![]() 205 Users Online

205 Users Online

Li-Ion Pouch Battery Market Segmented by Lithium Cobalt Oxide, Lithium Manganese Oxide, Lithium Nickel Manganese Cobalt Oxide, Lithium Iron Phosphate, Lithium Titanate Chemistry with Capacity and Thickness, Rated Voltage

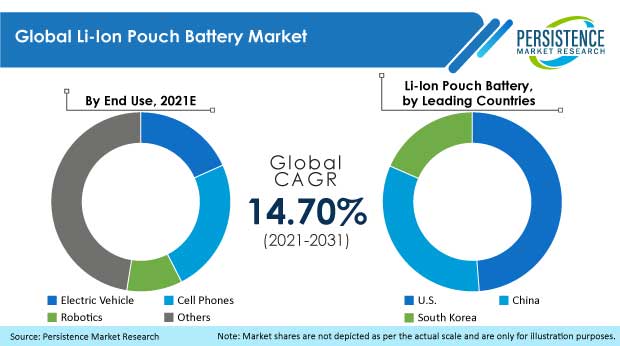

By value, Persistence Market Research has projected 9.6% CAGR for lithium-ion pouch battery sales during 2021-2031. In terms of volume, demand is expected to increase at over 14% CAGR over the same period.

As per Persistence Market Research projections, the United States, China, South Korea, ASEAN, and India are markets expanding at high CAGRs. Together, East Asia and South Asia Pacific are projected to hold around 1/3 market share through 2031.

Top suppliers of li-ion pouch batteries include tier-1 companies such as Contemporary Amperex Technology Co., Ltd., Panasonic Industrial Corporation, Toshiba Corporation and SK Innovation ,who together accounted for around 21% share of global revenue in 2020.

Historically, from 2016 to 2020, use of lithium-ion pouch batteries increased at around 4% CAGR, wherein, developed countries such as the U.S., Canada, Germany, and the U.K. held significant share in the global market.

Prices of the li-ion batteries and other substitutes are decreasing due to extensive use in electric vehicles and for power resilience to power grids. With rise in production and technological developments in the field of lithium-ion batteries, they are becoming cheaper to produce.

Shift in customer demand from fossil fuel vehicles to electric vehicles, and from old standard cell phones to new advanced smart phones, is also driving demand. The li-ion pouch battery market is projected to expand at a CAGR of 9.6% over the next ten years.

Increasing growth of the automotive industry in developing countries indicates substantial rise in demand for li-ion batteries which includes battery packs and pouch cells. Developing countries show enormous market potential for energy storage systems.

In developing countries, where other flexible options such as natural gas generation and cross border interconnections might not be sufficient, low cost renewable energy generation is on the rise. Today, the storage market is dominated by li-ion battery technologies that haven seen significant drop in cost over the last few years.

Automotive lithium-ion batteries, through their recycling capability, will play a crucial role over the coming years due to growing scarcity of raw materials and awareness.

Despite growing adoption of li-ion batteries in EVs and consumer electronics, these batteries can witness decay in hot conditions, which can trickle down the performance level of the batteries. Heat-related operational drawbacks are likely to remain significant challenges for manufacturers, which can impede market growth to some extent.

Apart from the better storage capacity from other types of batteries, li-ion batteries are expensive and harmful to travel with, and extra precautions are needed to avoid an explosion.

With an absolute dollar opportunity of around US$ 5 Bn, East Asia is expected to be the most lucrative market for lithium-ion pouch battery manufacturers. China is leading the East Asian market, and is expected to witness significantly higher growth during 2021-2031. Majority of key players with higher market shares are also located in East Asia.

Will the Automotive Sector in the U.S. drive Demand for Li-Ion Pouch Batteries?

The market in the U.S. is projected to expand at over 9% CAGR through 2031, and hold more than ¾ share of the North America market.

The automotive sector is expected to be one of the major end-use segments for market growth in the U.S., as the government is encouraging investors in both, EV and renewable industries, resulting in increased demand for battery-based energy storage systems, primarily led by li-ion batteries.

Falling li-ion battery prices and improving technology are expected to bring price-competitive electric vehicles to the market, creating demand for li-ion battery technology in the near future. As the country is a pioneer in research and innovation on a global scale, manufacturers are trying to make these batteries more reliable and safer to use.

What Makes China a Prominent Market for Li-Ion Pouch Batteries?

The market for li-ion pouch batteries is expected to surge ahead in China at an impressive CAGR of 15% over the next ten years.

Availability of cheap labour gives China a huge advantage, which allow it to dominate the market for li-ion pouch batteries. China is also dominating the market due to huge domestic demand and control of refining and manufacturing capacity.

China’s also has the advantage of raw material refining and mining. European countries and North America are trying to create their own battery champions to challenges Asian players.

Why are Manufacturers of Li-Ion Pouch Batteries Eyeing Germany?

Germany’s electronics industry saw a strong increase in the battery market in the past few years. Demand for li-ion batteries and their sub-parts for daily use and also in electric vehicles to cut carbon emissions in transport is increasing.

Which Chemistry is More Preferable for Li-Ion Pouch Batteries?

Lithium iron phosphate (LiFePO4) holds more than 1/3 market share due to its strong safety profile. LiFePO4 has extremely stable chemical property, and the phosphate in it makes the battery superior in thermal stability, thereby making them safer than li-ion batteries made with other cathode material.

Majority of battery-powered off-road vehicles uses LiFePO4 batteries that are less than half of the weight of traditional lead acid batteries. They are highly efficient and the battery capacity can be fully utilized without lowering the lifespan of the battery or reducing its capacity.

Which End User Holds Lucrative Opportunities for Li-Ion Pouch Battery Manufacturers?

Cell phones is the most lucrative end-use application, and represented over 23% demand for lithium-ion pouch batteries in 2020. The cell phone market and other accessories/end-use applications such as portable electronic devices are driving demand for these batteries.

Use of cell phones is increasing day by day due to urbanization and evolution in technology. Almost 55% to 60% of the global population uses cell phones and portable electronic devices such as iPod, MP3 player, etc.

Due to huge demand from cell phone and electric vehicle manufacturers, market players are implementing research methodologies to provide more storage capacity in these batteries and reducing their size.

How Has COVID-19 Impacted Sales of Li-Ion Pouch Batteries?

COVID-19 has affected the global economy resulting into significant decline in demand of products and raw material across regions. In Asia Pacific, China is the major supplier and manufacturer of li-ion batteries and cells. Due to government restrictions, major suppliers and manufacturers reduced their manufacturing capacities. Also, demand from the automotive industry declined in 2020.

Persistence Market Research has profiled the following key li-ion pouch battery manufacturers in its report:

Majority of companies discussed in the report have focused on product launches and expanding their manufacturing units in developing regions. Strategies include innovation, collaborations with key players, partnerships, strategic alliances, and strengthening of regional and global distribution networks. Some of the key developments are:

Similarly, recent developments related to companies manufacturing lithium-ion pouch batteries have been tracked by the team at Persistence Market Research, which are available in the full report.

| Attribute | Details |

|---|---|

|

Forecast Period |

2021-2031 |

|

Historical Data Available for |

2016-2020 |

|

Market Analysis |

US$ Mn for Value |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Segments Covered |

|

|

Key Companies Profiled |

|

|

Pricing |

Available upon Request |

By Chemistry

By Capacity

By Thickness

By Rated Voltage

By End User

By Region