adjacent drinkware categories indicate that stainless steel segments consistently outperform other materials. Capturing even a modest share of replacement cycles from water bottles and insulated cups represents a multi-hundred-million-dollar opportunity through 2033, particularly when bundled into corporate sustainability programs that offer predictable B2B demand.

Concerts, sports venues, universities, and municipal authorities are actively piloting reusable cup and tumbler systems. Scaling these programs at regional or national levels would generate recurring, high-volume contracts while increasing average order sizes. Conservatively, if 1% of major event beverage servings transition to reusable tumblers with multi-use lifecycles, the resulting incremental addressable market over a five-year period would be material for both manufacturers and service providers. This opportunity favors suppliers capable of offering contract manufacturing, logistics coordination, and deposit-return solutions.

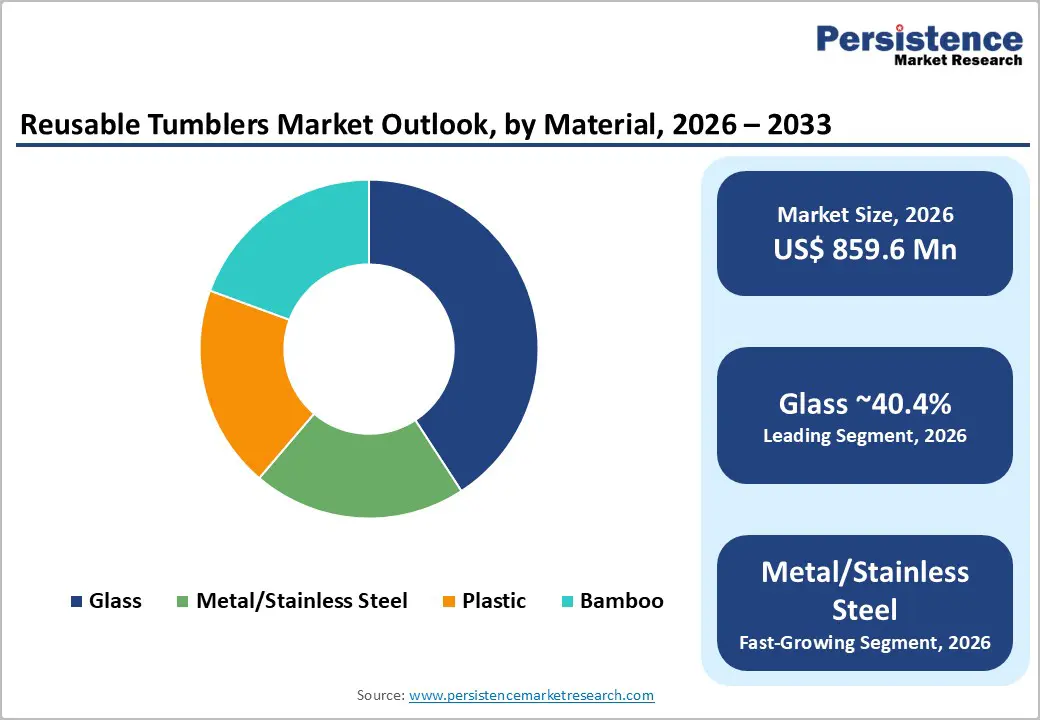

Glass tumblers are expected to be the leading material segment, accounting for approximately 40.4% of market share in 2026, driven by their clarity, recyclability, chemical non-reactivity, and suitability for household and premium tabletop use. Glass remains the preferred choice for consumers prioritizing taste neutrality, microwave compatibility, and visual appeal, particularly in home dining and office pantry settings. The segment benefits from strong gifting demand and steady replacement cycles, supported by designer tabletop collections and coordinated drinkware sets sold through mass merchants and specialty homeware retailers. Regionally, Europe and North America exhibit the highest penetration, reflecting consumer aversion to plastic-based food-contact products and the presence of mature glass recycling ecosystems. Brands offering borosilicate and tempered glass variants have gained traction due to improved thermal resistance and durability. Prominent examples include IKEA’s reusable glass tumbler ranges and Libbey’s premium tabletop collections, which reinforce glass as a staple material in sustainability-aligned households.

Stainless steel is likely to be the fastest-growing material segment and is anticipated to expand its market share steadily, supported by rising adoption in on-the-go, outdoor, and commercial use cases. Growth is primarily driven by superior thermal insulation enabled by double-wall vacuum technology, high impact resistance, and extended product lifespans, making stainless steel suitable for travel, fitness, and workplace consumption. These attributes align closely with urban mobility trends and increasing consumption of hot and cold beverages outside the home. Corporate gifting programs, coffee chains, and outdoor lifestyle brands are accelerating adoption due to stainless steel’s durability and ease of customization through laser engraving and logo printing. Brands such as YETI, Stanley, and Hydro Flask exemplify this trend, leveraging performance-led positioning and lifestyle branding. Ongoing investments in lightweight alloys, anti-corrosion coatings, and automated forming processes are improving cost efficiency, thereby expanding addressable demand across mid-priced consumer segments.

