![]() 215 Users Online

215 Users Online

Biopharmaceuticals Market by Product Type (Monoclonal Antibodies, Recombinant Proteins, Vaccines, Purified Proteins and Recombinant Hormone)

Biopharmaceuticals are pharmaceutical products which are produced through biotechnology methods involving recombinant DNA techniques, hybridoma techniques, and purification processes. Biopharmaceutical production involves the use of biological sources, either live organisms or their active components. They are made up of proteins and nucleic acids and target specific diseases and patients groups.

The global biopharmaceutical market is expected to grow at a robust rate in the coming five years, driven by the growing inclination towards targeted therapy and burgeoning research and development investments. The market for biosimilars is expected to grow at a robust pace, creating revenue pockets for the manufacturers. The protein therapeutics are projected rapid traction in the coming years owing to their high efficiency in target therapy.

COVID-19 pandemic is expected to escalate market growth with the growing expenditure in the healthcare sector. Such developments are expected to positively influence the market revenue. North America is expected to hold a major chunk of the market by the end of 2025 on to the back of developed healthcare infrastructure. With huge untapped potential, Asia Pacific is projected to grow at a rapid pace in the coming years.

The market players are taking the help of technological innovations and product launches to stay ahead in the market competition. They are competing in terms of cost-effective products. Pfizer, Inc., F. Hoffmann-La Roche AG, Johnson & Johnson Services, Inc., Sanofi, Amgen Inc., AbbVie Inc., Merck & Co., Inc., Biogen Idec, Bayer AG, Eli Lilly and Company, and Novartis AG are some of the leading players in the global market for biopharmaceuticals.

Some of the other players in the biopharmaceuticals market are GlaxoSmithKline Plc, Bristol-Myers Squibb Company, AstraZeneca PLC, and Abbott Laboratories.

Biopharmaceuticals are used in the treatment of various chronic diseases such as cardiovascular, metabolic, neurological, cancer, and other rare diseases for which there are no available treatments. It has led to enhancement of the quality of healthcare and has improved the quality of life of patients.

Various biopharmaceuticals used for treating such diseases are monoclonal antibodies, erythropoietin, growth hormones, recombinant proteins, recombinant human insulin, purified proteins, interferon, vaccines, and other biopharmaceuticals.

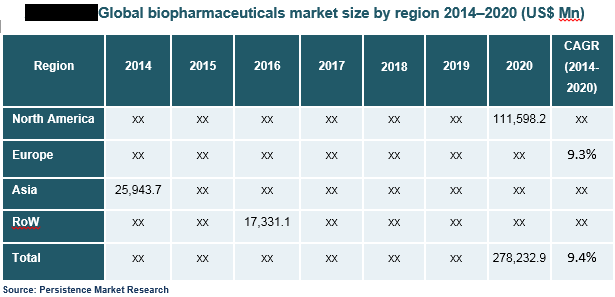

Factors such as high costs of biopharmaceuticals, entry of low-cost biosimilars, and risk of side-effects posed by biopharmaceuticals act as major restraints for the biopharmaceuticals market. The global biopharmaceuticals market was valued at US$ 161,851.6 Million in 2014 and is expected to expand at a CAGR of 9.4% to reach US$ 278,232.9 Million by 2020.

North America is the largest market for the biopharmaceuticals. This is due to technological advancements in the region. In terms of types, monoclonal antibodies are the fastest growing segment. In terms of therapeutic application, oncology is the largest segment in the biopharmaceuticals market. Biopharmaceuticals have wide applications in the pharmaceutical industry.

North America’s biopharmaceuticals market was valued at US$ 64,681.3 Million in 2014 and reached US$ 111,598.2 Million by 2020 at a CAGR of 9.5% over the forecast period. One of the latest trends in the global biopharmaceuticals market is outsourcing, wherein biopharmaceutical companies enter into partnerships with contract manufacturing organizations (CMOs) to produce biopharmaceutical drug substances. This reduces the overall investment to launch a new product in the market and helps gain market access with ease.

Some of the major players in the Biopharmaceuticals market:

These key market players have been profiled on the basis of attributes such as company overview, recent developments, growth strategies, sustainability, and financial overview.