Hypermarkets and supermarkets are likely to dominate the distribution landscape, anticipated to hold approximately 43.2% of market share in 2026, owing to their extensive geographic reach, high footfall, and ability to drive volume-led sales. These retail formats effectively support mainstream adoption by offering competitively priced multipacks, private-label assortments, and entry-level branded products. Placement in kitchenware aisles, seasonal aisles, and promotional endcaps increases product visibility and impulse purchases. Large-format retailers also play a critical role in sustainability messaging through eco-themed promotions and reusable product bundles. Retailers such as Walmart, Carrefour, and Tesco routinely integrate reusable tumblers into back-to-school, holiday gifting, and zero-waste campaigns. Despite margin pressure from private labels, this channel remains indispensable for household penetration and first-time buyers in both developed and emerging markets.

Online sales are likely to be the fastest-growing distribution channel, driven by personalization capabilities, direct-to-consumer (DTC) strategies, and broader product assortments. E-commerce platforms enable brands to offer customizable colors, engravings, and limited-edition designs that are impractical in physical retail. Subscription-based accessory sales, such as replacement lids and straws, further enhance customer lifetime value. Digitally native brands and established players alike leverage online channels to command higher average selling prices through premium positioning and storytelling. Platforms such as Amazon, brand-owned websites, and specialty lifestyle marketplaces facilitate rapid product testing and targeted marketing. For premium and niche manufacturers, online distribution has become a strategic channel for margin optimization, consumer data capture, and global reach without proportional physical retail investment.

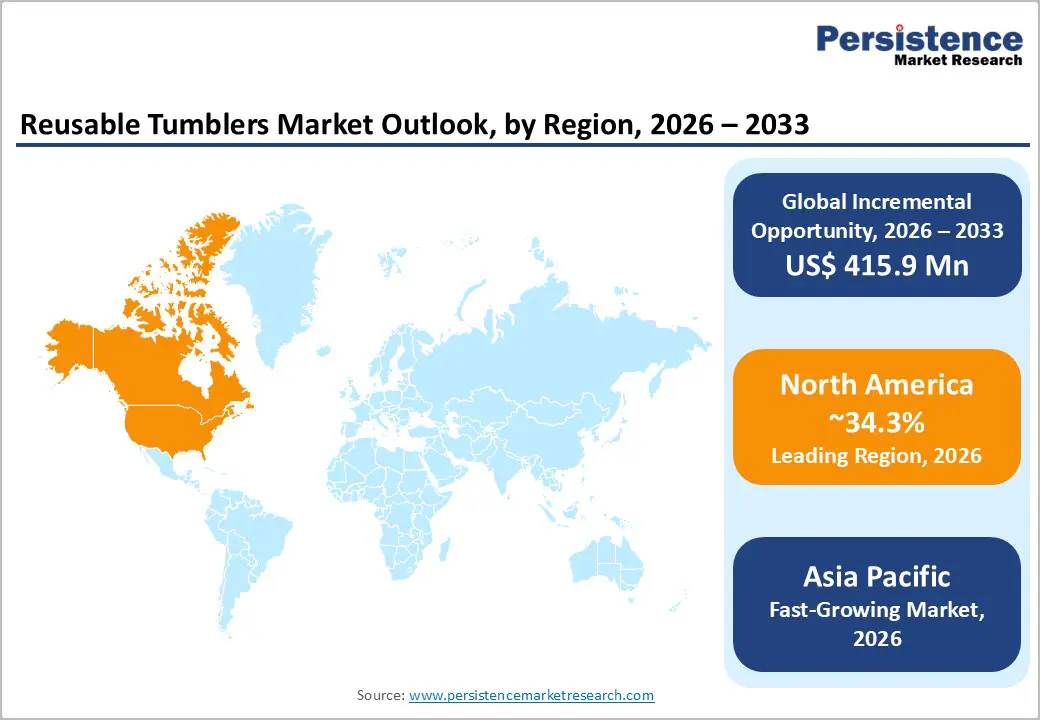

North America is projected to lead the market with approximately 34.3% share in 2026, anchored by strong demand in the U.S. and supported by Canada’s sustainability-oriented consumer base. The region benefits from high specialty beverage consumption, widespread café culture, and a mature omnichannel retail ecosystem that supports both high-volume household sales and premium lifestyle positioning. The U.S. demonstrates high per-capita spending on reusable drinkware, with strong penetration across specialty retailers, mass merchants, and direct-to-consumer platforms. Canada mirrors these sustainability-driven purchasing behaviors, albeit at lower absolute volumes.

Growth in North America is being driven by corporate sustainability initiatives and venue-based reuse programs, particularly across corporate campuses, universities, sports arenas, and event venues. Major companies such as Starbucks continue to encourage reusable cup use through incentives and limited-edition tumblers, fostering habitual reuse among urban consumers. Premium brands such as YETI, Hydro Flask, and Stanley are capitalizing on the premiumization trend, combining high-performance insulation, lifestyle-focused branding, and strong social media presence to command higher price points. Their success has raised consumer expectations for durability and thermal performance, influencing product development across the broader market.

While the U.S. does not have a unified national deposit-return or reuse mandate, state-level regulations in California, New York, and Washington, along with corporate-led waste-reduction programs, are driving institutional and commercial adoption. Investment is increasingly focused on vertically integrated reuse models that encompass manufacturing, reverse logistics, and cleaning services for large venues and foodservice operators. Nearshoring in Mexico and the U.S. Southeast is gaining traction as brands aim to shorten lead times, reduce tariff risks, and enhance supply chain resilience, particularly for stainless steel and insulated tumbler production.

Europe represents a mature, regulation-driven market for reusable tumblers, marked by high per-capita usage and strong adoption within institutions, especially in Germany, the U.K., and France. The region’s leadership stems from harmonized environmental standards, circular economy initiatives, and extended producer responsibility (EPR) frameworks, which collectively promote durable, traceable, and recyclable drinkware solutions. These policies support product standardization while driving demand from municipalities, transportation hubs, and event organizers.

Germany remains a cornerstone market, with strong consumer preference for glass and premium stainless-steel tumblers, reflecting an entrenched recycling culture and quality-driven purchasing behavior. German retailers and brands emphasize material integrity and lifecycle transparency, benefiting suppliers with certified production processes. In the U.K., event-based reuse pilots have accelerated rapidly, particularly across music festivals, sports venues, and university campuses.

Reuse service providers partnering with branded drinkware manufacturers have demonstrated measurable reductions in single-use waste, driving repeat procurement contracts. France and Spain are seeing increased adoption through public-sector initiatives and foodservice regulation, while pan-European brands and retailers benefit from regulatory alignment under EU waste directives. Compliance requirements increase upfront costs for manufacturers, yet they simultaneously create procurement advantages for certified and audit-ready suppliers. Investment activity across Europe focuses on localized manufacturing, public-private partnerships, and franchising of reuse systems, as companies seek to reduce total system costs and meet tightening regulatory benchmarks without compromising scale.

Asia Pacific is the fastest-growing regional market for reusable tumblers, supported by large population bases, rapid urbanization, rising disposable incomes, and a globally competitive manufacturing ecosystem. The region plays a dual role as both a major consumption market and the primary production hub for global reusable drinkware. China leads in manufacturing scale and domestic consumption, supported by vertically integrated supply chains and cost-efficient stainless steel processing capabilities. Many global brands source insulated tumblers from Chinese facilities, reinforcing the region’s significance as an export hub.

Japan emphasizes precision-manufactured, premium reusable tumblers, with strong demand from corporate gifting and high-end retail channels. Japanese brands prioritize design quality, thermal performance, and longevity, influencing product standards across the premium segment. India is emerging as a high-growth consumption market, driven by a cultural shift away from plastic toward stainless steel and glass for household, gifting, and religious use. Domestic brands and multinational players are expanding localized product lines to address price sensitivity while maintaining durability. Regional growth is fueled by expanding café culture, export-oriented manufacturing, and rising environmental awareness among urban consumers.

Regulatory approaches vary widely, yet single-use plastic bans and municipal pilots in China, India, and the ASEAN markets are driving surges in demand for reusable alternatives. Investment flows are concentrated in automation, capacity expansion, and contract manufacturing, enabling Asia Pacific suppliers to efficiently serve North American and European brands while also developing their own regional consumer labels.

The global reusable tumblers market exhibits a mixed structure, with a fragmented base of regional manufacturers alongside a more concentrated premium segment dominated by established insulated and stainless steel brands. While numerous small and mid-sized players serve local markets, a limited number of global suppliers capture a disproportionate share of premium and B2B revenues. Competitive positioning varies by material, distribution channel, and service capabilities. Consolidation is accelerating in premium manufacturing and reuse service layers as buyers increasingly favor integrated solutions.

Market leaders prioritize product differentiation through insulation and design, cost leadership via scale manufacturing, and downstream service integration. Emerging models bundle hardware with subscription or deposit-return services to generate recurring revenue and improve customer retention.

The global reusable tumbler market is valued at US$859.6 million in 2026.

By 2033, the global reusable tumblers market is expected to reach US$1,275.5 million.

Key trends include premiumization of stainless steel tumblers, growing demand for customized and branded products, expansion of online direct-to-consumer channels, and increasing adoption driven by corporate sustainability initiatives and plastic reduction policies.

By material, glass tumblers are the leading segment, accounting for 40.4% market share in 2025, driven by strong household usage, recyclability advantages, and preference for non-reactive drinkware.

The reusable tumblers market is projected to grow at a CAGR of 5.8% between 2026 and 2033.

Major players include YETI Holdings, Inc., Hydro Flask (Helen of Troy Ltd.), Stanley (PMI Worldwide), Tupperware Brands Corporation, and IKEA.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material

By Capacity

By Distribution Channel

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author